Radio Shack 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

expenditures during this time compared with a higher level

of capital expenditures in 2005 and prior years.

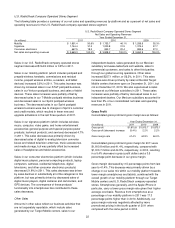

Impairment of Long-Lived Assets

Impairment of long-lived assets was $4.0 million and $1.5

million in 2010 and 2009, respectively. In 2010, this amount

was related primarily to underperforming U.S. RadioShack

company-operated stores and certain test store formats. In

2009, these amounts were related primarily to

underperforming U.S. RadioShack company-operated

stores and kiosk locations.

Net Interest Expense

Consolidated net interest expense, which is interest

expense net of interest income, was $39.3 million in both

2010 and 2009.

In 2010, interest expense primarily consisted of interest

paid at the stated coupon rate on our outstanding notes, the

non-cash amortization of the discount on our convertible

notes, cash received on our interest rate swaps, and the

non-cash change in fair value of our interest rate swaps.

Interest expense decreased $2.2 million in 2010. This

decrease was primarily driven by the reduced principal

balance of our 7.375% notes due May 15, 2011, (the “2011

Notes”) resulting from the September 2009 repurchase of

$43.2 million of the principal amount of the 2011 Notes and

increased payments received on our interest rate swap

contracts during 2010. Non-cash interest expense was

$15.2 million in 2010 compared with $13.7 million in 2009.

Interest income decreased $2.2 million in 2010. This

decrease was primarily due to lower average cash

balances in the second half of 2010.

Income Tax Expense

Our effective tax rate for 2010 was 38.7%, compared with

37.5% for 2009. The 2010 effective tax rate was affected by

the net reversal of approximately $1.2 million in previously

unrecognized tax benefits, deferred tax assets and accrued

interest due to the effective settlement of state income tax

matters during the period. These discrete items lowered the

effective tax rate by 0.4 percentage points.

The 2009 effective tax rate was affected by the net reversal

of approximately $6.1 million in previously unrecognized tax

benefits, deferred tax assets and accrued interest due to

the effective settlement of state income tax matters during

the period. These discrete items lowered the effective tax

rate by 1.9 percentage points.

RECENTLY ISSUED ACCOUNTING

PRONOUNCEMENTS

Refer to Note 2 – “Summary of Significant Accounting

Policies” under the section titled “New Accounting

Standards” in the Notes to Consolidated Financial

Statements.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Overview

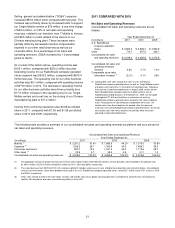

Operating Activities: Cash provided by operating activities

in 2011 was $217.9 million, compared with $155.0 million in

2010. Cash flows from operating activities are comprised of

net income plus non-cash adjustments to net income and

working capital components. Cash provided by net income

plus non-cash adjustments to net income was $219.2

million and $343.9 million in 2011 and 2010, respectively.

The decrease in net income plus non-cash adjustments

was primarily driven by decreased net income. Cash used

in working capital components was $1.3 million and $188.9

million in 2011 and 2010, respectively. The decrease in

cash used in working capital components in 2011 was

primarily driven by a larger accounts payable balance. Our

accounts payable balance was larger at December 31,

2011, than it was at December 31, 2010, because of

differences in the timing of invoice receipts and related

payments in 2011 compared with 2010.

Investing Activities: Cash used in investing activities was

$80.1 million and $80.0 million in 2011 and 2010,

respectively. Capital expenditures of $82.1 million in 2011

were consistent with the $80.1 million we spent in 2010.

Capital expenditures primarily related to information system

projects, Target Mobile centers, and our U.S. RadioShack

company-operated stores.

Financing Activities: Net cash used in financing activities

was $115.5 million in 2011 compared with $413.8 million in

2010. Our net cash used in financing activities for 2011 was

primarily driven by the repurchase of $113.3 million of our

common stock and the payment of a $49.6 million annual

dividend. Our net cash used in financing activities for 2010

was primarily driven by the repurchase of $398.8 million of

our common stock.

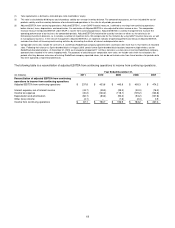

Free Cash Flow: Our free cash flow, defined as cash flows

from operating activities less dividends paid and additions to

property, plant and equipment, was $86.2 million in 2011,

$48.4 million in 2010, and $133.5 million in 2009. The

increase in free cash flow for 2011 was attributable to

increased cash flow from operating activities as described

above.

We believe free cash flow is a relevant indicator of our

ability to repay maturing debt, change dividend payments or

fund other uses of capital that management believes will

enhance shareholder value. The comparable financial

measure to free cash flow under generally accepted

accounting principles is cash flows from operating activities,

which was $217.9 million in 2011, $155.0 million in 2010,