Radio Shack 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

and $245.8 million in 2009. We do not intend for the

presentation of free cash flow, a non-GAAP financial

measure, to be considered in isolation or as a substitute for

measures prepared in accordance with GAAP, nor do we

intend to imply that free cash flow represents cash flow

available for discretionary expenditures.

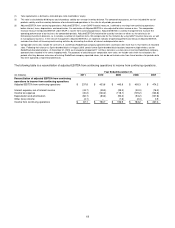

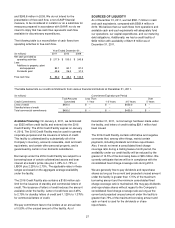

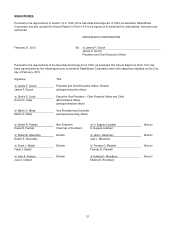

The following table is a reconciliation of cash flows from

operating activities to free cash flow.

Year Ended December 31,

(In millions) 2011 2010

2009

Net cash provided by

operating activities

$ 217.9

$ 155.0

$ 245.8

Less:

Additions to property, plant

and equipment

82.1

80.1

81.0

Dividends paid 49.6

26.5

31.3

Free cash flow $ 86.2

$ 48.4

$ 133.5

SOURCES OF LIQUIDITY

As of December 31, 2011, we had $591.7 million in cash

and cash equivalents, compared with $569.4 million in

2010. We believe that our cash flows from operations and

available cash and cash equivalents will adequately fund

our operations, our capital expenditures, and our maturing

debt obligations. Additionally, we had a credit facility of

$450 million with availability of $421.9 million as of

December 31, 2011.

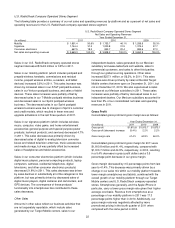

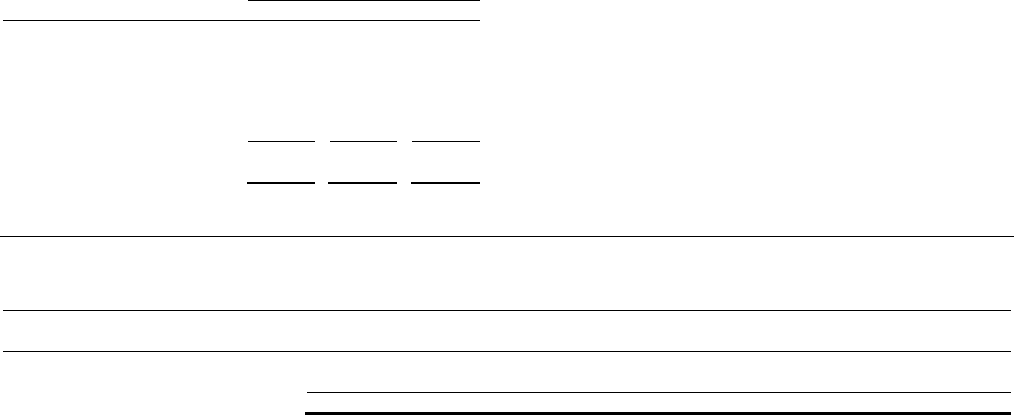

The table below lists our credit commitments from various financial institutions at December 31, 2011.

(In millions) Commitment Expiration per Period

Credit Commitments

Total Amounts

Committed

Less Than

1 Year

1-3 Years

3-5 Years

Over

5 Years

Lines of credit $450.0 $ -- $ -- $450.0 $ --

Standby letters of credit -- -- -- -- --

Total commercial commitments $450.0 $ -- $ -- $450.0 $ --

Available Financing: On January 4, 2011, we terminated

our $325 million credit facility and entered into the 2016

Credit Facility. The 2016 Credit Facility expires on January

4, 2016. The 2016 Credit Facility may be used for general

corporate purposes and the issuance of letters of credit.

This facility is collateralized by substantially all of the

Company’s inventory, accounts receivable, cash and cash

equivalents, and certain other personal property, and is

guaranteed by certain of our domestic subsidiaries.

Borrowings under the 2016 Credit Facility are subject to a

borrowing base of certain collateralized assets and bear

interest at a bank’s prime rate plus 1.25% to 1.75% or

LIBOR plus 2.25% to 2.75%. The applicable rates in these

ranges are based on the aggregate average availability

under the facility.

The 2016 Credit Facility also contains a $150 million sub-

limit for the issuance of standby and commercial letters of

credit. The issuance of letters of credit reduces the amount

available under the facility. Letter of credit fees are 2.25%

to 2.75% for standby letters of credit and 1.125% to 1.375%

for commercial letters of credit.

We pay commitment fees to the lenders at an annual rate

of 0.50% of the unused amount of the facility. As of

December 31, 2011, no borrowings had been made under

the facility, and letters of credit totaling $28.1 million had

been issued.

The 2016 Credit Facility contains affirmative and negative

covenants that, among other things, restrict certain

payments, including dividends and share repurchases.

Also, if we do not meet a consolidated fixed charge

coverage ratio during a trailing twelve-month period, the

availability under our credit facility will be reduced by the

greater of 12.5% of the borrowing base or $45 million. We

currently anticipate that we will be in compliance with the

consolidated fixed charge coverage ratio during 2012.

We are generally free to pay dividends and repurchase

shares as long as the current and projected unused amount

under the facility is greater than 17.5% of the maximum

borrowing amount and the minimum consolidated fixed

charge coverage ratio is maintained. We may pay dividends

and repurchase shares without regard to the Company's

consolidated fixed charge coverage ratio as long as the

current and projected unused amount under the facility is

greater than 75% of the maximum borrowing amount and

cash on hand is used for the dividends or share

repurchases.