Red Lobster 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

46 Darden Restaurants, Inc. 2012 Annual Report

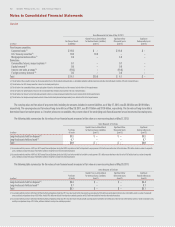

reporting unit’s fair value is less than its carrying value before applying the

two-step goodwill impairment model that is currently in place. If it is determined

through the qualitative assessment that a reporting unit’s fair value is more likely

than not greater than its carrying value, the remaining impairment steps would

be unnecessary. The qualitative assessment is optional, allowing companies to go

directly to the quantitative assessment. This update is effective for annual and

interim goodwill impairment tests performed in fiscal years beginning after

December15,2011,whichwillrequireustoadopttheseprovisionsinfiscal2013;

however, early adoption is permitted. We do not believe adoption of this new

guidance will have a significant impact on our consolidated financial statements.

In December 2011, the FASB issued ASU 2011-11, Balance Sheet (Topic 210),

Disclosures about Offsetting Assets and Liabilities, which requires companies to

disclose information about financial instruments that have been offset and

related arrangements to enable users of its financial statements to understand

the effect of those arrangements on its financial position. Companies will be

required to provide both net (offset amounts) and gross information in

the notes to the financial statements for relevant assets and liabilities that are

offset. This update is effective for us in our first quarter of fiscal 2014 and will

be applied retrospectively. We do not believe adoption of this new guidance

will have a significant impact on our consolidated financial statements.

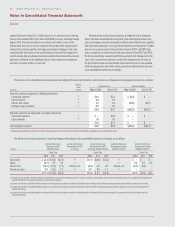

`NOTE 2

DISCONTINUED OPERATIONS

For fiscal 2012, 2011 and 2010, all gains and losses on disposition, impairment

charges and disposal costs related to the closure and disposition of Smokey Bones

and Rocky River Grillhouse restaurants and closure of nine Bahama Breeze

restaurants in fiscal 2007 and 2008 have been aggregated to a single caption

entitled losses from discontinued operations, net of tax benefit in our

consolidated statements of earnings and are comprised of the following:

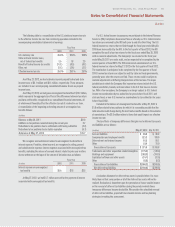

Fiscal Year

(in millions)

2012 2011 2010

Sales $ — $ — $ —

Losses before income taxes (1.7) (3.9) (4.0)

Income tax benefit 0.7 1.5 1.5

Net losses from

discontinued operations $(1.0) $(2.4) $(2.5)

As of May 27, 2012 and May 29, 2011, we had $5.6 million and $7.8 million,

respectively, of assets associated with the closed restaurants reported as

discontinued operations, which are included in land, buildings and equipment,

net on the accompanying consolidated balance sheets.

`NOTE 3

RECEIVABLES, NET

Receivables, net are primarily comprised of amounts owed to us from the sale

of gift cards in national retail outlets and receivables from national storage and

distribution companies with which we contract to provide services that are billed to

us on a per-case basis. In connection with these services, certain of our inventory

items are conveyed to these storage and distribution companies to transfer

ownership and risk of loss prior to delivery of the inventory to our restaurants.

We reacquire these items when the inventory is subsequently delivered to our

restaurants. These transactions do not impact the consolidated statements of

earnings. Receivables from the sale of gift cards in national retail outlets, national

storage and distribution companies and our overall allowance for doubtful

accounts are as follows:

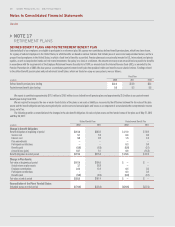

(in millions)

May 27, 2012 May 29, 2011

Retail outlet gift card sales $33.4 $25.0

Storage and distribution 6.5 17.4

Allowance for doubtful accounts (0.3) (0.3)

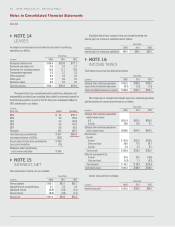

` NOTE 4

ASSET IMPAIRMENTS

During fiscal 2012, we recognized long-lived asset impairment charges of

$0.5 million ($0.3 million net of tax), primarily related to the permanent closure

of one Red Lobster, and the write-down of assets held for disposition based on

updated valuations. During fiscal 2011, we recognized long-lived asset impairment

charges of $4.7 million ($2.9 million net of tax), primarily related to the permanent

closure of two Red Lobsters, the write-down of another Red Lobster based on an

evaluation of expected cash flows, and the write-down of assets held for disposition

based on updated valuations. During fiscal 2010 we recognized long-lived asset

impairment charges of $6.2 million ($3.8 million net of tax), primarily related to

the write-down of assets held for disposition based on updated valuations, the

permanent closure of three Red Lobsters and three LongHorn Steakhouses and

the write-down of two LongHorn Steakhouses and one Olive Garden based on an

evaluation of expected cash flows. These costs are included in selling, general and

administrative expenses as a component of earnings from continuing operations

in the accompanying consolidated statements of earnings for fiscal 2012, 2011

and 2010. Impairment charges were measured based on the amount by which the

carrying amount of these assets exceeded their fair value. Fair value is generally

determined based on appraisals or sales prices of comparable assets and estimates

of future cash flows.

The results of operations for all Red Lobster, Olive Garden and

LongHorn Steakhouse restaurants permanently closed in fiscal 2012, 2011

and 2010 that would otherwise have met the criteria for discontinued

operations reporting are not material to our consolidated financial position,

results of operations or cash flows and, therefore, have not been presented

as discontinued operations.