Radio Shack 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

3.2 million shares. The 14.9 million shares delivered to us

was based on the average daily volume weighted average

price of our common stock over a period beginning

immediately after the effective date of the ASR agreements

and ending on November 2, 2010.

Dividends Declared: We paid a per share annual dividend

of $0.50, $0.25, and $0.25 in 2011, 2010 and 2009,

respectively. The dividends were paid in December of each

year.

Call Spread Transactions: In connection with the

issuance of the 2013 Convertible Notes (see Note 4 –

“Indebtedness and Borrowing Facilities”), we entered into

separate convertible note hedge transactions and separate

warrant transactions related to our common stock with

Citigroup and Bank of America to reduce the potential

dilution upon conversion of the 2013 Convertible Notes.

Under the terms of the convertible note hedge

arrangements (the “Convertible Note Hedges”), we paid

$86.3 million for a forward purchase option contract under

which we are entitled to purchase a fixed number of shares

(initially 15.5 million shares) of our common stock at an

initial price per share of $24.25. In the event of the

conversion of the 2013 Convertible Notes, this forward

purchase option contract allows us to purchase, at a fixed

price equal to the implicit conversion price of common

shares issued under the 2013 Convertible Notes, a number

of common shares equal to the common shares that we

issue to a note holder upon conversion. Settlement terms of

this forward purchase option allow us to elect cash or share

settlement based on the settlement option we choose in

settling the conversion feature of the 2013 Convertible

Notes. The Convertible Note Hedges expire on August 1,

2013.

The exercise price of the Convertible Note Hedges is linked

to our 2013 Convertible Notes. In 2011, the Convertible

Note Anti-Dilutive Provision was triggered. See Note 4 -

“Indebtedness and Borrowing Facilities,” for more

information on the Convertible Note Anti-Dilutive Provision.

As a result, at December 31, 2011, the Convertible Note

Hedges entitled us to purchase 15.8 million shares of our

common stock at a price per share of $23.77.

Also concurrent with the issuance of the 2013 Convertible

Notes, we sold warrants (the “Warrants”) permitting the

purchasers to acquire shares of our common stock. The

Warrants were initially exercisable for 15.5 million shares of

our common stock at an initial exercise price of $36.60 per

share. We received $39.9 million in proceeds for the sale of

the Warrants. The Warrants may be settled at various dates

beginning in November 2013 and ending in March 2014.

The Warrants provide for net share settlement. In no event

will we be required to deliver a number of shares in

connection with the transaction in excess of twice the

aggregate number of Warrants.

The exercise price of the Warrants is linked to our 2013

Convertible Notes. In 2011, a Convertible Note Anti-Dilutive

Provision was triggered. As a result, at December 31, 2011,

the Warrants were exercisable for 15.8 million shares of our

common stock at an exercise price of $35.88 per share.

We determined that the Convertible Note Hedges and

Warrants meet the requirements of the FASB’s accounting

guidance for accounting for derivative financial instruments

indexed to, and potentially settled in, a company's own

stock and other relevant guidance and, therefore, are

classified as equity transactions. As a result, we recorded

the purchase of the Convertible Note Hedges as a

reduction in additional paid-in capital and the proceeds of

the Warrants as an increase to additional paid-in capital in

the Consolidated Balance Sheets, and we will not

recognize subsequent changes in the fair value of the

agreements in the financial statements.

In accordance with the FASB’s accounting guidance in

calculating earnings per share, the Warrants will have no

effect on diluted net income per share until our common

stock price exceeds the per share strike price of $35.88 for

the Warrants. We will include the effect of additional shares

that may be issued upon exercise of the Warrants using the

treasury stock method. The Convertible Note Hedges are

antidilutive and, therefore, will have no effect on diluted net

income per share.

Treasury Stock Retirement: In December 2010, our

Board of Directors approved the retirement of 45.0 million

shares of our common stock held as treasury stock. These

shares returned to the status of authorized and unissued.

NOTE 6 – PLANT CLOSURE

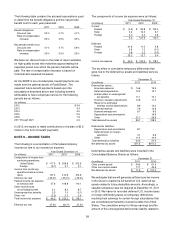

During the second quarter of 2011, we ceased production

operations in our Chinese manufacturing plant. Since

production operations ceased, we have continued to

acquire inventory similar to that previously produced by this

facility from alternative product sourcing channels. In

conjunction with the plant closing, we incurred total costs of

$11.4 million in 2011. We incurred $7.7 million in

compensation expense for severance packages for the

termination of approximately 1,500 employees. We

recorded a foreign currency exchange loss of $1.5 million

related to the reversal of our foreign currency cumulative

translation adjustment, which is classified as a selling,

general and administrative expense. The remaining $2.2

million related to an inventory valuation loss, accelerated

depreciation, and other general and administrative costs.

Substantially all of these costs were incurred in the second

quarter of 2011. Future costs to manage the liquidation,