Red Lobster 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

28 Darden Restaurants, Inc. 2012 Annual Report

Our fixed-charge coverage ratio, which measures the number of times each

year that we earn enough to cover our fixed charges, amounted to 5.0 times and

5.4 times, on a continuing operations basis, for the fiscal years ended May 27,

2012 and May 29, 2011, respectively. Our adjusted debt to adjusted total capital

ratio (which includes 6.25 times the total annual minimum rent of $136.6 million

and $125.6 million for the fiscal years ended May 27, 2012 and May 29, 2011,

respectively, as components of adjusted debt and adjusted total capital) was

62 percent and 56 percent at May 27, 2012 and May 29, 2011, respectively.

We include the lease-debt equivalent and contractual lease guarantees in our

adjusted debt to adjusted total capital ratio reported to shareholders, as we

believe its inclusion better represents the optimal capital structure that we

target from period to period and because it is consistent with the calculation

of the covenant under our New Revolving Credit Agreement.

Based on these ratios, we believe our financial condition is strong.

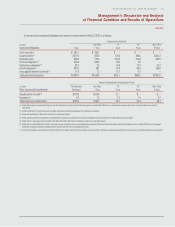

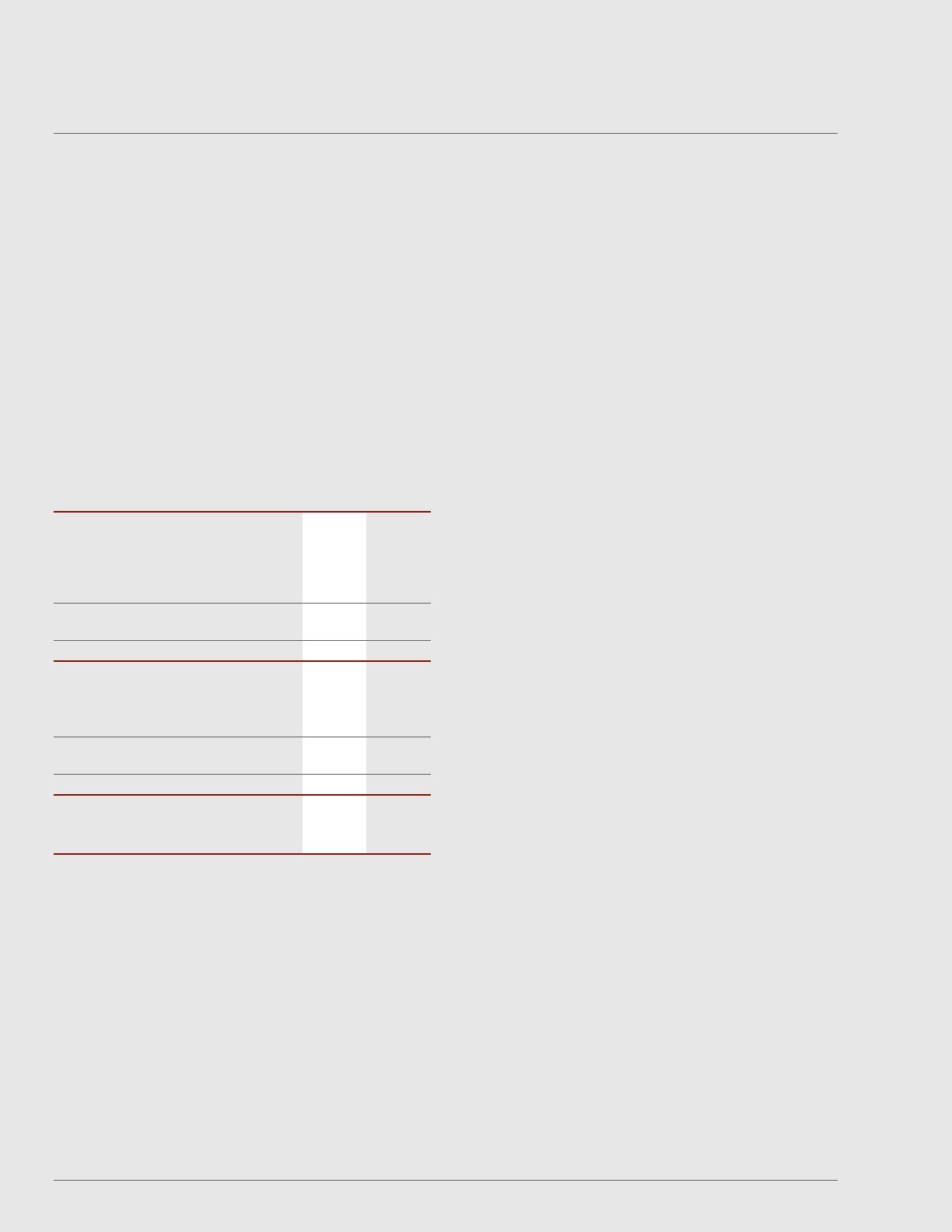

The composition of our capital structure is shown in the following table.

