Radio Shack 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

that ships store fixtures to our U.S. and Mexico

company-operated stores and kiosks.

RadioShack Technology Services (“RSTS”) - Our

management information system architecture is

composed of a distributed, online network of

computers that links all stores, kiosks, customer

channels, delivery locations, service centers, credit

providers, distribution facilities and our home office into

a fully integrated system. Each retail location has its

own server to support the point-of-sale (“POS”)

system. The majority of our U.S. company-operated

stores and kiosks communicate through a broadband

network, which provides efficient access to customer

support data. This design also allows store

management to track daily sales and inventory at the

product or sales associate level. RSTS provides the

majority of our programming and systems analysis

needs.

RadioShack Global Sourcing (“RSGS”) - RSGS

serves our wide-ranging international import/export,

sourcing, evaluation, logistics and quality control

needs. RSGS’s activities support our name brand and

private brand businesses.

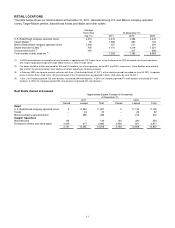

DISCONTINUED OPERATIONS

In February 2009, we signed a contract extension with

Sam’s Club through March 31, 2011, with a transition

period that ended on June 30, 2011, to continue operating

kiosks in certain Sam’s Club locations. As of December 31,

2010, we operated 417 of these kiosks. All of these kiosks

were transitioned to Sam’s Club by June 30, 2011. We

determined that the cash flows from these kiosks have

been eliminated from our ongoing operations. Therefore,

these operations were classified as discontinued operations

and the operating results of these kiosks are presented in

the consolidated statements of income as discontinued

operations, net of income taxes, for all periods presented.

SEASONALITY

As with most other specialty retailers, our net sales and

operating revenues and operating cash flows are greater

during the fourth calendar quarter, which includes the

majority of the holiday shopping season in the U.S., than

during other periods of the year. There is a corresponding

pre-seasonal inventory build-up, which requires working

capital related to the anticipated increased sales volume.

This is described in “Cash Requirements” in our MD&A.

Also, refer to Note 16 – “Quarterly Data (Unaudited)” in the

Notes to Consolidated Financial Statements for data

showing seasonality trends. We expect this seasonality to

continue.

PATENTS AND TRADEMARKS

We own or are licensed to use many trademarks and

service marks related to our RadioShack stores in the

United States and in foreign countries. We believe the

RadioShack name and marks are well recognized by

consumers, and that the name and marks are associated

with high-quality products and services. We also believe the

loss of the RadioShack name and RadioShack marks

would materially adversely affect our business. Our private

brands include brands such as RadioShack, AUVIO,

Enercell and Gigaware. We also own various patents and

patent applications relating to consumer electronics

products.

SUPPLIERS AND NAME BRAND RELATIONSHIPS

Our business strategy depends, in part, upon our ability to

offer name brand and private brand products, as well as to

provide our customers access to third-party services. We

utilize a large number of suppliers located in various parts

of the world to obtain name brand and private brand

merchandise. We have formed vendor and third-party

service provider relationships with well-recognized

companies such as Sprint, AT&T, Verizon Wireless

(“Verizon”), T-Mobile, Apple, Casio, Garmin, Hewlett-

Packard, HTC, Microsoft, Research In Motion, Samsung and

SanDisk. In the aggregate, these relationships have or are

expected to have a significant effect on both our operations

and financial strategy.

ORDER BACKLOG

We have no material backlog of orders in any of our

operating segments for the products or services we sell.

COMPETITION

Due to consumer demand for wireless products and

services, as well as rapid consumer acceptance of new

digital technology products, the consumer electronics retail

business continues to be highly competitive, driven

primarily by technology and product cycles.

In the consumer electronics retail business, competitive

factors include convenient retail locations, price, quality,

features, product availability, consumer services,

distribution capability, brand reputation and the number of

competitors. We compete in the sale of our products and

services with several retail formats, including national,

regional, and independent consumer electronics retailers.

We compete with department and specialty retail stores in

more select product categories. We compete with wireless

providers in the wireless handset category through their

own retail and online presence. We compete with big-box

retailers, discount and warehouse retailers, and Internet

retailers on a more widespread basis. Numerous domestic

and foreign companies manufacture products similar to our

privately-branded products for other retailers, which are