Red Lobster 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

Darden Restaurants, Inc. 2012 Annual Report 45

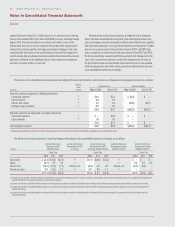

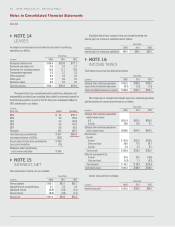

The following table presents the computation of basic and diluted net

earnings per common share:

Fiscal Year

(in millions, except per share data)

2012 2011 2010

Earnings from continuing operations $476.5 $478.7 $407.0

Losses from discontinued operations (1.0) (2.4) (2.5)

Net earnings $475.5 $476.3 $404.5

Average common shares

outstanding–Basic 130.1 136.8 139.3

Effect of dilutive stock-based

compensation 3.1 3.5 3.1

Average common shares

outstanding–Diluted 133.2 140.3 142.4

Basic net earnings per share:

Earnings from continuing operations $ 3.66 $ 3.50 $ 2.92

Losses from discontinued operations (0.01) (0.02) (0.02)

Net earnings $ 3.65 $ 3.48 $ 2.90

Diluted net earnings per share:

Earnings from continuing operations $ 3.58 $ 3.41 $ 2.86

Losses from discontinued operations (0.01) (0.02) (0.02)

Net earnings $ 3.57 $ 3.39 $ 2.84

Restricted stock and options to purchase shares of our common stock

excluded from the calculation of diluted net earnings per share because the

effect would have been anti-dilutive, are as follows:

Fiscal Year Ended

(in millions)

May 27, 2012 May 29, 2011 May 30, 2010

Anti-dilutive restricted

stock and options 2.6 1.2 3.3

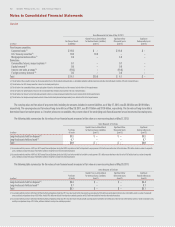

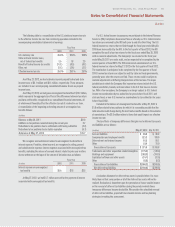

COMPREHENSIVE INCOME

Comprehensive income includes net earnings and other comprehensive income

(loss) items that are excluded from net earnings under U.S. generally accepted

accounting principles. Other comprehensive income (loss) items include foreign

currency translation adjustments, the effective unrealized portion of changes in

the fair value of cash flow hedges, unrealized gains and losses on our marketable

securities classified as held for sale and recognition of the funded status and

amortization of unrecognized net actuarial gains and losses related to our

pensionandotherpostretirementplans.SeeNote13–Stockholders’Equity

for additional information.

FOREIGN CURRENCY

The Canadian dollar is the functional currency for our Canadian restaurant

operations. Assets and liabilities denominated in Canadian dollars are translated

into U.S. dollars using the exchange rates in effect at the balance sheet date. Results

of operations are translated using the average exchange rates prevailing through-

out the period. Translation gains and losses are reported as a separate component of

other comprehensive income (loss). Aggregate cumulative translation losses were

$1.6 million and $0.4 million at May 27, 2012 and May 29, 2011, respectively.

Gains and losses from foreign currency transactions recognized in our consolidated

statements of earnings were not significant for fiscal 2012, 2011 or 2010.

SEGMENT REPORTING

As of May 27, 2012, we operated the Red Lobster, Olive Garden, LongHorn

Steakhouse, The Capital Grille, Bahama Breeze, Seasons 52 and Eddie V’s

restaurant brands in North America as operating segments. The brands operate

principally in the U.S. within the full-service dining industry, providing similar

products to similar customers. The brands also possess similar economic

characteristics, resulting in similar long-term expected financial performance

characteristics. Sales from external customers are derived principally from food

and beverage sales. We do not rely on any major customers as a source of sales.

We believe we meet the criteria for aggregating our operating segments into a

single reporting segment.

APPLICATION OF NEW ACCOUNTING STANDARDS

In May 2011, the FASB issued Accounting Standards Update (ASU) 2011-04,

Fair Value Measurement (Topic 820), Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRS. Many of the

amendments in this update change the wording used in the existing guidance

to better align U.S. generally accepted accounting principles with International

Financial Reporting Standards and to clarify the FASB’s intent on various aspects

of the fair value guidance. This update also requires increased disclosure of

quantitative information about unobservable inputs used in a fair value measure-

ment that is categorized within Level 3 of the fair value hierarchy. This update is

effective for us in our first quarter of fiscal 2013 and will be applied prospectively.

Other than requiring additional disclosures, adoption of this new guidance will

not have a significant impact on our consolidated financial statements.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income

(Topic 220), Presentation of Comprehensive Income, which requires companies to

present the total of comprehensive income, the components of net income, and

the components of other comprehensive income either in a single continuous

statement of comprehensive income or in two separate but consecutive statements.

This update eliminates the option to present the components of other compre-

hensive income as part of the statement of equity. In December 2011, the FASB

issued ASU 2011-12, Comprehensive Income (Topic 220), Deferral of the Effective

Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated

Other Comprehensive Income in ASU 2011-05, to defer the effective date of the

specific requirement to present items that are reclassified out of accumulated

other comprehensive income to net income alongside their respective components

of net income and other comprehensive income. We adopted all other provisions

of this update in our fourth quarter of fiscal 2012, with the addition of our

consolidated statements of comprehensive income and other changes to our

consolidated financial statements.

InSeptember2011,theFASBissuedASU2011-08,Intangibles–Goodwill

and Other (Topic 350), Testing Goodwill for Impairment, which permits an entity

to make a qualitative assessment of whether it is more likely than not that a