Red Lobster 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

Darden Restaurants, Inc. 2012 Annual Report 47

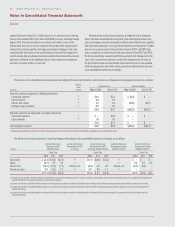

` NOTE 5

LAND, BUILDINGS AND

EQUIPMENT, NET

The components of land, buildings and equipment, net, are as follows:

(in millions)

May 27, 2012 May 29, 2011

Land $ 854.1 $ 799.6

Buildings 3,959.7 3,633.1

Equipment 1,701.2 1,511.3

Assets under capital leases 68.1 67.7

Construction in progress 142.5 155.7

Total land, buildings and equipment $ 6,725.6 $ 6,167.4

Less accumulated depreciation and amortization (2,758.3) (2,533.0)

Less amortization associated with assets

under capital leases (16.0) (12.4)

Land, buildings and equipment, net $ 3,951.3 $ 3,622.0

` NOTE 6

OTHER ASSETS

The components of other assets are as follows:

(in millions)

May 27, 2012 May 29, 2011

Trust-owned life insurance $ 68.9 $ 67.5

Capitalized software costs, net 20.9 23.8

Liquor licenses 47.3 43.7

Acquired below-market leases, net 16.9 16.7

Loan costs, net 15.3 12.2

Marketable securities 33.0 18.4

Insurance-related 16.7 16.5

Miscellaneous 12.8 10.9

Total other assets $231.8 $209.7

` NOTE 7

SHORT-TERM DEBT

As of May 27, 2012, amounts outstanding as short-term debt, which consist of

unsecured commercial paper borrowings, bearing an interest rate of 0.32 percent,

were $262.7 million. As of May 29, 2011, amounts outstanding as short-term debt,

which consist of unsecured commercial paper borrowings, bearing an interest

rate of 0.30 percent, were $185.5 million.

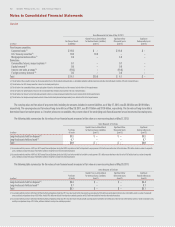

`NOTE 8

OTHER CURRENT LIABILITIES

The components of other current liabilities are as follows:

(in millions)

May 27, 2012 May 29, 2011

Non-qualified deferred compensation plan $201.4 $200.1

Sales and other taxes 60.6 61.5

Insurance-related 35.2 33.6

Employee benefits 59.7 42.6

Derivative liabilities 45.3 23.2

Accrued interest 15.6 14.0

Miscellaneous 36.6 34.3

Total other current liabilities $454.4 $409.3

` NOTE 9

LONG-TERM DEBT

The components of long-term debt are as follows:

(in millions)

May 27, 2012 May 29, 2011

5.625% senior notes due October 2012 $ 350.0 $ 350.0

7.125% debentures due February 2016 100.0 100.0

6.200% senior notes due October 2017 500.0 500.0

4.500% senior notes due October 2021 400.0 —

6.000% senior notes due August 2035 150.0 150.0

6.800% senior notes due October 2037 300.0 300.0

ESOP loan with variable rate of interest

(0.59% at May 27, 2012) due December 2018 5.9 8.0

Total long-term debt $1,805.9 $1,408.0

Fair value hedge 3.2 3.7

Less issuance discount (5.5) (4.4)

Total long-term debt less issuance discount $1,803.6 $1,407.3

Less current portion (349.9) —

Long-term debt, excluding current portion $1,453.7 $1,407.3

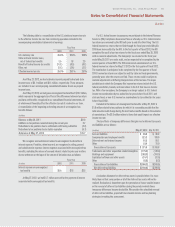

Until October 3, 2011, we maintained a $750.0 million revolving Credit

Agreement dated September 20, 2007 (Prior Revolving Credit Agreement) with

Bank of America, N.A. (BOA), as administrative agent, and the lenders and other

agents party thereto. The Prior Revolving Credit Agreement was a senior unsecured

credit commitment to the Company and contained customary representations,

affirmative and negative covenants (including limitations on liens and subsidiary

debt and a maximum consolidated lease adjusted total debt to total capitalization

ratio of 0.75 to 1.00) and events of default usual for credit facilities of this type.

The Prior Revolving Credit Agreement also contained a sub-limit of $150.0 million

for the issuance of letters of credit. The Prior Revolving Credit Agreement sup-

ported our commercial paper borrowing program and would have matured on

September 20, 2012, but was terminated on October 3, 2011 when we entered

into the new credit arrangements described below and repaid all amounts that

were outstanding under the Prior Revolving Credit Agreement.