Radio Shack 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

interest, if any. As of December 31, 2011, none of the

conditions allowing holders of the 2013 Convertible Notes

to convert or requiring us to repurchase the 2013

Convertible Notes had been met.

Concurrent with the issuance of the 2013 Convertible

Notes, we entered into note hedge transactions with

Citigroup and Bank of America whereby we have the option

to purchase up to 15.8 million (originally 15.5 million)

shares of our common stock at a price of $23.77 per share

(originally $24.25 per share) (the “Convertible Note

Hedges”), and we sold warrants to the same financial

institutions whereby they have the option to purchase up to

15.8 million shares (originally 15.5 million shares) of our

common stock at a per share price of $35.88 (originally

$36.60) (the “Warrants”). The Convertible Note Hedges and

Warrants were structured to reduce the potential future

share dilution associated with the conversion of the 2013

Convertible Notes. The Convertible Note Hedges and

Warrants are separate contracts with the two financial

institutions, are not part of the terms of the 2013

Convertible Notes, and do not affect the rights of holders

under the 2013 Convertible Notes. A holder of the 2013

Convertible Notes does not have any rights with respect to

the Convertible Note Hedges or Warrants.

For a more detailed description of the 2013 Convertible

Notes, Convertible Note Hedges, and Warrants, please see

Note 4 – “Indebtedness and Borrowing Facilities” and Note

5 – “Stockholders’ Equity” in the Notes to Consolidated

Financial Statements.

Operating Leases: We use operating leases, primarily for

our retail locations and our corporate campus, to lower our

capital requirements.

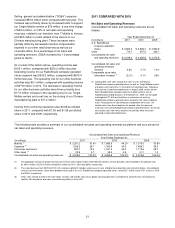

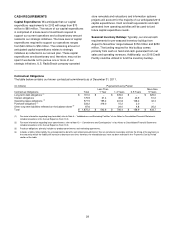

Capitalization

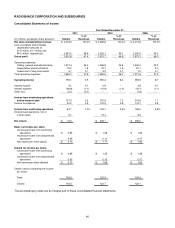

The following table sets forth information about our

capitalization on the dates indicated.

December 31,

2011 2010

(Dollars in millions)

Dollars

% of Total

Capitalization

Dollars

% of Total

Capitalization

Short-term debt $ -- 0.0% $ 308.0

20.8%

Long-term debt 670.6

47.1 331.8

22.4

Total debt 670.6

47.1 639.8

43.2

Stockholders’

equity

753.3

52.9

842.5

56.8

Total capitalization

$1,423.9

100.0% $1,482.3

100.0%

Our debt-to-total capitalization ratio increased in 2011 from

2010, primarily due to the repurchase of $113.3 million of

our common stock in 2011.

Dividends: We have paid common stock cash dividends

for 25 consecutive years. On October 25, 2011, we

announced that our Board of Directors declared an

increase in the annual dividend on the Company’s common

stock to $0.50 per share in 2011, compared with $0.25 per

share paid in 2010, and changed the annual dividend

payout to a quarterly payout. The annual cash dividend of

$0.50 per share for 2011 was paid on December 15, 2011,

to stockholders of record at the close of business on

November 25, 2011. The dividend payment of $49.6 million

was funded from cash on hand. The Company expects

dividends will be paid on a quarterly basis beginning in the

first quarter of 2012 and will be funded from cash on hand

and operating cash flows.

Share Repurchases: In October 2011, our Board of

Directors approved an authorization for a total share

repurchase of $200 million of the Company’s common

stock to be executed through open market or private

transactions. During the fourth quarter of 2011, we

repurchased 0.9 million shares or $11.9 million of our

common stock under this program. We announced on

January 30, 2012, that we have suspended further share

repurchases under this program.

During the second quarter of 2011, we paid $101.4 million

to purchase 6.3 million shares of our common stock in open

market purchases under our 2008 share repurchase

program. These purchases completed our $610 million

2008 share repurchase authorization.

The declaration of dividends, the dividend rate, and the

amount and timing of share repurchases are at the sole

discretion of our Board of Directors, and plans for future

dividends and share repurchases may be revised by the

Board of Directors at any time. RadioShack's dividend and

share repurchase programs could be affected by, among

other things, changes in RadioShack's results of

operations, capital expenditures, cash flows, and applicable

tax laws.

OFF-BALANCE SHEET ARRANGEMENTS

Other than the operating leases described above, we do

not have any off-balance sheet financing arrangements,

transactions, or special purpose entities.

INFLATION

Inflation has not significantly affected us over the past three

years. We do not expect inflation to have a significant effect

on our operations in the foreseeable future.

CRITICAL ACCOUNTING POLICIES AND

ESTIMATES

Our consolidated financial statements are prepared in

accordance with generally accepted accounting principles

(“GAAP”) in the United States. The application of GAAP

requires us to make estimates and assumptions that affect

the reported values of assets and liabilities at the date of

the financial statements, the reported amount of revenues