Red Lobster 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

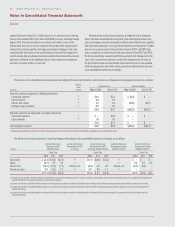

Notes to Consolidated Financial Statements

Darden

40 Darden Restaurants, Inc. 2012 Annual Report

RECEIVABLES, NET

Receivables, net of the allowance for doubtful accounts, represent their estimated

net realizable value. Provisions for doubtful accounts are recorded based on

historical collection experience and the age of the receivables. Receivables are

writtenoffwhentheyaredeemeduncollectible.SeeNote3–Receivables,Net

for additional information.

INVENTORIES

Inventories consist of food and beverages and are valued at the lower of weighted-

average cost or market.

MARKETABLE SECURITIES

Available-for-sale securities are carried at fair value. Classification of marketable

securities as current or noncurrent is dependent upon management’s intended

holding period, the security’s maturity date, or both. Unrealized gains and losses,

net of tax, on available-for-sale securities are carried in accumulated other

comprehensive income (loss) within the consolidated financial statements and

are reclassified into earnings when the securities mature or are sold.

LAND, BUILDINGS AND EQUIPMENT, NET

Land, buildings and equipment are recorded at cost less accumulated depreciation.

Building components are depreciated over estimated useful lives ranging from

7 to 40 years using the straight-line method. Leasehold improvements, which are

reflected on our consolidated balance sheets as a component of buildings in

land, buildings and equipment, net, are amortized over the lesser of the expected

lease term, including cancelable option periods, or the estimated useful lives of

the related assets using the straight-line method. Equipment is depreciated over

estimated useful lives ranging from 2 to 10 years also using the straight-line

method.SeeNote5–Land,BuildingsandEquipment,Netforadditionalinfor-

mation. Gains and losses on the disposal of land, buildings and equipment are

included in selling, general and administrative expenses in our accompanying

consolidated statements of earnings. Depreciation and amortization expense

from continuing operations associated with buildings and equipment and losses

on disposal of land, buildings and equipment were as follows:

