Radio Shack 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

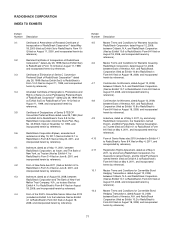

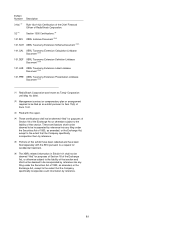

EXPLANATION OF NON-GAAP

FINANCIAL MEASURES

Management measures and reports RadioShack’s

financial results in accordance with U.S. generally accepted

accounting principles (“GAAP”). In this annual report,

RadioShack highlights certain items that have significantly

impacted the Company’s financial results and uses

non-GAAP financial measures to help readers understand

the financial impact of these items. These non-GAAP

financial measures are not intended to be a substitute for

the corresponding GAAP measures and should be read

only in conjunction with our consolidated financial statements

prepared in accordance with GAAP. Information concerning

the reconciliation of non-GAAP financial measures to their

comparable GAAP financial measures is included in the

adjacent tables.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

Net Income

12 Months Ended Dec. 31, 2011

(in millions)

Excluding one-time items $ 98.4

T-Mobile charge (14.4)

T-Mobile inventory costs (1.6)

China plant closing costs (7.7)

Early retirement of debt (2.5)

As reported according to GAAP $ 72.2

Net Cash Provided by Operating Activities

12 Months Ended Dec. 31, 2011

(in millions)

Free cash flow $ 86.2

Additions to property, plant & equipment 82.1

Dividends paid 49.6

As reported according to GAAP $217.9

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements,

as referenced in the Private Securities Litigation Reform

Act of 1995. These forward-looking statements reflect

management’s current views and projections regarding

economic conditions, the retail industry environment and

Company performance. These statements can be identified

by the fact that they include words like “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “project,”

“guidance,” “plan,” “outlook” and other words with similar

meaning. We specifically disclaim any duty to update any

of the information set forth in this annual report, including

any forward-looking statements. These statements involve

a number of risks and uncertainties that could cause our

actual results to differ materially from the results discussed in

our forward-looking statements. Factors that could cause our

actual results to differ materially from the results discussed in

our forward-looking statements include, but are not limited

to, our ability to execute and the effectiveness of our 2012

initiatives; the underperformance or loss of certain of our

important vendors, such as our wireless carrier providers, or

breaches by them of our agreements with them; difficulties

associated with our transition to an outsourced arrangement

for the production of products we previously manufactured

at our Chinese manufacturing plant; an adverse impact

on our sales or profitability due to our transition to such an

outsourced arrangement; an adverse impact on our sales

or profitability due to changes wireless carrier providers

make to their customer credit requirements, frequency of

upgrade eligibility, or other operational matters, and the

timing, completeness, and accuracy of information we

receive about such changes; a decline in our gross margin

due to customer demand for lower margin mobile devices,

such as smartphones and tablets; difficulties associated with

profitably operating our new Target Mobile centers; overall

sales performance; economic conditions; product demand;

expense levels; competitive activity; interest rates; changes

in the Company’s financial condition; availability of products

and services and other risks associated with the Company’s

vendors and service providers; the regulatory environment;

and other factors affecting the retail category in general. In

addition, the declaration of dividends and the dividend rate

are at the sole discretion of RadioShack Corporation’s board

of directors, and plans for future dividends may be revised

by the board at any time. RadioShack’s dividend could

be adversely affected by, among other things, changes in

RadioShack’s financial position, results of operations, capital

expenditures, cash flows, and applicable tax laws. Additional

information regarding these and other factors is included in

the Company’s filings with the SEC, including its most recent

Annual Report on Form 10-K for the year ended Dec. 31, 2011.

82 2011 ANNUAL REPORT