Red Lobster 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

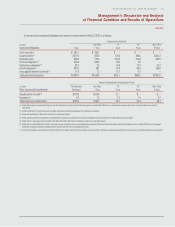

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

Darden Restaurants, Inc. 2012 Annual Report 25

FASB ASC Topic 740, Income Taxes, requires that a position taken or

expected to be taken in a tax return be recognized (or derecognized) in the

financial statements when it is more likely than not (i.e., a likelihood of more

than 50 percent) that the position would be sustained upon examination by

tax authorities. A recognized tax position is then measured at the largest

amount of benefit that is greater than 50 percent likely of being realized upon

ultimate settlement.

We provide for federal and state income taxes currently payable as well as

for those deferred because of temporary differences between reporting income

and expenses for financial statement purposes versus tax purposes. Federal

income tax credits are recorded as a reduction of income taxes. Deferred tax

assets and liabilities are recognized for the future tax consequences attributable

to differences between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases. Deferred tax assets and

liabilities are measured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are expected to be

recovered or settled. The effect on deferred tax assets and liabilities of a change

in tax rates is recognized in earnings in the period that includes the enactment

date. Interest recognized on reserves for uncertain tax positions is included in

interest, net in our consolidated statements of earnings. A corresponding liability

for accrued interest is included as a component of other current liabilities in our

consolidated balance sheets. Penalties, when incurred, are recognized in selling,

general and administrative expenses.

We base our estimates on the best available information at the time that

we prepare the provision. We generally file our annual income tax returns several

months after our fiscal year end. For U.S. federal income tax purposes, we par-

ticipate in the Internal Revenue Service’s (IRS) Compliance Assurance Process

whereby our U.S. federal income tax returns are reviewed by the IRS both prior

to and after their filing. The U.S. federal income tax returns that we filed through

the fiscal year ended May 30, 2010 have been audited by the IRS. In the first

quarter of fiscal 2012, the IRS completed the audit of our tax returns for the fiscal

year ended May 30, 2010 with no material adjustments. The Company’s tax

returns for the fiscal year ended May 29, 2011 are under audit, and are expected

to be completed by the second quarter of fiscal 2013. The IRS commenced

examination of our U.S. federal income tax returns for May 27, 2012 in the first

quarter of fiscal 2012. The examination is anticipated to be completed by the

first quarter of fiscal 2014. Income tax returns are subject to audit by state and

local governments, generally years after the returns are filed. These returns

could be subject to material adjustments or differing interpretations of the tax

laws. The major jurisdictions in which the Company files income tax returns

include the U.S. federal jurisdiction, Canada, and most states in the U.S. that have

an income tax. With a few exceptions, the Company is no longer subject to U.S.

federal income tax examinations by tax authorities for years before fiscal 2011,

and state and local, or non-U.S. income tax examinations by tax authorities for

years before fiscal 2002.

Included in the balance of unrecognized tax benefits at May 27, 2012 is

$1.0 million related to tax positions for which it is reasonably possible that the

total amounts could change during the next twelve months based on the

outcome of examinations. The $1.0 million relates to items that would impact

our effective income tax rate.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows generated from operating activities provide us with a significant

source of liquidity, which we use to finance the purchases of land, buildings

and equipment for new restaurants and to remodel existing restaurants, to pay

dividends to our shareholders and to repurchase shares of our common stock.

Since substantially all of our sales are for cash and cash equivalents, and accounts

payable are generally due in 5 to 30 days, we are able to carry current liabilities

in excess of current assets. In addition to cash flows from operations, we use a

combination of long-term and short-term borrowings to fund our capital needs.

We currently manage our business and financial ratios to maintain an

investment grade bond rating, which has historically allowed flexible access to

financing at reasonable costs. Currently, our publicly issued long-term debt

carries “Baa2” (Moody’s Investors Service), “BBB” (Standard & Poor’s) and

“BBB” (Fitch) ratings. Our commercial paper has ratings of “P-2” (Moody’s

Investors Service), “A-2” (Standard & Poor’s) and “F-2” (Fitch). These ratings

are as of the date of the filing of this annual report and have been obtained with

the understanding that Moody’s Investors Service, Standard & Poor’s and Fitch

will continue to monitor our credit and make future adjustments to these ratings

to the extent warranted. The ratings are not a recommendation to buy, sell or

hold our securities, may be changed, superseded or withdrawn at any time and

should be evaluated independently of any other rating.

Until October 3, 2011, we maintained a $750.0 million revolving Credit

Agreement dated September 20, 2007 (Prior Revolving Credit Agreement) with

Bank of America, N.A. (BOA), as administrative agent, and the lenders and other

agents party thereto. The Prior Revolving Credit Agreement supported our com-

mercial paper borrowing program and would have matured on September 20,

2012, but was terminated on October 3, 2011 when we entered into the new

credit arrangements described below and repaid all amounts that were

outstanding under the Prior Revolving Credit Agreement.

On October 3, 2011, we entered into a new $750.0 million revolving Credit

Agreement (New Revolving Credit Agreement) with BOA, as administrative

agent, and the lenders and other agents party thereto. The New Revolving Credit

Agreement is a senior unsecured credit commitment to the Company and

contains customary representations and affirmative and negative covenants

(including limitations on liens and subsidiary debt and a maximum consolidated

lease adjusted total debt to total capitalization ratio of 0.75 to 1.00) and events

of default customary for credit facilities of this type. As of May 27, 2012, we were

in compliance with the covenants under the New Revolving Credit Agreement.

Additional information regarding terms and conditions of the Prior Revolving

Credit Agreement and the New Revolving Credit Agreement is incorporated by

reference from Note 9 to our consolidated financial statements in Part II, Item 8

of this report.

As of May 27, 2012, we had no outstanding balances under the New

Revolving Credit Agreement. As of May 27, 2012, $262.7 million of commercial

paper and $70.9 million of letters of credit were outstanding, which are backed

by this facility. After consideration of outstanding commercial paper and letters

of credit backed by the New Revolving Credit Agreement, as of May 27, 2012, we

had $416.4 million of credit available under the New Revolving Credit Agreement.

On October 11, 2011, we issued $400.0 million aggregate principal amount

of unsecured 4.500 percent senior notes due October 2021 (the New Senior Notes)