Red Lobster 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LongHorn Steakhouse ended the fiscal

year with 386 restaurants and has the

ultimate potential for 600 to 800 total

locations. We expect to open more than

200 new restaurants by fiscal 2017, which

will generate annual sales of $650 million

and annual operating profit of $90 million.

With its current locations concentrated in

the eastern third of the country, LongHorn

Steakhouse’s opportunity to expand

nationwide makes it a valuable growth

engine in our portfolio.

LONGHORN

STEAKHOUSE

The Specialty Restaurant Group ended

the fiscal year with 110 restaurants and

has the ultimate potential for over 350

total locations. We expect to open more

than 100 new-restaurant units by fiscal

2017, which will generate annual sales

of $650 million and annual operating

profit of $80 million. With its strong

cash flows, the Specialty Restaurant

Group is a growth engine that is able

to fund its own growth.

THE SPECIALTY

RESTAURANT GROUP

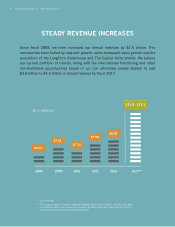

500We intend to add 500 more restaurants over

the next five years which we would translate

to 5 percent annual sales growth.

We have meaningful, value-creating unit growth

opportunities across all of our brands, looking only

at traditional restaurant sites and formats. The net

addition of 500 more restaurants by fiscal 2017 is

significant growth indeed, considering how few full-

service dining brands have more than 500 restaurants

in total. As we engage in this level of traditional

unit expansion, however, we are also exploring the

development of non-traditional sites and formats

that may enable us to deliver even more significant

new-restaurant growth.

Darden Restaurants, Inc. 2012 Annual Report 11