Radio Shack 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

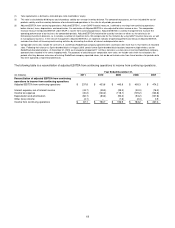

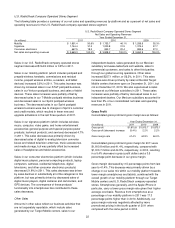

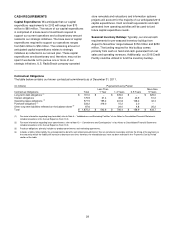

Depreciation and Amortization

The table below provides a summary of our total

depreciation and amortization by segment.

Year Ended December 31,

(In millions) 2011 2010

2009

U.S. RadioShack

company-operated stores

$ 37.9

$ 45.4

$ 45.8

Other 8.7 5.2 6.4

Unallocated 36.1 32.8 38.1

Total depreciation and

amortization from continuing

operations

$ 82.7

$ 83.4

$ 90.3

The table below provides an analysis of total depreciation

and amortization.

Year Ended December 31,

(In millions) 2011 2010

2009

Depreciation and

amortization expense

$ 75.2

$ 75.7

$ 81.1

Depreciation and

amortization included

in cost of products sold

7.5

7.7

9.2

Total depreciation and

amortization from continuing

operations

$ 82.7

$ 83.4

$ 90.3

Impairment of Long-Lived Assets

Impairment of long-lived assets was $3.1 million and $4.0

million in 2011 and 2010, respectively. In 2011, these

amounts were related primarily to underperforming U.S.

RadioShack company-operated stores. In 2010, this

amount was related primarily to underperforming U.S.

RadioShack company-operated stores and certain test

store formats.

Net Interest Expense

Consolidated net interest expense, which is interest

expense net of interest income, was $43.7 million in 2011,

compared with $39.3 million in 2010.

In 2011 and 2010, interest expense primarily consisted of

interest paid at the stated coupon rate on our outstanding

notes, the non-cash amortization of the discounts on our

long-term debt, cash received on our interest rate swaps,

and the non-cash change in fair value of our interest rate

swaps. Interest expense increased $4.9 million in 2011.

This increase was driven by the increased average amount

of long-term debt outstanding during 2011, the increased

debt discount amortization related to our 2.50% convertible

senior notes due August 1, 2013 (the “2013 Convertible

Notes”), and increased commitment fees related to the five-

year $450 million asset-based revolving credit facility we

entered into on January 4, 2011, with a group of lenders

with Bank of America, N.A., as administrative and collateral

agent (the “2016 Credit Facility”). Non-cash interest

expense was $17.0 million in 2011 compared with $15.2

million in 2010.

Income Tax Expense

Our effective tax rate for 2011 was 37.5%, compared with

38.7% for 2010. The 2011 effective tax rate was affected by

the realization of job retention credits generated pursuant to

the Hiring Incentives to Restore Employment Act. These

credits lowered the effective tax rate by 1.1 percentage

points.

The 2010 effective tax rate was affected by the net reversal

of approximately $1.2 million in previously unrecognized tax

benefits, deferred tax assets and accrued interest due to

the effective settlement of state income tax matters during

the period. These discrete items lowered the effective tax

rate by 0.4 percentage points.

2010 COMPARED WITH 2009

Wireless Service Provider Settlement Agreement

The business terms of our relationships with our wireless

service providers are governed by our wireless reseller

agreements. These contracts are complex and include

provisions determining our upfront commission revenue,

net of chargebacks for wireless service deactivations; our

acquisition and return of wireless handsets; and, in some

cases, future residual revenue, performance targets and

marketing development funds. Disputes occasionally arise

between the parties regarding the interpretation of these

contract provisions.

Certain disputes arose with one of the Company’s wireless

service providers pertaining to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks for wireless service deactivations.

Negotiations regarding resolution of these disputes

culminated in the signing of a settlement agreement in July

2010. In connection with the decision to settle these

disputes, the Company considered the following: the timing

of cash outflows and inflows in connection with the disputed

upfront commission revenue and related chargebacks, and

the estimated future residual revenue; the benefits of

settling the disputes and agreeing to enter into good faith

negotiations with the wireless service provider in the third

quarter of 2010 to modify the commission and chargeback

provisions of our wireless reseller agreement; and the risks

associated with the ultimate realization of the estimated

future residual revenue.

Key elements of the settlement agreement included the

following:

• All disputes relating to upfront commission revenue

for activations prior to July 1, 2010, and related

chargebacks were settled.