Radio Shack 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

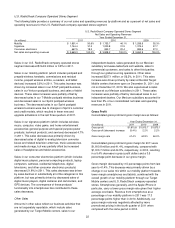

other factors discussed later in this MD&A had an effect on

the decrease of our gross margin rate in 2011.

During 2011, our business experienced a transition to a

lower gross margin rate. This decrease in gross margin rate

has been driven primarily by a transition towards lower

margin products as discussed later in this MD&A.

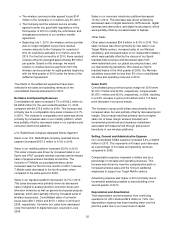

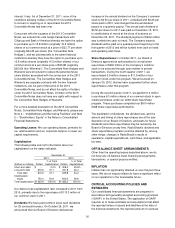

T-Mobile to Verizon Transition: In 2011, we notified T-

Mobile that it had breached its agreement with us through

which we offered T-Mobile wireless products and services

in our U.S. company-operated stores. We ceased offering

T-Mobile wireless products and services in our U.S.

company-operated stores on September 14, 2011, and

began offering Verizon products and services in our U.S.

company-operated stores on September 15, 2011. In

conjunction with this transition, we recognized a $2.6 million

inventory valuation loss with respect to T-Mobile wireless

handsets we had on hand at June 30, 2011, which was

classified as additional cost of products sold. Furthermore,

in conjunction with this transition, we incurred an additional

charge to earnings of $23.4 million in the third quarter of

2011 relating to a payment to T-Mobile. We continue to sell

T-Mobile wireless products and services in certain Target

Mobile centers.

Our sales of Verizon products and services in our U.S.

company-operated stores from September 15, 2011,

through December 31, 2011, outperformed the sale of T-

Mobile products and services in those stores during the

same period last year, and we view this as a growth

opportunity for us in 2012.

Target Mobile Centers: By December 31, 2011, we had

successfully completed our rollout of Target Mobile centers

in 1,496 Target stores.

Closure of Chinese Manufacturing Plant: We ceased

production operations in our Chinese manufacturing plant

during the second quarter of 2011. Since production

operations ceased, we have continued to acquire inventory

similar to that previously produced by this facility from

alternative product sourcing channels. In conjunction with

the plant closing, we incurred total costs of $11.4 million in

2011. We incurred $7.7 million in compensation expense

for severance packages for the termination of

approximately 1,500 employees. We recorded a foreign

currency exchange loss of $1.5 million related to the

reversal of our foreign currency cumulative translation

adjustment, which is classified as a selling, general and

administrative expense. The remaining $2.2 million relates

to an inventory valuation loss, accelerated depreciation,

and other general and administrative costs. Substantially all

of these costs were incurred in the second quarter of 2011.

Future costs to manage the liquidation, which are not

expected to be significant, will be expensed as incurred and

will include compensation expense such as retention

bonuses for the remaining employees, rent expense, and

professional fees.

Discontinued Operations: All of our remaining kiosks

located in Sam’s Club stores were transitioned to Sam’s

Club by June 30, 2011. We determined that the cash flows

from these kiosks were eliminated from our ongoing

operations. Therefore, these operations were reclassified

from the kiosks segment to discontinued operations in the

second quarter. The operating results of these kiosks are

presented in the consolidated statements of income as

discontinued operations, net of income taxes, for all periods

presented. We incurred no significant gain or loss in

connection with the transition of these kiosks to Sam’s

Club. We redeployed substantially all of our Sam’s Club

kiosk employees to nearby RadioShack stores or Target

Mobile centers, and we redistributed our Sam’s Club kiosk

inventory to our remaining retail channels.

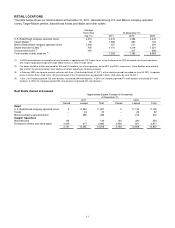

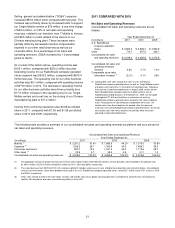

RESULTS OF OPERATIONS

2011 Summary

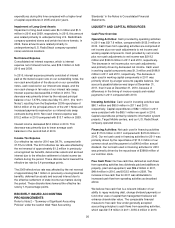

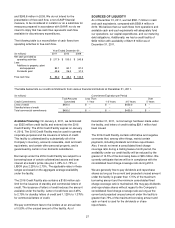

Net sales and operating revenues increased $112.2 million,

or 2.6%, to $4,378.0 million when compared with last year.

Comparable store sales decreased 2.2%. The increase in

our net sales and operating revenues was driven primarily

by sales at the 646 Target Mobile centers that were open

on December 31, 2011, but not on December 31, 2010.

The increase in sales that was driven by our additional

Target Mobile centers was partially offset by a decrease in

comparable store sales. The decrease in comparable store

sales was primarily driven by sales decreases in our

consumer electronics and signature platforms, which were

partially offset by an increase in our mobility platform sales.

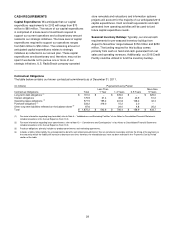

Gross margin decreased by 3.5 percentage points from last

year to 41.4%. This decrease was primarily driven by a

change in our sales mix within our mobility platform towards

lower margin smartphones and tablets, combined with the

overall growth of our mobility platform through our Target

Mobile centers and U.S. RadioShack company-operated

stores. Smartphones generally, and the Apple iPhone in

particular, carry a lower gross margin rate, given their

higher average cost basis. Revenue from smartphones as a

percentage of our mobility platform in 2011 was 17.3

percentage points higher than in 2010. Additionally, our

gross margin rate was negatively affected by more

promotional pricing in the fourth quarter of 2011 when

compared with the same period in 2010.

We expect this change in our sales mix to continue to affect

our gross margin rate in 2012 primarily because of:

customer migration to smartphones, the effect of Sprint and

Verizon offering the iPhone for all of 2012 compared with

less than full years in 2011, and the effect of our recently

opened Target Mobile centers being open for a full year.