Red Lobster 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and décor. They show as well in the fundamental strength

of Olive Garden, which – in its fourth decade of operation –

has average sales per restaurant that are among the highest

in the industry for nationally advertised casual dining chains.

Our brand management capabilities also show in our

comprehensive action plan to address Olive Garden’s recent

same-restaurant sales softness. We believe the loss of sales

momentum is the result of erosion over time in the value

leadership position Olive Garden has long enjoyed compared

to competitors. In response, we are taking a number of steps.

For one, we have been changing Olive Garden’s promotional

approach. In the second half of fiscal 2012, we accelerated

our movement away from promotions that feature one or two

new dishes, sometimes at a price point – an approach that

worked well for over a decade but has grown increasingly less

effective over the past 18 months. Our new approach is

consistent with Red Lobster’s and LongHorn Steakhouse’s

strategy for the past two years. We are featuring a wider

variety of dishes that are part of a broader value and/or

culinary theme, and when there is a price point, our adver-

tising is focusing more intensively on price and affordability.

In fiscal 2013, we will also introduce a new advertising

campaign at Olive Garden that communicates key brand

attributes, including value and affordability, in a fresher

way. In addition, we will make meaningful changes to the

core menu to increase the number of approachable price

points in each menu category and begin ramping up the

remodeling of our earliest 430 Olive Garden restaurants.

With these and other enhancements at Olive Garden and

continued momentum at Red Lobster, LongHorn Steakhouse

and our Specialty Restaurant Group brands, we continue to

target compound annual same-restaurant sales growth of

2 percent to 4 percent over the long-term. We expect, however,

that fiscal 2013 will be another year of below normalized

economic growth. Therefore, we are planning same-restaurant

sales growth of 1 percent to 2 percent this year.

The performance of our new restaurants, which are generating

value-creating returns on an overall basis, is another indication

of the strength of our brands. In fiscal 2013, we will once

again accelerate new-restaurant expansion, opening a total

of 100 to 110 net new restaurants, excluding Yard House,

up from 89 in fiscal 2012. At LongHorn Steakhouse, which

remains on track to become a national brand, we plan to add

44 to 48 net new restaurants in fiscal 2013 and 200 to 220

new units over the next five years. At Olive Garden, which

continues to have an ultimate unit potential in North America

of 925 to 975 restaurants, our plan is to open 35 to 40 net

new restaurants in fiscal 2013 and 125 to 135 new restaurants

over the next five years. Excluding Yard House’s addition

to the Group, we plan to add 14 to 16 net new restaurants

at our Specialty Restaurant Group in fiscal 2013 and 100

to 110 over the next five years.

In total, excluding Yard House, we expect overall new-restaurant

growth for the Company to be approximately 5 percent in

fiscal 2013, reaching what has been our long-range target

for some time now. And including or excluding Yard House,

we expect to meet or exceed that level of growth each of

the following four years.

A WEALTH OF COLLECTIVE EXPERIENCE

AND EXPERTISE

We believe the breadth and depth of our collective experience

and expertise – which the addition of the talented team at

Yard House will only increase – sets us apart in the full-service

restaurant industry. This collective capability is the product

of investments over many years in areas that are critical

to success in our business, including brand-management

excellence, restaurant operations excellence, supply chain,

talent management and information technology, among

other things. To support future growth, we are changing in

two important ways. We are modifying our organizational

structure so we can better leverage our existing experience

and expertise. And we are adding new expertise in additional

areas that are critical to future success.

A significant structural change occurred in fiscal 2008, with

the acquisition of LongHorn Steakhouse and The Capital

Grille, when we created the Specialty Restaurant Group.

The Specialty Restaurant Group provides our smaller brands

with world-class leadership and with support that is tailored

to meet their needs, without burdening them with costs

that compromise their ability to create value.

Several more recent structural changes reflect the recognition

that, with the tremendous day-to-day retail intensity of our

business, we were not paying sufficient attention to major

sales-building opportunities that have longer lead times.

To take full advantage of these opportunities, in the past

two years we have created enterprise-level Marketing and

Restaurant Operations units and established forward-looking

strategy units in our Finance and Information Technology

functions. These teams have been resourced with talented

leaders who have long tenure with the Company and with

talented professionals new to the organization. Together, the

teams are developing a more robust longer-term growth

agenda to supplement the ongoing work of our brands. In

fiscal 2013, we will be in the marketplace with two of the

resulting initiatives – a greatly enhanced “To Go!” takeout

operation at Olive Garden to respond to guests’ increasing

need for convenience, and a national Spanish-language

advertising campaign for Red Lobster to increase awareness

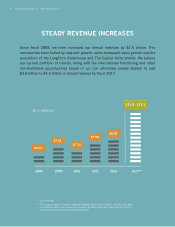

“As we look forward, we believe that over the next five years we have the opportunity

to increase our annual revenues by $3 billion to $4.5 billion...”

Darden Restaurants, Inc. 2012 Annual Report 3