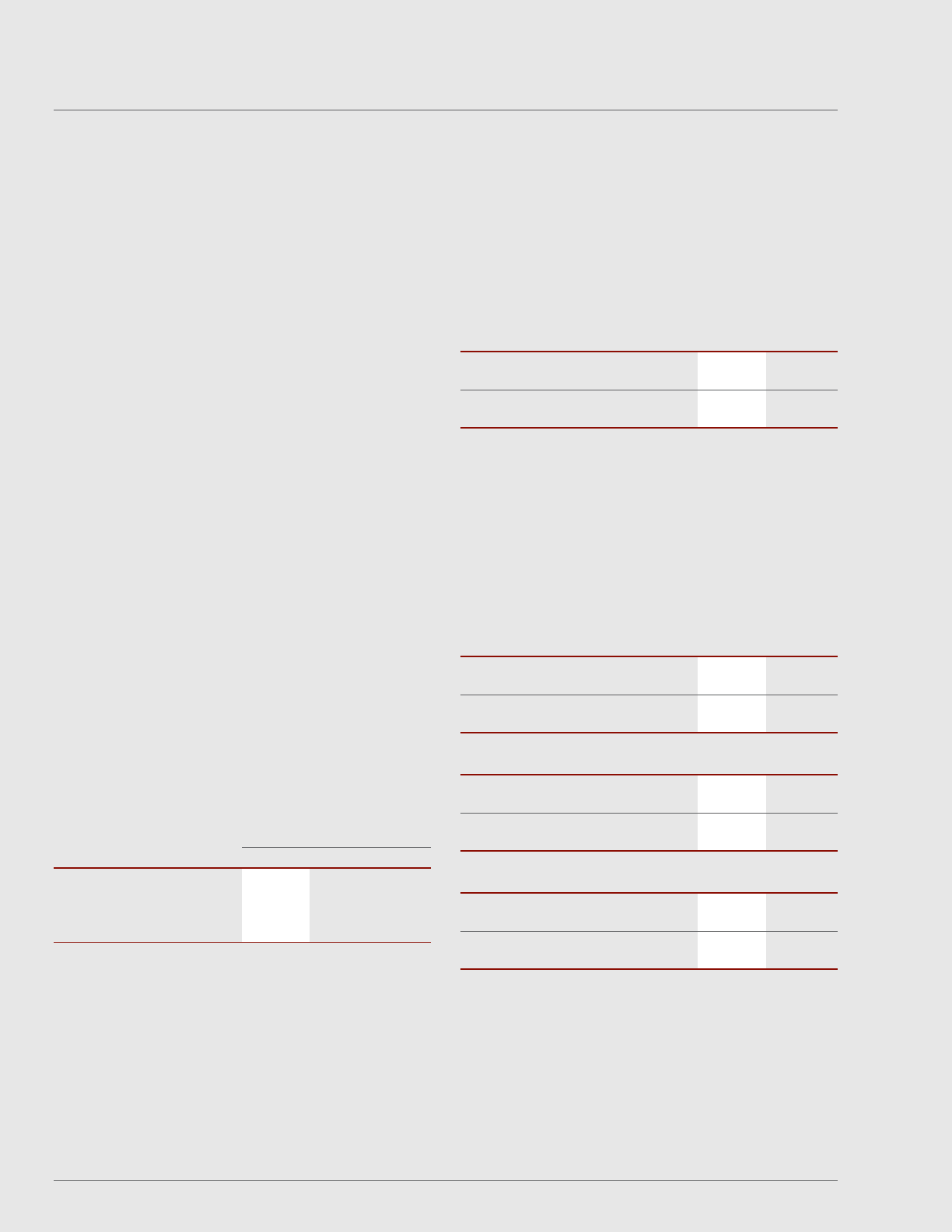

Fiscal Year

(in millions)

2012 2011 2010

Depreciation and amortization on

buildings and equipment $340.6 $308.7 $293.2

Losses on disposal of land,

buildings and equipment 7.1 6.9 0.3

CAPITALIZED SOFTWARE COSTS AND OTHER

DEFINITE-LIVED INTANGIBLES

Capitalized software, which is a component of other assets, is recorded at cost

less accumulated amortization. Capitalized software is amortized using the

straight-line method over estimated useful lives ranging from 3 to 10 years.

The cost of capitalized software and related accumulated amortization was

as follows:

(in millions)

May 27, 2012 May 29, 2011

Capitalized software $ 84.3 $ 79.9

Accumulated amortization (63.4) (56.1)

Capitalized software, net of

accumulated amortization $ 20.9 $ 23.8

We have other definite-lived intangible assets, including assets related to the

value of below-market leases, which were acquired as part of the RARE Hospitality

International, Inc. (RARE) and Eddie V’s acquisitions and are included as a

component of other assets on our consolidated balance sheets. We also have

definite-lived intangible liabilities related to the value of above-market leases,

which were acquired as part of the RARE and Eddie V’s acquisitions and are

included in other liabilities on our consolidated balance sheets. Definite-lived

intangibles are amortized on a straight-line basis over estimated useful lives

of 1 to 20 years. The cost and related accumulated amortization was as follows:

(in millions)

May 27, 2012 May 29, 2011

Other definite-lived intangibles $13.2 $11.1

Accumulated amortization (6.2) (5.6)

Other definite-lived intangible assets,

net of accumulated amortization $ 7.0 $ 5.5

(in millions)

May 27, 2012 May 29, 2011

Below-market leases $24.0 $25.3

Accumulated amortization (7.1) (8.6)

Below-market leases, net of

accumulated amortization $16.9 $16.7

(in millions)

May 27, 2012 May 29, 2011

Above-market leases $(8.6) $(8.4)

Accumulated amortization 2.3 1.8

Above-market leases, net of

accumulated amortization $(6.3) $(6.6)