Red Lobster 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

60 Darden Restaurants, Inc. 2012 Annual Report

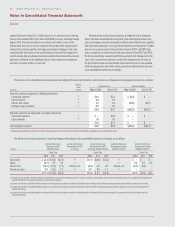

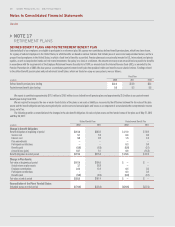

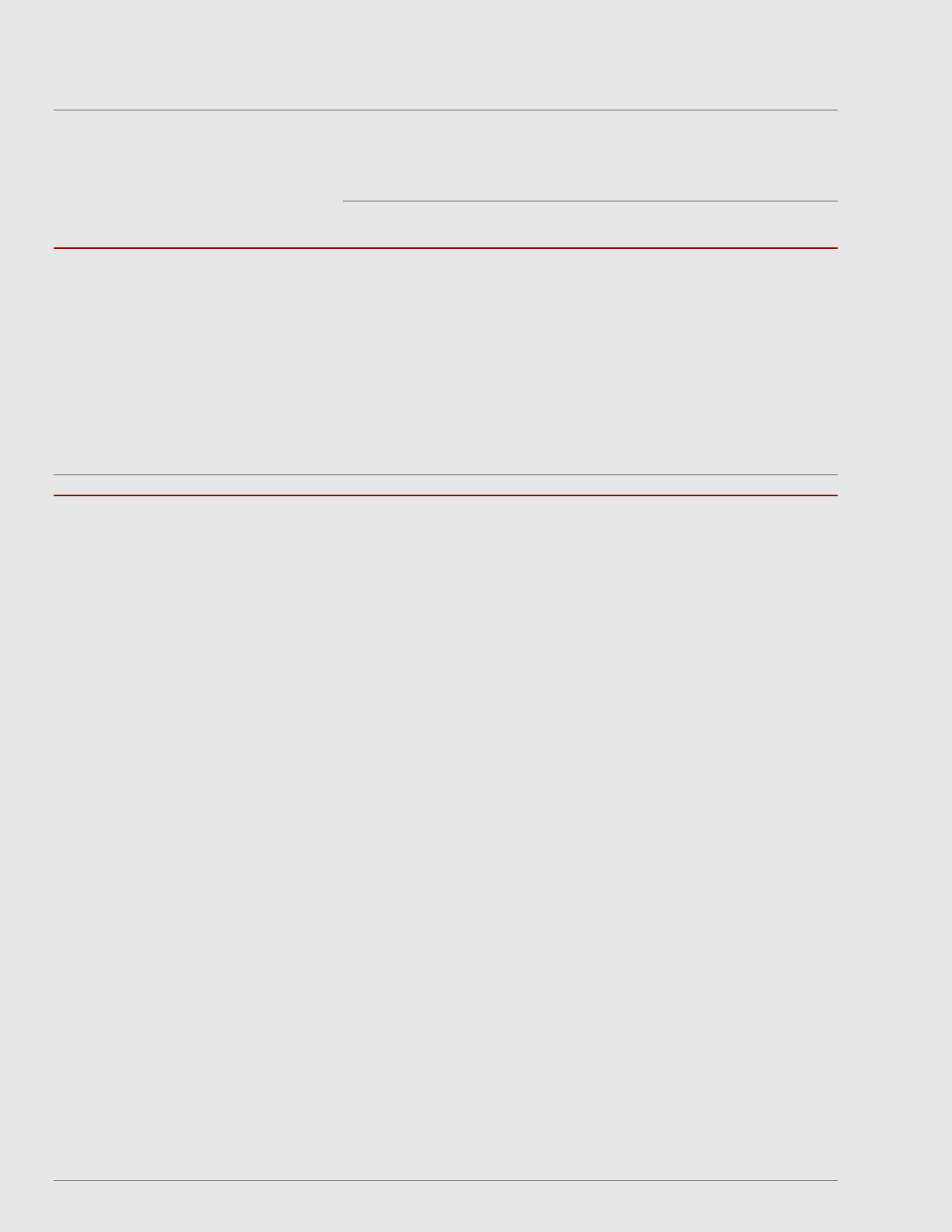

Items Measured at Fair Value at May 29, 2011

Quoted Prices in Active Market Significant Other Significant

Fair Value of Assets for Identical Assets (Liabilities) Observable Inputs Unobservable Inputs

