Radio Shack 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

life of the software, which ranges between three and five

years. The unamortized balance of capitalized software

costs at December 31, 2011 and 2010, was $42.7 million

and $55.3 million, respectively. Amortization of computer

software was approximately $12.6 million, $11.9 million and

$15.1 million in 2011, 2010 and 2009, respectively.

Impairment of Long-Lived Assets: We review long-lived

assets (primarily property, plant and equipment) held and

used, or to be disposed of, for impairment whenever events

or changes in circumstances indicate that the net book

value of the asset may not be recoverable. Recoverability is

assessed based on estimated undiscounted cash flows

from the useful asset. If the carrying amount of an asset is

not recoverable, we recognize an impairment loss equal to

the amount by which the carrying amount exceeds fair

value. We estimate fair value based on projected future

discounted cash flows. Our policy is to evaluate long-lived

assets for impairment at a store level for retail operations.

Leases: For lease agreements that provide for escalating

rent payments or free-rent occupancy periods, we

recognize rent expense on a straight-line basis over the

non-cancelable lease term and certain option renewal

periods that appear to be reasonably assured at the

inception of the lease term. The lease term commences on

the date we take possession of or control the physical use

of the property. Deferred rent is included in other current

liabilities in the Consolidated Balance Sheets.

Goodwill and Intangible Assets: Goodwill represents the

excess of the purchase price over the fair value of net

assets acquired. Goodwill and intangible assets with

indefinite useful lives are reviewed at least annually for

impairment (and in interim periods if certain events occur

indicating that the carrying value of goodwill and intangible

assets may be impaired). We estimate fair values utilizing

valuation methods such as discounted cash flows and

comparable market valuations. We have elected the fourth

quarter to complete our annual goodwill impairment test. As

a result of the fourth quarter impairment analyses, we

determined that no impairment charges to goodwill were

required.

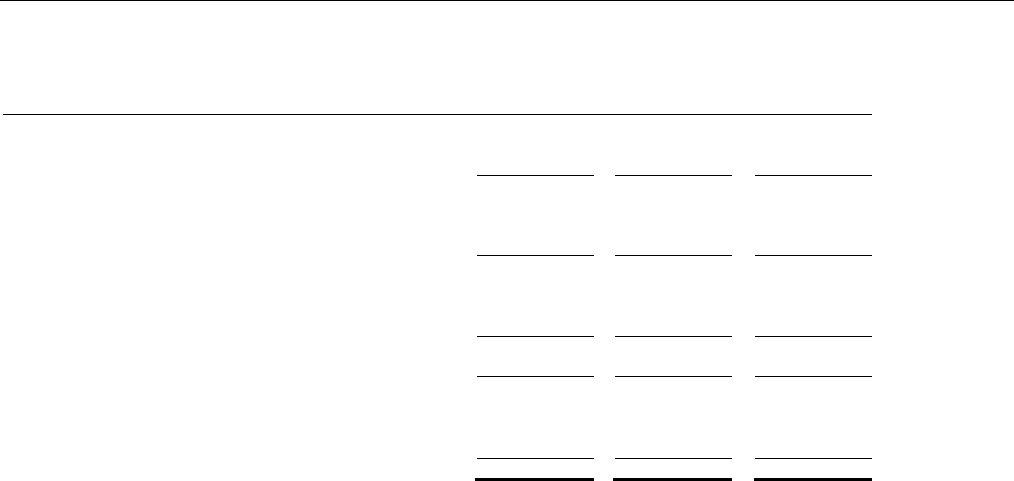

The changes in the carrying amount of goodwill by segment were as follows for the years ended December 31, 2011 and

2010:

(In millions)

U.S.

RadioShack

Stores

Other

Total

Balances at December 31, 2009

Goodwill $ 2.8 $ 36.1 $ 38.9

Accumulated impairment losses -- -- --

2.8 36.1 38.9

Acquisition of dealer

0.1

--

0.1

Foreign currency translation adjustment -- 2.2 2.2

Balances at December 31, 2010

Goodwill 2.9 38.3 41.2

Accumulated impairment losses -- -- --

2.9 38.3 41.2

Foreign currency translation adjustment -- (4.2) (4.2)

Balances at December 31, 2011

Goodwill 2.9 34.1 37.0

Accumulated impairment losses -- -- --

$ 2.9 $ 34.1 $ 37.0

Self-Insurance: We are self-insured for certain claims

relating to workers’ compensation, automobile, property,

employee health care, and general and product liability

claims, although we obtain third-party insurance coverage

to limit our exposure to these claims. We estimate our self-

insured liabilities using historical claims experience and

actuarial assumptions followed in the insurance industry.

Although we believe we have the ability to reasonably

estimate losses related to claims, it is possible that actual

results could differ from recorded self-insurance liabilities.

Income Taxes: Income taxes are accounted for using the

asset and liability method. Deferred taxes are recognized

for the tax consequences of temporary differences by

applying enacted statutory tax rates applicable to future

years to differences between the financial statement

carrying amounts and the tax bases of existing assets and

liabilities. The effect on deferred taxes of a change in tax

rates is recognized in income in the period that includes the

enactment date. In addition, we recognize future tax

benefits to the extent that such benefits are more likely than