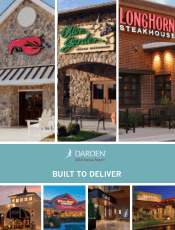

Red Lobster 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Left: Clarence Otis, Jr.

Chairman and Chief Executive Officer

Right: Andrew H. Madsen

President and Chief Operating Officer

The underlying resilience and vibrancy of our business came through clearly in fiscal

2012, despite several important challenges. These included a frustratingly slow and

uneven economic recovery; flagging sales momentum at Olive Garden, our largest brand;

and a meaningful spike in the cost of seafood, our largest food expenditure category.

TO OUR SHAREHOLDERS, EMPLOYEES AND GUESTS:

In the face of these difficulties, we generated solid sales

and earnings growth, largely because our other brands

performed well while we continued to enhance the cost-

effectiveness of our support platform. As we look to the

future, we are highly confident that – with a return to stronger

growth at Olive Garden, continued momentum across the

balance of our soon-to-be-expanded brand portfolio, our

increasingly efficient support platform, the considerable

collective expertise we possess as an organization and

our winning culture – Darden can generate compelling

shareholder value. Following a review of fiscal 2012, we

summarize what that compelling value should look like

over the next five years.

FISCAL 2012 FINANCIAL HIGHLIGHTS

Driven by higher same-restaurant sales growth than the

prior year and continued acceleration in new-restaurant

growth, we enjoyed strong sales growth in fiscal 2012.

However, because of Olive Garden’s lower-than-expected

sales growth and the abnormally elevated seafood cost

inflation we experienced, our growth in diluted net earnings

per share for the fiscal year was more modest.

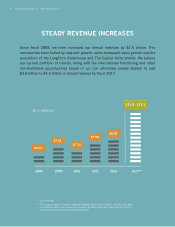

` Total sales from continuing operations were $8.0 billion,

a 6.6 percent increase from the $7.5 billion generated in

fiscal year 2011. This compares to a 2.7 percent increase

in total sales growth for the year for the Knapp-Track™

restaurant benchmark.

` Our total sales growth from continuing operations continued

to reflect a balance of new- and same-restaurant sales

growth. Combined U.S. same-restaurant sales increased

1.8 percent in fiscal 2012 for the Company’s large brands

(Olive Garden, Red Lobster and LongHorn Steakhouse),

which was higher than the 1.4 percent increase in fiscal

2011 and exceeded the 1.3 percent same-restaurant sales

increase in fiscal 2012 for the Knapp-Track™ restaurant

benchmark, excluding Darden. Combined U.S. same-

restaurant sales increased 4.6 percent in fiscal 2012 for

the Company’s Specialty Restaurant Group (The Capital

Grille, Bahama Breeze, Seasons 52 and Eddie V’s). The

Company also had a 4.7 percent increase in sales in fiscal

year 2012 due to new restaurants, which included the

acquisition of 11 Eddie V’s restaurants in fiscal 2012 and

the net addition of 89 net new restaurants during the year

at our other brands.

Darden Restaurants, Inc. 2012 Annual Report 1