Radio Shack 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

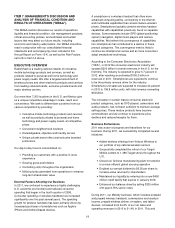

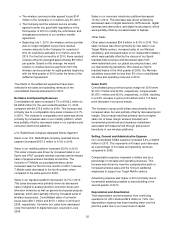

Selling, general and administrative (“SG&A”) expense

increased $93.6 million when compared with last year. This

increase was primarily driven by increased costs to support

our Target Mobile centers of $76 million, a one-time charge

of $23.4 million, or 0.5% of net sales and operating

revenues, related to our transition from T-Mobile to Verizon,

and $9.5 million in costs related to the closure of our

Chinese manufacturing plant. These increases were

partially offset by decreased incentive compensation

expense in our other retail channels as well as our

corporate office. As a percentage of net sales and

operating revenues, SG&A increased by 1.2 percentage

points to 36.0%.

As a result of the factors above, operating income was

$155.1 million, compared with $350.2 million last year.

Operating income for our RadioShack company-operated

stores segment was $530.2 million, compared with $675.4

million last year. The operating loss for our other business

activities was $0.1 million, compared with operating income

of $37.8 million in 2010. The decrease in operating income

for our other business activities was driven primarily by a

$17.0 million increase in the operating loss for our Target

Mobile centers and a net loss on the closing of our Chinese

manufacturing plant of $11.4 million.

Income from continuing operations was $0.65 per diluted

share in 2011, compared with $1.55 and $1.56 per diluted

share in 2010 and 2009, respectively.

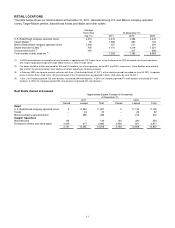

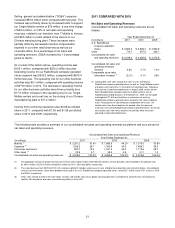

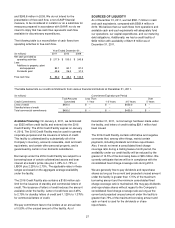

2011 COMPARED WITH 2010

Net Sales and Operating Revenues

Consolidated net sales and operating revenues are as

follows:

Year Ended December 31,

(In millions) 2011 2010

2009

U.S. RadioShack

company-operated

stores

$ 3,663.3

$ 3,808.2

$ 3,650.9

Other 714.7

457.6

422.7

Consolidated net sales

and operating revenues

$ 4,378.0

$ 4,265.8

$ 4,073.6

Consolidated net sales and

operating revenues

increase

2.6%

4.7%

1.0%

Comparable store sales

(decrease) increase (1)

(2.2%)

4.1%

0.8%

(1)

Comparable store sales include the sales of U.S. and Mexico

RadioShack company-operated stores as well as Target Mobile centers

and kiosks with more than 12 full months of recorded sales. Following

their closure as Sprint-branded kiosks in August 2009, certain former

Sprint-branded kiosk locations became multiple wireless carrier

RadioShack-branded locations. At December 31, 2009, we managed

and reported 111 of these locations as extensions of existing

RadioShack company-operated stores located in the same shopping

malls. For purposes of calculating our comparable store sales, we

include sales from these locations for periods after they became

extensions of existing RadioShack company-operated stores, but we do

not include sales from these locations for periods while they were

operated as Sprint-branded kiosks.

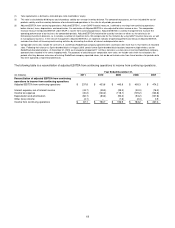

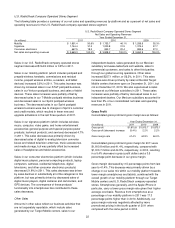

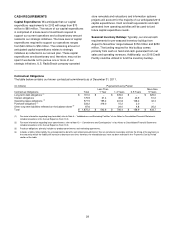

The following table provides a summary of our consolidated net sales and operating revenues by platform and as a percent of

net sales and operating revenues.

Consolidated Net Sales and Operating Revenues

Year Ended December 31,

(In millions) 2011 2010 2009

Mobility

(1)

$ 2,251.2 51.4%

$ 1,885.6 44.2%

$ 1,375.0 33.8%

Signature

(2)

1,256.2 28.7

1,303.9 30.6

1,486.7 36.5

Consumer electronics 840.7 19.2

1,041.0 24.4

1,170.8 28.7

Other sales

(3)

29.9 0.7

35.3 0.8

41.1 1.0

Consolidated net sales and operating revenues $ 4,378.0 100.0%

$ 4,265.8 100.0%

$ 4,073.6 100.0%

(1) The aggregate amount of upfront commission revenue and residual income received from wireless service providers and recorded in this platform was

$1,499.1 million, $1,270.5 million and $926.5 million for 2011, 2010 and 2009, respectively.

(2) The sales decrease from 2009 to 2010 in the signature platform includes a decrease in sales of digital-to-analog television converter boxes. Consolidated

sales of converter boxes, which were predominantly sold in our U.S. RadioShack company-operated stores, were $33.7 million and $170.1 million in 2010

and 2009, respectively.

(3) Other sales include outside sales from repair services and outside sales of our global sourcing operations and domestic and overseas manufacturing

facilities. We closed our overseas manufacturing facility in June 2011.