Red Lobster 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

Darden Restaurants, Inc. 2012 Annual Report 59

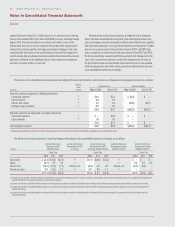

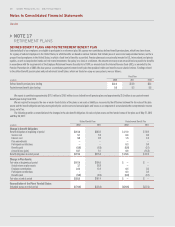

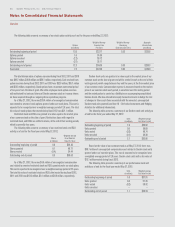

Components of net periodic benefit cost included in continuing operations are as follows:

Defined Benefit Plans Postretirement Benefit Plan

(in millions)

2012 2011 2010 2012 2011 2010

Service cost $ 5.1 $ 5.9 $ 4.9 $ 0.8 $0.9 $0.6

Interest cost 9.6 9.5 10.0 1.5 2.3 1.9

Expected return on plan assets (17.8) (16.6) (16.4) — — —

Amortization of unrecognized prior service cost 0.1 0.1 0.1 (0.1) — —

Recognized net actuarial loss 8.2 4.5 0.3 — 1.3 0.6

Net pension and postretirement cost (benefit) $ 5.2 $ 3.4 $ (1.1) $ 2.2 $4.5 $3.1

The amortization of the net actuarial loss component of our fiscal 2013 net periodic benefit cost for the defined benefit plans and postretirement benefit plan is

expected to be approximately $8.8 million and $0.0 million, respectively.

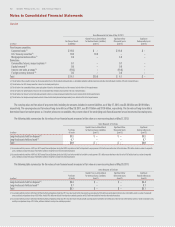

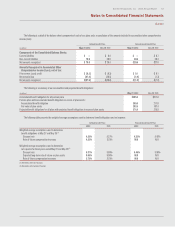

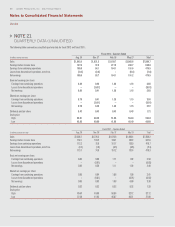

The fair values of the defined benefit pension plans assets at their measurement dates of May 27, 2012 and May 29, 2011, are as follows:

Items Measured at Fair Value at May 27, 2012

Quoted Prices in Active Market Significant Other Significant

Fair Value of Assets for Identical Assets (Liabilities) Observable Inputs Unobservable Inputs

(In millions) (Liabilities) (Level 1) (Level 2) (Level 3)

Equity:

U.S. Commingled Funds (1) $ 80.5 $ — $ 80.5 $ —

International Commingled Funds (2) 26.8 — 26.8 —

Emerging Market Commingled Funds (3) 11.3 — 11.3 —

Real Estate Commingled Funds (4) 10.0 — 10.0 —

Fixed-Income:

U.S. Treasuries (5) 20.0 20.0 — —

U.S. Corporate Securities (5) 37.7 — 37.7 —

International Securities (5) 2.7 — 2.7 —

Public Sector Utility Securities (5) 10.4 — 10.4 —

Cash & Accruals 4.1 4.1 — —

Total $203.5 $24.1 $179.4 $ —

(1) U.S. commingled funds are comprised of investments in funds that purchase publicly traded U.S. common stock for total return purposes. Investments are valued at unit values provided by the investment managers which are based on the fair value

of the underlying investments. There are no redemption restrictions associated with these funds.

(2) International commingled funds are comprised of investments in funds that purchase publicly traded non-U.S. common stock for total return purposes. Investments are valued at unit values provided by the investment managers which are based

on the fair value of the underlying investments. There are no redemption restrictions associated with these funds.

(3) Emerging market commingled funds and developed market securities are comprised of investments in funds that purchase publicly traded common stock of non-U.S. companies for total return purposes. Funds are valued at unit values provided

by the investment managers which are based on the fair value of the underlying investments. There are no redemption restrictions associated with these funds.

(4) Real estate commingled funds are comprised of investments in funds that purchase publicly traded common stock of real estate securities for purposes of total return. These investments are valued at unit values provided by the investment managers

which are based on the fair value of the underlying investments. There are no redemption restrictions associated with these funds.

(5) Fixed-income securities are comprised of investments in government and corporate debt securities. These securities are valued by the trustee at closing prices from national exchanges or pricing vendors on the valuation date.