Radio Shack 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

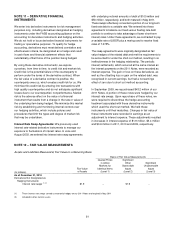

the Plans and the benefit payments were based solely on

the discretion and approval of the MD&C, and the benefit

payments did not bear any relationship to a participant’s

present compensation, final compensation or years of

service. We accrued benefit payments earned based on the

provisions set forth by the MD&C for each individual

person. Based on the method by which the Plans were

administered and because there was not a specific plan

governing the benefit payment calculation, the accounting

and disclosure provisions of the FASB’s accounting

guidance for pensions were not previously required.

The Company adopted an unfunded Supplemental

Executive Retirement Plan (“SERP”) effective January 1,

2006, for selected officers of the Company. The SERP was

most recently amended and restated effective as of

December 31, 2010. Upon retirement at age 55 years or

older, participants in the SERP are eligible to receive, for

ten years, an annual amount equal to a percentage of the

average of their five highest consecutive years of

compensation (base salary and bonus), to be paid in 120

monthly installments. The amount of the percentage

increases by 2 ½% for each year of participation in the

SERP, up to a maximum of 50%.

To be a participant in the SERP, officers who were

participants in the SCP or DCP had to withdraw from the

applicable plan and would then only receive benefits under

the SERP. The benefits for these officers are calculated

under the SERP using a formula that calculates the benefit

under each plan (SERP, SCP or DCP) and pays the

participant the highest dollar benefit.

If a SERP participant terminates employment due to

retirement or disability between the ages of 55 and 70, the

participant is entitled to their normal vested SERP benefit,

paid in 120 equal monthly payments.

Based on the effective date of the SERP of January 1,

2006, fiscal year 2006 was the initial year in which an

actuarial valuation was performed. The projected benefit

obligation at the beginning of 2006 represents the actuarial

valuation that was performed as of January 1, 2006, based

on the information and assumptions developed at that time.

Participants in the SERP as of January 1, 2006, were given

credit for prior service as an officer of the Company.

Therefore, this service credit generated prior service costs

that are not required to be immediately recognized, but that

are amortized for purposes of the net periodic benefit cost

calculation over the estimated average remaining service

period for active employee participants.

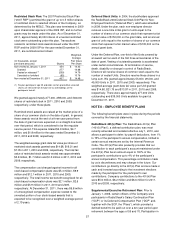

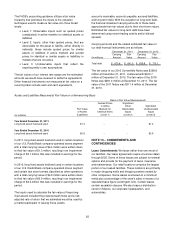

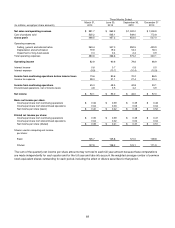

We use the last day of our fiscal year as the measurement

date for determining SERP obligations and conduct an

actuarial valuation at that date. The change in benefit

obligation, plan assets, and funded status for 2011 and

2010 are as follows:

Year Ended

December 31,

(In millions) 2011 2010

Change in benefit obligation:

Benefit obligation at

beginning of year

$ 21.2

$ 24.0

Service cost – benefits earned

during the year

0.8

0.6

Interest cost on projected

benefit obligation

0.8

1.0

Actuarial loss 0.3 0.5

Benefits paid (4.0) (4.9)

Benefit obligation at end of year 19.1 21.2

Change in plan assets:

Fair value of plan assets at

beginning of year

--

--

Employer contribution 4.0 4.9

Benefits paid (4.0) (4.9)

Fair value of plan assets

at end of year

--

--

Underfunded status $ (19.1) $ (21.2)

The accumulated benefit obligation was $18.8 million and

$20.6 million at December 31, 2011 and 2010, respectively.

Amounts recognized as liabilities in the Consolidated

Balance Sheets consist of:

December 31,

(In millions) 2011 2010

Accrued expenses and other

current liabilities

$ 3.2

$ 3.9

Other non-current liabilities 15.9 17.3

Net amount recognized $ 19.1 $ 21.2

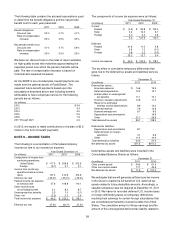

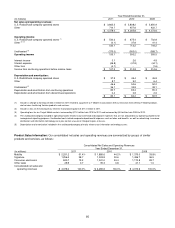

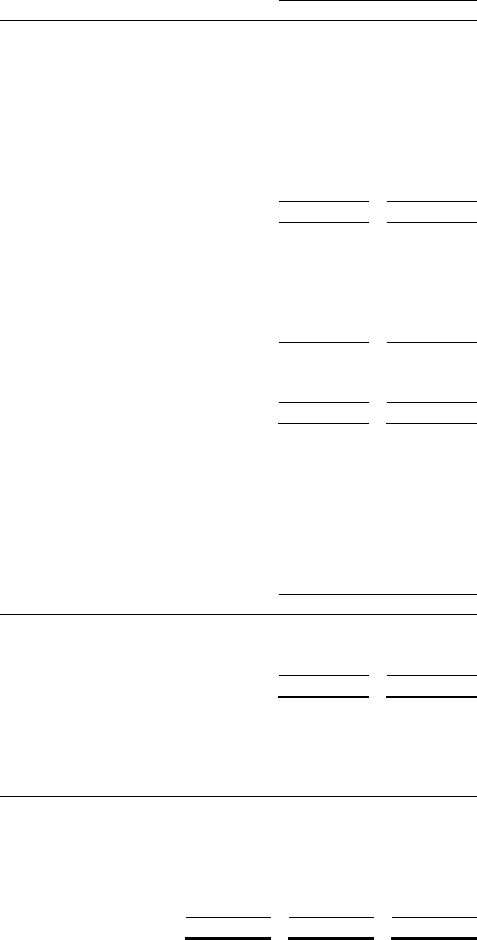

The cost of the SERP defined benefit plan included the

following components for the last three years:

(In millions) 2011 2010 2009

Service cost – benefits

earned during the year

$ 0.8

$ 0.6

$ 0.5

Interest cost on projected

benefit obligation

0.8

1.0

1.4

Amortization of prior

service cost

0.1

0.1

0.1

Net periodic benefit cost $ 1.7 $ 1.7 $ 2.0

Amounts not yet reflected in net periodic benefit cost and

included in accumulated other comprehensive loss (pre-tax)

included prior service cost of $0.5 million and $0.7 million at

December 31, 2011 and 2010, respectively, and an

actuarial loss of $0.5 million and $0.2 million at December

31, 2011 and 2010, respectively. The amount of prior

service cost that will be amortized from accumulated other

comprehensive loss into net periodic benefit cost in 2012 is

estimated to be $0.1 million.