SkyWest Airlines 2010 Annual Report Download - page 154

Download and view the complete annual report

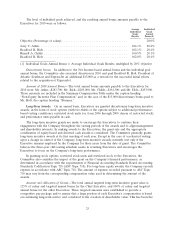

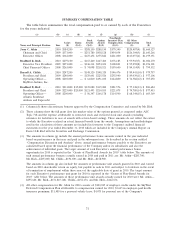

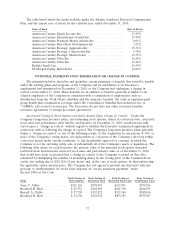

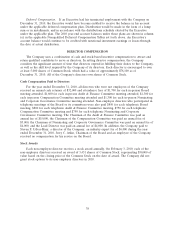

Please find page 154 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recreational equipment; and $1,097 in discretionary matching contributions under the SkyWest 401(k) Plan.

Discretionary matching contributions under the SkyWest 401(k) Plan are paid to all participating employees.

(5) All other compensation for Mr. Atkin for 2009 consists of: $99,510 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2009; $2,644 in employer-paid health

insurance premiums; $15,161 for a personal vehicle lease; $3,189 for personal use of the Company’s

recreational equipment; $4,600 for country club dues; and $1,200 in discretionary matching contributions

under the SkyWest 401(k) Plan. Discretionary matching contributions under the SkyWest 401(k) Plan are paid

to all participating employees.

(6) All other compensation for Mr. Atkin for 2008 consists of: $87,450 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2008; $2,567 in employer-paid health

insurance premiums; $15,259 for a personal vehicle lease; $2,930 for personal use of the Company’s

recreational equipment; and, $4,851 country club dues.

(7) All other compensation for Mr. Rich for 2010 consists of: $72,615 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2010; $4,166 in employer-paid health

insurance premiums; $13,920 for a personal vehicle allowance; $4,166 for personal use of the Company’s

recreational equipment; and $1,189 in discretionary matching contributions under the SkyWest 401(k) Plan.

Discretionary matching contributions under the SkyWest 401(k) Plan are paid to all participating employees.

(8) All other compensation for Mr. Rich for 2009 consists of: $72,705 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2009; $4,149 in employer-paid health

insurance premiums; $13,920 for a personal vehicle allowance; $3,189 for personal use of the Company’s

recreational equipment; and $1,329 in discretionary matching contributions under the SkyWest 401(k) Plan.

Discretionary matching contributions under the SkyWest 401(k) Plan are paid to all participating employees.

(9) All other compensation for Mr. Rich for 2008 consists of: $63,390 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2008; $4,074 in employer-paid health

insurance premiums; $13,920 for a personal vehicle allowance; and, $2,930 for personal use of the Company’s

recreational equipment.

(10) All other compensation for Mr. Childs for 2010 consists of: $66,225 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2010; $4,166 in employer-paid health

insurance premiums; $13,966 for a personal vehicle lease; $4,075 for personal use of the Company’s

recreational equipment and $1,009 in discretionary matching contributions under the SkyWest 401(k) Plan.

Discretionary matching contributions under the SkyWest 401(k) Plan are paid to all participating employees.

(11) All other compensation for Mr. Childs for 2009 consists of: $67,305 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2009; $3,466 in employer-paid health

insurance premiums; $13,965 for a personal vehicle lease; $3,189 for personal use of the Company’s

recreational equipment and $1,114 in discretionary matching contributions under the SkyWest 401(k) Plan.

Discretionary matching contributions under the SkyWest 401(k) Plan are paid to all participating employees.

(12) All other compensation for Mr. Childs for 2008 consists of: $56,220 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2008; $3,466 in employer-paid health

insurance premiums; $13,966 for a personal vehicle lease; and, $2,930 for personal use of the Company’s

recreational equipment.

(13) All other compensation for Mr. Holt for 2010 consists of: $57,885 of employer credits under the Atlantic

Southeast Deferred Compensation Plan attributable to compensation earned for 2010; $3,905 in

employer-paid health insurance premiums; $13,563 for a personal vehicle lease, and, $4,075 for personal use

of the Company’s recreational equipment.

(14) All other compensation for Mr. Holt for 2009 consists of: $55,065 of employer credits under the Atlantic

Southeast Deferred Compensation Plan attributable to compensation earned for 2009; $3,674 in

employer-paid health insurance premiums; $12,852 for a personal vehicle lease, and, $3,189 for personal use

of the Company’s recreational equipment.

(15) All other compensation for Mr. Holt for 2008 consists of: $47,175 of employer credits under the Atlantic

Southeast Deferred Compensation Plan attributable to compensation earned for 2008; $3,170 in

employer-paid health insurance premiums; $12,444 for a personal vehicle lease, and, $2,930 for personal use

of the Company’s recreational equipment; and $2,625 in matching contributions under the Atlantic Southeast

401(k) Plan. Discretionary matching contributions under the SkyWest 401(k) Plan are paid to all participating

employees.

32