SkyWest Airlines 2010 Annual Report Download - page 152

Download and view the complete annual report

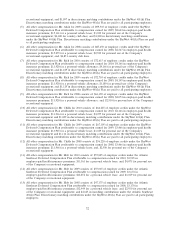

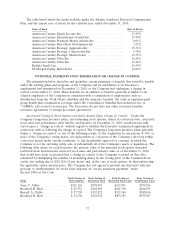

Please find page 152 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.employed at the end of the tax year (other than the Company’s principal financial officer). The limit

does not apply to compensation that meets the requirements of Section 162(m) of the Code for

‘‘qualified performance-based compensation’’ (i.e., compensation paid only if the executive meets

pre-established, objective goals based upon performance criteria approved by the Company’s

shareholders). The Committee reviews and considers the deductibility of executive compensation under

Section 162(m) of the Code. In certain situations, the Committee may approve compensation that will

not meet the requirements of Code Section 162(m) in order to ensure competitive levels of total

compensation for its executive officers. Stock option grants and long-term performance unit awards in

2010 were intended to constitute ‘‘qualified performance-based compensation’’ under Section 162(m) of

the Code. The Company’s 2010 restricted stock unit grants and performance-based annual bonuses,

however, were not ‘‘qualified performance-based compensation.’’

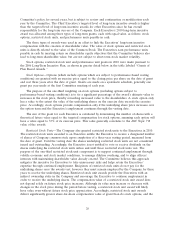

Effect of Compensation on Risk

Based on the Company’s review of the various elements of the Company’s executive compensation

practices and policies, the Company believes its executive compensation policies and practices are

designed to create appropriate and meaningful incentives for the Company’s executive employees

without encouraging excessive or inappropriate risk taking. Among other factors, the Company

considered the following information:

• The Company’s compensation policies and practices are designed to include a significant level of

long-term compensation, which discourages short-term risk taking.

• The base salaries the Company provides to its employees are generally consistent with salaries

paid for comparable positions in the Company’s industry, and provide the Company’s employees

with steady income while reducing the incentive for employees to take risks in pursuit of

short-term benefits.

• The Company has established internal controls and adopted codes of ethics and business

conduct, which are designed to reinforce the balanced compensation objectives established by

the Committee.

•The Company has adopted equity ownership guidelines for its executive officers, which the

Committee believes discourages excessive risk-taking.

Based on the review outlined above, the Company has concluded that the risks arising from the

Company’s compensation policies and practices for its employees are not reasonably likely to have a

material adverse effect on the Company.

COMPENSATION COMMITTEE REPORT

The Committee has reviewed the foregoing compensation discussion and analysis and discussed

with the Company’s management the information set forth herein. Based on such review and

discussions with management, the Committee recommended to the Board that the foregoing

compensation discussion and analysis be included in this proxy statement.

The Compensation Committee

Henry J. Eyring, Chair

Margaret S. Billson

Steven F. Udvar-Hazy

Michael K. Young

30