Red Lobster 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

64 Darden Restaurants, Inc. 2012 Annual Report

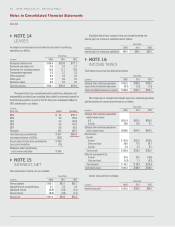

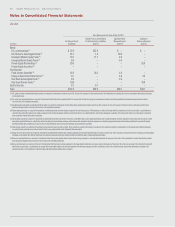

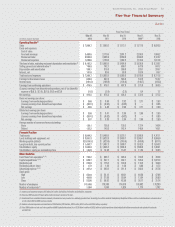

The following table presents a summary of our stock option activity as of and for the year ended May 27, 2012:

Weighted-Average Weighted-Average Aggregate

Options Exercise Price Remaining Intrinsic Value

(in millions) Per Share Contractual Life (Yrs) (in millions)

Outstanding beginning of period 13.0 $32.77 5.53 $235.6

Options granted 1.6 51.06

Options exercised (2.2) 28.12

Options canceled (0.1) 35.71

Outstanding end of period 12.3 $36.05 5.58 $209.3

Exercisable 7.2 $32.28 3.90 $150.0

The total intrinsic value of options exercised during fiscal 2012, 2011 and 2010

was $49.7 million, $49.9 million and $59.1 million, respectively. Cash received from

option exercises during fiscal 2012, 2011 and 2010 was $62.9 million, $55.7 million

and $59.3 million, respectively. Stock options have a maximum contractual period

of ten years from the date of grant. We settle employee stock option exercises

with authorized but unissued shares of Darden common stock or treasury shares

we have acquired through our ongoing share repurchase program.

As of May 27, 2012, there was $33.4 million of unrecognized compensation

cost related to unvested stock options granted under our stock plans. This cost is

expected to be recognized over a weighted-average period of 2.5 years. The total

fair value of stock options that vested during fiscal 2012 was $21.1 million.

Restricted stock and RSUs are granted at a value equal to the market price

of our common stock on the date of grant. Restrictions lapse with regard to

restricted stock, and RSUs are settled in shares, at the end of their vesting periods,

which is generally four years.

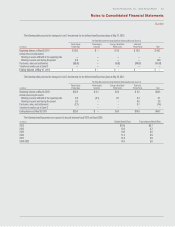

The following table presents a summary of our restricted stock and RSU

activity as of and for the fiscal year ended May 27, 2012:

Weighted-Average

Shares Grant Date Fair

(in millions) Value Per Share

Outstanding beginning of period 0.6 $29.36

Shares granted 0.1 46.71

Shares vested (0.4) 34.44

Outstanding end of period 0.3 $39.63

As of May 27, 2012, there was $4.6 million of unrecognized compensation

cost related to unvested restricted stock and RSUs granted under our stock plans.

This cost is expected to be recognized over a weighted-average period of 2.5 years.

The total fair value of restricted stock and RSUs that vested during fiscal 2012,

2011 and 2010 was $10.0 million, $9.1 million and $9.4 million, respectively.

Darden stock units are granted at a value equal to the market price of our

common stock on the date of grant and will be settled in cash at the end of their

vesting periods, which range between four and five years, at the then market price

of our common stock. Compensation expense is measured based on the market

price of our common stock each period, is amortized over the vesting period

and the vested portion is carried as a liability in our accompanying consolidated

balance sheets. We also entered into equity forward contracts to hedge the risk

of changes in future cash flows associated with the unvested, unrecognized

Dardenstockunitsgranted(seeNote10–DerivativeInstrumentsandHedging

Activities for additional information).

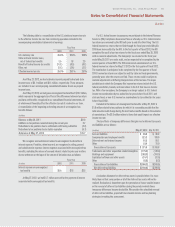

The following table presents a summary of our Darden stock unit activity as

of and for the fiscal year ended May 27, 2012:

Units Weighted-Average

(in millions) Fair Value Per Unit

Outstanding beginning of period 1.9 $50.92

Units granted 0.6 50.08

Units vested (0.3) 48.74

Units canceled (0.1) 39.38

Outstanding end of period 2.1 $53.06

Based on the value of our common stock as of May 27, 2012, there was

$48.7 million of unrecognized compensation cost related to Darden stock units

granted under our incentive plans. This cost is expected to be recognized over

a weighted-average period of 2.9 years. Darden stock units with a fair value of

$12.1 million vested during fiscal 2012.

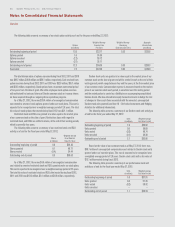

The following table presents a summary of our performance stock unit

activity as of and for the fiscal year ended May 27, 2012:

Units Weighted-Average

(in millions) Fair Value Per Unit

Outstanding beginning of period 1.0 $37.91

Units granted 0.3 51.45

Units vested (0.2) 50.42

Units canceled — —

Outstanding end of period 1.1 $39.33