Radio Shack 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

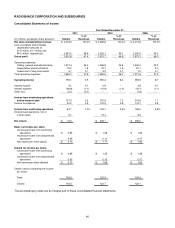

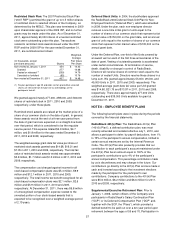

Property, Plant and Equipment, Net:

December 31,

(In millions) 2011 2010

Land $ 2.5 $ 2.4

Buildings 62.4 55.7

Furniture, fixtures, equipment

and software

663.0

673.5

Leasehold improvements 360.9 362.8

Total PP&E 1,088.8 1,094.4

Less accumulated depreciation

and amortization

(818.6)

(820.1)

Property, plant and equipment, net $ 270.2 $ 274.3

Other Assets, Net:

December 31,

(In millions) 2011 2010

Notes receivable $ 8.9 $ 9.6

Deferred income taxes 17.1 45.9

Other 29.1 25.7

Total other assets, net $ 55.1 $ 81.2

Accrued Expenses and Other Current Liabilities:

December 31,

(In millions) 2011 2010

Payroll and bonuses $ 45.7 $ 60.0

Insurance 65.3 65.0

Sales and payroll taxes 41.1 41.4

Rent 33.9 36.5

Advertising

30.8 26.9

Gift card deferred revenue 20.6 19.5

Income taxes payable -- 9.7

Other 78.0 68.7

Total accrued expenses and

other current liabilities

$ 315.4

$ 327.7

Other Non-Current Liabilities:

December 31,

(In millions) 2011 2010

Deferred compensation $ 28.9 $ 34.6

Liability for unrecognized tax benefits 33.6 36.6

Other 25.1 21.8

Total other non-current liabilities $ 87.6 $ 93.0

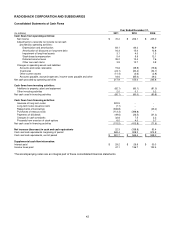

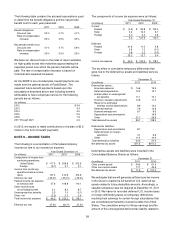

NOTE 4 – INDEBTEDNESS AND BORROWING

FACILITIES

Long-Term Debt:

December 31,

(In millions) 2011 2010

Five year 2.5% unsecured

convertible notes due in 2013

$ 375.0

$ 375.0

Eight year 6.75% unsecured

note payable due in 2019

325.0

--

Ten-year 7.375% unsecured

note payable due in 2011

--

306.8

Other 1.0 1.0

701.0 682.8

Unamortized debt discounts (30.4) (44.2)

Basis adjustment due to interest

rate swaps

--

1.2

670.6 639.8

Less current portion of:

Notes payable -- 306.8

Basis adjustment due to interest

rate swaps

--

1.2

-- 308.0

Total long-term debt $ 670.6 $ 331.8

Long-term borrowings outstanding at December 31, 2011,

mature as follows:

Long-Term

Borrowings

(In millions)

2012 $ --

2013 375.0

2014 1.0

2015 --

2016 --

2017 and thereafter 325.0

Total $ 701.0

2019 Notes: On May 3, 2011, we sold $325 million

aggregate principal amount of 6.75% senior unsecured

notes due May 15, 2019 in a private offering to qualified

institutional buyers (such notes, together with any notes

issued in the exchange offer we subsequently registered

with the SEC for such notes (the “Exchange Offer”), being

referred to as the “2019 Notes”). In September 2011,

substantially all of the privately placed notes were

exchanged for notes in an equal principal amount that we

issued pursuant to the Exchange Offer. Accordingly, the

exchange resulted in the issuance of substantially all of the

2019 Notes in a transaction registered with the SEC, but it

did not result in the incurrence of any additional debt.

The obligation to pay principal and interest on the 2019

Notes is jointly and severally guaranteed on a full and

unconditional basis by all of the guarantors under our five-

year, $450 million revolving credit agreement. At December

31, 2011, the 2019 Notes were guaranteed by all of our

wholly-owned domestic subsidiaries except Tandy Life

Insurance Company. The 2019 Notes pay interest at a fixed

rate of 6.75% per year. Interest is payable semiannually, in