Red Lobster 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

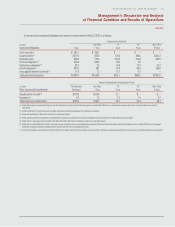

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

Darden Restaurants, Inc. 2012 Annual Report 23

Such costs include the cost of disposing of the assets as well as other

facility-related expenses from previously closed restaurants. These costs are

generally expensed as incurred. Additionally, at the date we cease using a property

under an operating lease, we record a liability for the net present value of any

remaining lease obligations, net of estimated sublease income. Any subsequent

adjustments to that liability as a result of lease termination or changes in estimates

of sublease income are recorded in the period incurred. Upon disposal of the

assets, primarily land, associated with a closed restaurant, any gain or loss is

recorded in the same caption within our consolidated statements of earnings

as the original impairment.

The judgments we make related to the expected useful lives of long-lived

assets and our ability to realize undiscounted cash flows in excess of the carrying

amounts of these assets are affected by factors such as the ongoing maintenance

and improvements of the assets, changes in economic conditions, changes in

usage or operating performance, desirability of the restaurant sites and other

factors, such as our ability to sell our assets held for sale. As we assess the

ongoing expected cash flows and carrying amounts of our long-lived assets,

significant adverse changes in these factors could cause us to realize a material

impairment loss. During fiscal 2012, we recognized asset impairment losses of

$0.5 million ($0.3 million after tax), primarily related to the permanent closure

of one Red Lobster, and the write-down of assets held for disposition based on

updated valuations. During fiscal 2011, we recognized asset impairment losses

of $4.7 million ($2.9 million after tax), primarily related to the permanent closure

of two Red Lobsters and the write-down of another Red Lobster based on an

evaluation of expected cash flows, and the write-down of assets held for disposi-

tion based on updated valuations. During fiscal 2010, we recognized asset

impairment losses of $6.2 million ($3.8 million after tax), primarily related to the

write-down of assets held for disposition based on updated valuations, the perma-

nent closure of three Red Lobsters and three LongHorn Steakhouses and the

write-down of two LongHorn Steakhouses and one Olive Garden based on an

evaluation of expected cash flows. Asset impairment losses are included in selling,

general and administrative expenses on our consolidated statements of earnings.

Valuation and Recoverability of Goodwill

and Trademarks

We review our goodwill and trademarks for impairment annually, as of the first

day of our fiscal fourth quarter, or more frequently if indicators of impairment

exist. Goodwill and trademarks are not subject to amortization and have been

assigned to reporting units for purposes of impairment testing. The reporting

units are our restaurant brands. At May 27, 2012 and May 29, 2011, we had

goodwill of $538.6 million and $517.1 million, respectively. At May 27, 2012 and

May 29, 2011, we had trademarks of $464.9 million and $454.0 million, respectively.

A significant amount of judgment is involved in determining if an indicator

of impairment has occurred. Such indicators may include, among others: a

significantdeclineinourexpectedfuturecashflows;asustained,significant

declineinourstockpriceandmarketcapitalization;asignificantadversechange

inlegalfactorsorinthebusinessclimate;unanticipatedcompetition;thetesting

forrecoverabilityofasignificantassetgroupwithinareportingunit;andslower

growth rates. Any adverse change in these factors could have a significant

impact on the recoverability of these assets and could have a material impact on

our consolidated financial statements.

The goodwill impairment test involves a two-step process. The first step is

a comparison of each reporting unit’s fair value to its carrying value. We estimate

fair value using the best information available, including market information and

discounted cash flow projections (also referred to as the income approach).

The income approach uses a reporting unit’s projection of estimated operating

results and cash flows that is discounted using a weighted-average cost of capital

that reflects current market conditions. The projection uses management’s best

estimates of economic and market conditions over the projected period including

growth rates in sales, costs and number of units, estimates of future expected

changes in operating margins and cash expenditures. Other significant estimates

and assumptions include terminal value growth rates, future estimates of capital

expenditures and changes in future working capital requirements. We validate

our estimates of fair value under the income approach by comparing the values to

fair value estimates using a market approach. A market approach estimates fair

value by applying cash flow and sales multiples to the reporting unit’s operating

performance. The multiples are derived from comparable publicly traded compa-

nies with similar operating and investment characteristics of the reporting units.

If the fair value of the reporting unit is higher than its carrying value,

goodwill is deemed not to be impaired, and no further testing is required. If the

carrying value of the reporting unit is higher than its fair value, there is an

indication that impairment may exist and the second step must be performed to

measure the amount of impairment loss. The amount of impairment is determined

by comparing the implied fair value of reporting unit goodwill to the carrying

value of the goodwill in the same manner as if the reporting unit was being

acquired in a business combination. Specifically, we would allocate the fair value

to all of the assets and liabilities of the reporting unit, including any unrecognized

intangible assets, in a hypothetical analysis that would calculate the implied fair

value of goodwill. If the implied fair value of goodwill is less than the recorded

goodwill, we would record an impairment loss for the difference.

Consistent with our accounting policy for goodwill and trademarks, we

performed our annual impairment test of our goodwill and trademarks as of the

first day of our fiscal fourth quarter. As of the beginning of our fiscal fourth

quarter, we had seven reporting units: Red Lobster, Olive Garden, LongHorn

Steakhouse, The Capital Grille, Bahama Breeze, Seasons 52 and Eddie V’s. Two

of these reporting units, LongHorn Steakhouse and The Capital Grille, have a

significant amount of goodwill. As we finalized the purchase price allocation for

Eddie V’s during our fourth fiscal quarter of 2012 and no indicators of impairment

were identified, we excluded the goodwill allocated to Eddie V’s from our annual

impairment test. As part of our process for performing the step one impairment

test of goodwill, we estimated the fair value of our reporting units utilizing the

income and market approaches described above to derive an enterprise value of

the Company. We reconciled the enterprise value to our overall estimated market

capitalization. The estimated market capitalization considers recent trends in our

market capitalization and an expected control premium, based on comparable

recent and historical transactions. Based on the results of the step one impairment

test, no impairment of goodwill was indicated.

Given the significance of goodwill related to LongHorn Steakhouse

($49.5 million) and The Capital Grille ($401.8 million), we also performed sensi-

tivity analyses on our estimated fair value of these reporting units using the

income approach. A key assumption in our fair value estimate is the weighted-

average cost of capital utilized for discounting our cash flow estimates in our