Red Lobster 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.` Net earnings from continuing operations were $476.5 million

in fiscal 2012, a 0.5 percent decrease from net earnings

from continuing operations of $478.7 million in fiscal 2011.

Diluted net earnings per share from continuing operations

were $3.58 in fiscal 2012, a 5.0 percent increase from

diluted net earnings per share of $3.41 in fiscal 2011.

` In fiscal 2012, on an after-tax basis, net losses from

discontinued operations were $1.0 million and diluted net

losses per share from discontinued operations were $0.01,

related primarily to the carrying costs and losses on the

remaining properties held for disposition associated with

Smokey Bones Barbeque & Grill and Bahama Breeze

closings from fiscal 2007 and fiscal 2008. Including losses

from discontinued operations, combined net earnings

were $475.5 million in fiscal 2012, 0.2 percent below the

combined net earnings of $476.3 million in fiscal 2011.

Including losses from discontinued operations, combined

diluted net earnings per share were $3.57 in fiscal 2012,

compared to $3.39 in fiscal 2011.

` Olive Garden’s total sales were $3.58 billion, up 2.5 percent

from fiscal 2011. This reflected average annual sales per

restaurant of $4.7 million, the addition of 38 net new

restaurants and a U.S. same-restaurant sales decrease

of 1.2 percent.

` Red Lobster’s total sales were $2.67 billion, a 5.9 percent

increase from fiscal 2011. This reflected average annual

sales per restaurant of $3.8 million, the addition of six

net new restaurants and a U.S. same-restaurant sales

increase of 4.6 percent.

` LongHorn Steakhouse’s total sales were $1.12 billion,

up 13.5 percent from fiscal 2011. This reflected average

annual sales per restaurant of $3.0 million in fiscal 2012,

the addition of 32 net new restaurants and a U.S. same-

restaurant sales increase of 5.3 percent.

` The Specialty Restaurant Group’s total sales were

$623 million, a 24.1 percent increase from fiscal 2011,

and reflected strong growth from its three legacy brands

as well as the addition of Eddie V’s. Total sales increased

10.3 percent at The Capital Grille to $305 million, based on

a same-restaurant sales increase of 5.3 percent and the

addition of two net new restaurants. Total sales increased

12.5 percent for Bahama Breeze to $154 million, based

on a same-restaurant sales increase of 3.4 percent and

the addition of four new restaurants. And total sales

increased 45.3 percent at Seasons 52 to $128 million,

based on a same-restaurant sales increase of 3.8 percent

and the addition of six new restaurants. Finally, the

acquisition and operation of the 11 Eddie V’s restaurants

added $35 million of sales in fiscal 2012.

` We continued the buyback of Darden common stock,

spending $375 million in fiscal 2012 to repurchase

8.2 million shares. Since our share repurchase program

began in 1995, we have repurchased over 170 million

shares of our common stock for $3.77 billion, which

amounts to approximately 55 percent of our market

capitalization as of the end of fiscal 2012.

CREATING COMPELLING VALUE

As we look forward, we believe that over the next five years

we have the opportunity to increase our annual revenues by

$3 billion to $4.5 billion and increase our annual diluted

net earnings per share from continuing operations by $2.15

to $3.65, while returning $2.9 billion to $3.6 billion to share-

holders through dividends and repurchase of our common

stock. And, we have this level of opportunity even before

including the effect of our pending acquisition of Yard House,

which is expected to close early in our fiscal second quarter.

One of the most exciting brands in the full-service restaurant

industry, Yard House currently operates 39 restaurants in

13 states, its average sales per restaurant are $8.4 million,

it achieved compound annual sales growth of 21 percent

from 2009 through 2011, and today it is on track to open at

least five new restaurants each year for the next several years.

Based on its success and expansion since the first restaurant

opened in 1996, we believe Yard House has the potential to

reach at least 150 to 200 restaurants nationally.

Given Darden’s current scale, scope and capital cost, we

think it is appropriate to define the level of sales, earnings

and cash flow growth we envision – which will be elevated by

the addition of Yard House – as compelling value creation.

We are confident we can achieve these growth goals for two

reasons. First, we have a track record of creating comparable

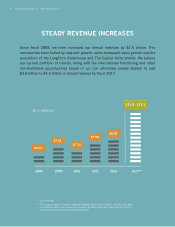

value. Since fiscal 2008, for example, our annual revenues

increased by $1.4 billion, our annual diluted net earnings

per share from continuing operations increased by $1.03

and our cumulative dividends and share repurchase totaled

$1.9 billion. Second, we believe our Company has what it

takes to deliver on the opportunity before us. Our brands

have strong individual and collective growth profiles. We

have a wealth of collective experience and expertise. Our

operating support platform is robust and ever more cost-

effective. In addition, we have a vibrant culture that is marked

by both an insatiable appetite to win in the marketplace

and a burning desire to make a positive difference in the

lives of our guests, employees, partners and neighbors.

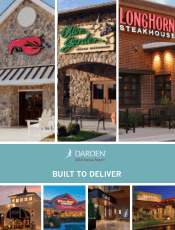

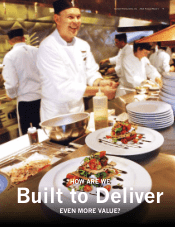

STRONG BRANDS

We have a demonstrated ability to build compelling brands

and evolve them over time so that they remain highly relevant

to restaurant consumers. These capabilities show in the

competitively superior same-restaurant sales growth we

achieved in fiscal 2012 at Red Lobster and LongHorn

Steakhouse, which are in their fifth and fourth decades of

operation, respectively. Their performance reflects consid-

erable work over the past several years in refreshing critical

brand elements, including each brand’s promotional

approach, core menu, advertising, and restaurant design

2 Darden Restaurants, Inc. 2012 Annual Report