Red Lobster 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

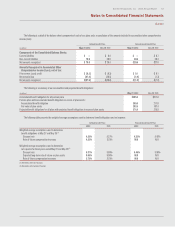

Darden Restaurants, Inc. 2012 Annual Report 67

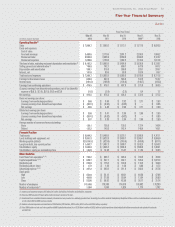

Five-Year Financial Summary

Darden

Fiscal Year Ended

May 27, May 29, May 30, May 31, May 25,

(in millions, except per share data) 2012 2011 2010 2009 (2) 2008

Operating Results (3)

Sales $ 7,998.7 $ 7,500.2 $ 7,113.1 $ 7,217.5 $ 6,626.5

Costs and expenses:

Cost of sales:

Food and beverage 2,460.6 2,173.6 2,051.2 2,200.3 1,996.2

Restaurant labor 2,502.0 2,396.9 2,350.6 2,308.2 2,124.7

Restaurant expenses 1,200.6 1,129.0 1,082.2 1,128.4 1,017.8

Total cost of sales, excluding restaurant depreciation and amortization (4) $ 6,163.2 $ 5,699.5 $ 5,484.0 $ 5,636.9 $ 5,138.7

Selling, general and administrative (1) 746.8 742.7 690.7 677.6 641.7

Depreciation and amortization 349.1 316.8 300.9 283.1 245.7

Interest, net 101.6 93.6 93.9 107.4 85.7

Total costs and expenses $ 7,360.7 $ 6,852.6 $ 6,569.5 $ 6,705.0 $ 6,111.8

Earnings before income taxes 638.0 647.6 543.6 512.5 514.7

Income taxes (161.5) (168.9) (136.6) (140.7) (145.2)

Earnings from continuing operations $ 476.5 $ 478.7 $ 407.0 $ 371.8 $ 369.5

(Losses) earnings from discontinued operations, net of tax (benefit)

expense of $(0.7), $(1.5), $(1.5), $0.2 and $3.0 (1.0) (2.4) (2.5) 0.4 7.7

Net earnings $ 475.5 $ 476.3 $ 404.5 $ 372.2 $ 377.2

Basic net earnings per share:

Earnings from continuing operations $ 3.66 $ 3.50 $ 2.92 $ 2.71 $ 2.63

(Losses) earnings from discontinued operations $ (0.01) $ (0.02) $ (0.02) $ — $ 0.06

Net earnings $ 3.65 $ 3.48 $ 2.90 $ 2.71 $ 2.69

Diluted net earnings per share:

Earnings from continuing operations $ 3.58 $ 3.41 $ 2.86 $ 2.65 $ 2.55

(Losses) earnings from discontinued operations $ (0.01) $ (0.02) $ (0.02) $ — $ 0.05

Net earnings $ 3.57 $ 3.39 $ 2.84 $ 2.65 $ 2.60

Average number of common shares outstanding:

Basic 130.1 136.8 139.3 137.4 140.4

Diluted 133.2 140.3 142.4 140.4 145.1

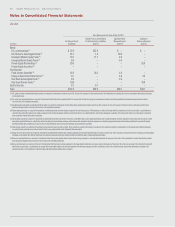

Financial Position

Total assets $ 5,944.2 $ 5,466.6 $ 5,276.1 $ 5,056.6 $ 4,761.1

Land, buildings and equipment, net $ 3,951.3 $ 3,622.0 $ 3,403.7 $ 3,306.7 $ 3,066.0

Working capital (deficit) $ (1,016.5) $ (623.0) $ (519.6) $ (493.8) $ (631.1)

Long-term debt, less current portion $ 1,453.7 $ 1,407.3 $ 1,408.7 $ 1,632.3 $ 1,634.3

Stockholders’ equity $ 1,842.0 $ 1,936.2 $ 1,894.0 $ 1,606.0 $ 1,409.1

Stockholders’ equity per outstanding share $ 14.28 $ 14.38 $ 13.47 $ 11.53 $ 10.03

Other Statistics

Cash flows from operations (2) (3) $ 762.2 $ 894.7 $ 903.4 $ 783.5 $ 766.8

Capital expenditures (3) (5) $ 639.7 $ 547.7 $ 432.1 $ 535.3 $ 1,627.3

Dividends paid $ 223.9 $ 175.5 $ 140.0 $ 110.2 $ 100.9

Dividends paid per share $ 1.72 $ 1.28 $ 1.00 $ 0.80 $ 0.72

Advertising expense (2) (3) $ 357.2 $ 340.2 $ 311.9 $ 308.3 $ 257.8

Stock price:

High $ 55.84 $ 52.12 $ 49.01 $ 40.26 $ 47.08

Low $ 40.69 $ 37.08 $ 29.94 $ 13.54 $ 20.99

Close $ 53.06 $ 50.92 $ 42.90 $ 36.17 $ 31.74

Number of employees 181,468 178,380 174,079 178,692 178,200

Number of restaurants (3) 1,994 1,894 1,824 1,773 1,702

(1) Includes asset impairment charges of $0.5 million, $4.7 million, $6.2 million, $12.0 million and $0.0 million, respectively.

(2) Fiscal year 2009 consisted of 53 weeks while all other fiscal years consisted of 52 weeks.

(3) Consistent with our consolidated financial statements, information has been presented on a continuing operations basis. Accordingly, the activities related to Smokey Bones, Rocky River Grillhouse and the nine Bahama Breeze restaurants closed

or sold in fiscal 2007 and 2008 have been excluded.

(4) Excludes restaurant depreciation and amortization of $326.9 million, $295.6 million, $283.4 million, $267.1 million and $230.0 million, respectively.

(5) Fiscal 2008 includes net cash used in the acquisition of RARE Hospitality International, Inc. of $1.20 billion in addition to $429.2 million of capital expenditures related principally to building new restaurants and replacing old restaurants

and equipment.