Red Lobster 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

Darden Restaurants, Inc. 2012 Annual Report 19

In June 2012, we announced a quarterly dividend of $0.50 per share,

payable on August 1, 2012. Previously, our quarterly dividend was $0.43 per share,

or $1.72 per share on an annual basis. Based on the $0.50 quarterly dividend

declaration, our expected annual dividend is $2.00 per share, a 16.3 percent

increase. Dividends are subject to the approval of the Company’s Board of

Directors and, accordingly, the timing and amount of our dividends are subject

to change.

To support future growth, we are striving to change in two important ways:

we are modifying our organizational structure so we can better leverage our existing

experience and expertise, and we are adding new expertise in additional areas that

are critical to future success. In the past two years we have created enterprise-

level marketing and restaurant operations units and established forward-looking

strategy units in our finance and information technology functions. We have

initiatives focusing on our Specialty Restaurant Group, enterprise-level sales

building, digital guest and employee engagement, health and wellness, and

centers of excellence. We plan to grow by leveraging our expertise and new

capabilities to increase same-restaurant sales, increase the number of restaurants

in each of our existing brands, and develop or acquire additional brands that can

be expanded profitably. We also continue to pursue other avenues of new business

development, including franchising our restaurants outside of the U.S. and Canada,

testing “synergy restaurants” and other formats to expand our brands, and selling

consumer packaged goods such as Olive Garden salad dressing.

The total sales growth we envision should increase the cost-effectiveness

of our support platform. However, we also plan to supplement our conventional

incremental year-to-year cost management efforts with an ongoing focus on

identifying and pursuing transformational multi-year cost reduction opportunities.

In fiscal 2013, we plan to continue to implement the four transformational

initiativesthatwereourfocuslastyear–furtherautomatingoursupplychain,

significantly reducing the use of energy, water and cleaning supplies in our

restaurants, centralizing management of our restaurant facilities and optimizing

labor costs within our restaurants.

There are significant risks and challenges that could impact our operations

and ability to increase sales and earnings. The full-service restaurant industry

is intensely competitive and sensitive to economic cycles and other business

factors, including changes in consumer tastes and dietary habits. Other risks

and uncertainties are discussed and referenced in the subsection below entitled

“Forward-Looking Statements.”

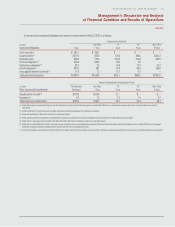

RESULTS OF OPERATIONS FOR FISCAL 2012, 2011

AND 2010

The following table sets forth selected operating data as a percent of sales from

continuing operations for the fiscal years ended May 27, 2012, May 29, 2011 and

May 30, 2010. This information is derived from the consolidated statements of

earnings found elsewhere in this report.

Fiscal Years

2012 2011 2010

Sales 100.0% 100.0% 100.0%

Costs and expenses:

Cost of sales:

Food and beverage 30.8 29.0 28.8

Restaurant labor 31.3 32.0 33.1

Restaurant expenses 15.0 15.1 15.2

Total cost of sales, excluding restaurant

depreciation and amortization of

4.1%, 3.9% and 4.0%, respectively 77.1% 76.1% 77.1%

Selling, general and administrative 9.2 9.9 9.7

Depreciation and amortization 4.4 4.2 4.3

Interest, net 1.3 1.2 1.3

Total costs and expenses 92.0% 91.4% 92.4%

Earnings before income taxes 8.0 8.6 7.6

Income taxes (2.0) (2.2) (1.9)

Earnings from continuing operations 6.0 6.4 5.7

Losses from discontinued operations,

net of taxes (0.1) — —

Net earnings 5.9% 6.4% 5.7%

SALES

Sales from continuing operations were $8.00 billion in fiscal 2012, $7.50 billion

in fiscal 2011 and $7.11 billion in fiscal 2010. The 6.6 percent increase in sales

from continuing operations for fiscal 2012 was driven by the addition of 89 net

new company-owned restaurants plus the addition of 11 Eddie V’s purchased

restaurants, and the 1.8 percent blended same-restaurant sales increase for

Olive Garden, Red Lobster and LongHorn Steakhouse.

Olive Garden’s sales of $3.58 billion in fiscal 2012 were 2.5 percent above

last fiscal year, driven primarily by revenue from 38 net new restaurants partially

offset by a U.S. same-restaurant sales decrease of 1.2 percent. The decrease

in U.S. same-restaurant sales resulted from a 1.3 percent decrease in same-

restaurant guest counts partially offset by a 0.1 percent increase in average

check. Average annual sales per restaurant for Olive Garden were $4.7 million

in fiscal 2012 compared to $4.8 million in fiscal 2011.

Red Lobster’s sales of $2.67 billion in fiscal 2012 were 5.9 percent above

last fiscal year, driven primarily by a U.S. same-restaurant sales increase of

4.6 percent combined with revenue from six net new restaurants. The increase

in U.S. same-restaurant sales resulted from a 2.2 percent increase in same-

restaurant guest counts combined with a 2.4 percent increase in average guest

check. Average annual sales per restaurant for Red Lobster were $3.8 million

in fiscal 2012 compared to $3.6 million in fiscal 2011.