SkyWest Airlines 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

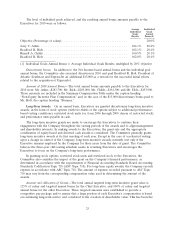

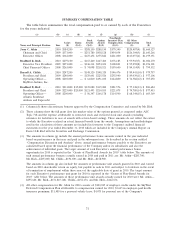

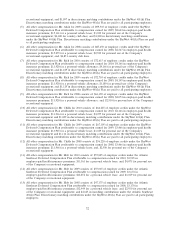

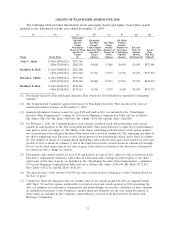

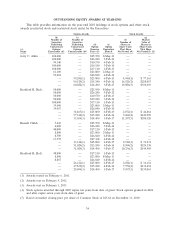

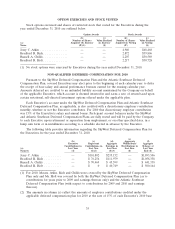

OPTION EXERCISES AND STOCK VESTED

Stock options exercised and shares of restricted stock that vested for the Executives during the

year ended December 31, 2010 are outlined below.

Option Awards Stock Awards

(b) (c) (d) (e)

Number of Shares Value Realized Number of Shares Value Realized

(a) Acquired On Exercise on Exercise Acquired on Vesting on Vesting

Name (#)(1) ($) (#) ($)

Jerry C. Atkin ................ ——4,940 $68,468

Bradford R. Rich .............. ——2,872 $39,806

Russell A. Childs .............. ——2,207 $30,589

Bradford R. Holt .............. ——2,217 $30,728

(1) No stock options were exercised by Executives during the year ended December 31, 2010.

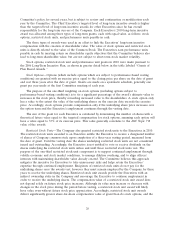

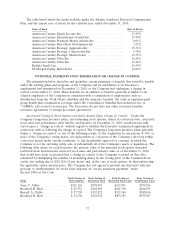

NON-QUALIFIED DEFERRED COMPENSATION FOR 2010

Pursuant to the SkyWest Deferred Compensation Plan and the Atlantic Southeast Deferred

Compensation Plan, covered Executives may elect prior to the beginning of each calendar year to defer

the receipt of base salary and annual performance bonuses earned for the ensuing calendar year.

Amounts deferred are credited to an unfunded liability account maintained by the Company on behalf

of the applicable Executive, which account is deemed invested in and earns a rate of return based upon

certain notational, self-directed investment options offered under the applicable plan.

Each Executive’s account under the SkyWest Deferred Compensation Plan and Atlantic Southeast

Deferred Compensation Plan, as applicable, is also credited with a discretionary employer contribution

monthly, whether or not the Executive contributes. For 2010 that discretionary employer contribution

was 15% of the Executive’s salary and annual bonus. Participant account balances under the SkyWest

and Atlantic Southeast Deferred Compensation Plans are fully vested and will be paid by the Company

to each Executive upon retirement or separation from employment, or on other specified dates, in a

lump sum form or in installments according to a schedule elected in advance by the Executive.

The following table provides information regarding the SkyWest Deferred Compensation Plan for

the Executives for the year ended December 31, 2010.

(e)

(b) (c) (d) Aggregate (f)

Executive Registrant Aggregate Withdrawals/ Aggregate

Contributions in Contributions in Earnings in Distributions in Balance at

(a) Last Year Last Year Last Year Last Year Last Year

Name(1) ($) ($)(2) ($)(3) ($) End ($)

Jerry C. Atkin ............ —$101,802 $235,152 — $1,893,506

Bradford R. Rich .......... —$ 76,256 $111,979 — $1,058,338

Russell A. Childs .......... — $ 70,469 $ 45,599 — $ 441,338

Bradford R. Holt .......... — $ 0 $ 40,749 — $ 500,164

(1) For 2010, Messrs. Atkin, Rich and Childs were covered by the SkyWest Deferred Compensation

Plan only and Mr. Holt was covered by both the SkyWest Deferred Compensation Plan (as to

contributions for years prior to 2009 and earnings thereon only) and the Atlantic Southeast

Deferred Compensation Plan (with respect to contributions for 2009 and 2010 and earnings

thereon).

(2) The amounts in column (c) reflect the amounts of employer contributions credited under the

applicable deferred compensation plan for 2010 at the rate of 15% of each Executive’s 2010 base

35