(In millions) (Liabilities) (Level 1) (Level 2) (Level 3)

Equity:

U.S. & International (1) $ 37.9 $37.9 $ — $ —

U.S. Mutual & Commingled Funds (2) 22.1 1.6 20.5 —

Developed Market Equity Funds (3) 19.7 11.7 8.0 —

Emerging Market Equity Funds (3) 6.9 — 6.9 —

Private Equity Partnerships (4) 25.6 — — 25.6

Private Equity Securities (5) — — — —

Fixed-Income:

Fixed-income Securities (6) 43.2 38.3 4.9 —

Energy & Real Estate Public Sector (7) 9.1 — 4.8 4.3

Real Asset Commingled Funds (8) 4.0 — 4.0 —

Real Asset Private Funds (9) 10.8 — — 10.8

Cash & Accruals 8.1 8.1 — —

Total $187.4 $97.6 $49.1 $40.7

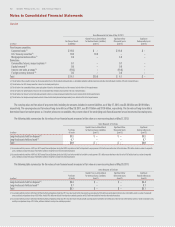

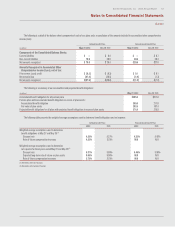

(1) U.S. equity securities and international equity securities are comprised of investments in common stock of U.S. and non-U.S. companies for total return purposes. These investments are valued by the trustee at closing prices from national exchanges

on the valuation date.

(2) U.S. mutual and commingled funds are comprised of investments in funds that purchase publicly traded U.S. common stock for total return purposes. Investments are valued at unit values provided by the investment managers which are based

on the fair value of the underlying investments.

(3) Emerging market equity funds and developed market securities are comprised of investments in funds that purchase publicly traded common stock of non-U.S. companies for total return purposes. Funds are valued at unit values provided by the

investment managers which are based on the fair value of the underlying investments.

(4) Private equity partnerships are comprised of investments in limited partnerships that invest in private companies for total return purposes. The investments are valued at fair value which is generally based on the net asset value or capital balance as

reported by the partnerships subject to the review and approval of the investment managers and their consultants. As there is not a liquid market for some of these investments, realization of the estimated fair value of such investments is dependent

upon transactions between willing sellers and buyers.

(5) Private equity securities are comprised of investments in publicly traded common stock that were received as a distribution from a private equity partnership as well as equity investments in private companies for total return purposes. Stocks received

from private equity distributions are valued by the trustee at closing prices from national exchanges on the valuation date. Investments in private companies are valued by management based upon information provided by the respective third-party

investment manager who considers factors such as the cost of the investment, most recent round of financing, and expected future cash flows.

(6) Fixed-income securities are comprised of investments in government and corporate debt securities. These securities are valued by the trustee at closing prices from national exchanges or pricing vendors on the valuation date. Unlisted investments

are valued at prices quoted by various national markets, fixed-income pricing models and/or independent financial analysts.

(7) Energy and real estate securities are comprised of investments in publicly traded common stock of energy companies and real estate investment trusts for purposes of total return. These securities are valued by the trustee at closing prices from national

exchanges on the valuation date. Unlisted investments are valued at prices quoted by various national markets and publications and/or independent financial analysts.

(8) Real asset commingled funds are comprised of investments in funds that purchase publicly traded common stock of energy companies or real estate investment trusts for purposes of total return. These investments are valued at unit values provided

by the investment managers which are based on the fair value of the underlying investments.

(9) Real asset private funds are comprised of interests in limited partnerships that invest in private companies in the energy industry and private real estate properties for purposes of total return. These interests are valued at fair value which is generally

based on the net asset value or capital balance as reported by the partnerships subject to the review and approval of the investment managers and their consultants. As there is not a liquid market for some of these investments, realization of the

estimated fair value of such investments is dependent upon transactions between willing sellers and buyers.