May 27, May 29,

(in millions, except ratios)

2012 2011

CAPITAL STRUCTURE

Short-term debt $ 262.7 $ 185.5

Current portion long-term debt 350.0 —

Long-term debt, excluding unamortized discounts 1,459.1 1,411.7

Capital lease obligations 56.0 57.3

Total debt $2,127.8 $1,654.5

Stockholders’ equity 1,842.0 1,936.2

Total capital $3,969.8 $3,590.7

CALCULATION OF ADJUSTED CAPITAL

Total debt $2,127.8 $1,654.5

Lease-debt equivalent 853.8 785.0

Guarantees 5.4 7.4

Adjusted debt $2,987.0 $2,446.9

Stockholders’ equity 1,842.0 1,936.2

Adjusted total capital $4,829.0 $4,383.1

CAPITAL STRUCTURE RATIOS

Debt to total capital ratio 54% 46%

Adjusted debt to adjusted total capital ratio 62% 56%

Net cash flows provided by operating activities from continuing operations

were $762.2 million, $894.7 million and $903.4 million in fiscal 2012, 2011

and 2010, from continuing operations of $476.5 million, $478.7 million and

$407.0 million in fiscal 2012, 2011 and 2010, respectively. Net cash flows

provided by operating activities from continuing operations decreased in fiscal

2012 primarily due to higher inventory levels and the settlement of our October

2011 treasury-lock instruments. The increase in inventory levels in fiscal 2012

was primarily related to the timing of inventory purchases as a result of our

strategy to take ownership of our inventory earlier in the supply chain to ensure a

more secure and efficient supply of inventory to our restaurants. Net cash flows

provided by operating activities reflect income tax payments of $123.5 million,

$126.4 million and $94.8 million in fiscal 2012, 2011 and 2010, respectively. The

lower tax payments in fiscal 2010, as compared with tax payments in fiscal 2012

and 2011, primarily relates to the recognition of tax benefits related to the

timing of deductions for fixed-asset related expenditures and the application

of the overpayment of income taxes in prior years to fiscal 2010 tax liabilities.

Net cash flows used in investing activities from continuing operations were

$721.6 million, $552.7 million and $428.7 million in fiscal 2012, 2011 and 2010,

respectively. Net cash flows used in investing activities from continuing operations

included capital expenditures incurred principally for building new restaurants,

remodeling existing restaurants, replacing equipment, and technology initiatives.

Capital expenditures related to continuing operations were $639.7 million in fiscal

2012, compared to $547.7 million in fiscal 2011 and $432.1 million in fiscal 2010.

The increasing trend of expenditures in fiscal 2012 and 2011 results primarily

from increases in remodel and new restaurant activity over the past two years.

Additionally, net cash used in the acquisition of Eddie V’s in fiscal 2012 was

$58.5 million.

Net cash flows used in financing activities from continuing operations were

$40.4 million, $521.0 million and $290.0 million in fiscal 2012, 2011 and 2010,

respectively. During October 2011, we completed the offering of $400.0 million

of New Senior Notes, resulting in net proceeds of $394.9 million which were used

to effectively refinance the $225.0 million of long-term notes that we repaid at

maturity during fiscal 2011 and a portion of our outstanding short-term debt.

Repayments of long-term debt were $2.1 million, $226.8 million and $1.8 million

in fiscal 2012, 2011 and 2010, respectively. Net proceeds from the issuance of

short-term debt were $77.2 million and $185.5 million in fiscal 2012 and 2011,

respectively, while net repayments of short-term debt were $150.0 million in

fiscal 2010. For fiscal 2012, net cash flows used in financing activities included

our repurchase of 8.2 million shares of our common stock for $375.1 million,

compared to 8.6 million shares of our common stock for $385.5 million in fiscal

2011 and 2.0 million shares of our common stock for $85.1 million in fiscal 2010.

As of May 27, 2012, our Board of Directors had authorized us to repurchase up to

187.4 million shares of our common stock and a total of 170.9 million shares had

been repurchased under the authorization. The repurchased common stock is

reflected as a reduction of stockholders’ equity. As of May 27, 2012, our unused

authorization was 16.5 million shares. We received proceeds primarily from the

issuance of common stock upon the exercise of stock options of $70.2 million,

$63.0 million and $66.3 million in fiscal 2012, 2011 and 2010, respectively. Net

cash flows used in financing activities also included dividends paid to stock-

holders of $223.9 million, $175.5 million and $140.0 million in fiscal 2012, 2011

and 2010, respectively. The increase in dividend payments reflects the increase

in our annual dividend rate from $1.00 per share in fiscal 2010, to $1.28 per

share in fiscal 2011 and to $1.72 per share in fiscal 2012. In June 2012, our

Board of Directors approved an increase in the quarterly dividend to $0.50 per

share, which indicates an annual dividend of $2.00 per share in fiscal 2013.

Our defined benefit and other postretirement benefit costs and liabilities are

determined using various actuarial assumptions and methodologies prescribed

underFASBASCTopic715,Compensation–RetirementBenefitsandTopic712,

Compensation–NonretirementPostemploymentBenefits.Weusecertain

assumptions including, but not limited to, the selection of a discount rate,

expected long-term rate of return on plan assets and expected health care cost

trend rates. We set the discount rate assumption annually for each plan at its

valuation date to reflect the yield of high-quality fixed-income debt instruments,