Radio Shack 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

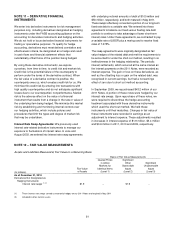

Restricted Stock Plan: The 2007 Restricted Stock Plan

(“2007 RSP”) permitted the grant of up to 0.5 million shares

of restricted stock to selected officers of the Company, as

determined by the MD&C. This plan was terminated in 2009

upon shareholder approval of the 2009 ISP, and no further

grants may be made under this plan. As of December 31,

2011, approximately 63,000 shares of unvested restricted

stock were outstanding under this plan. Transactions

related to restricted stock awards issued under the 2007

RSP and the 2009 ISP for the year ended December 31,

2011, are summarized as follows:

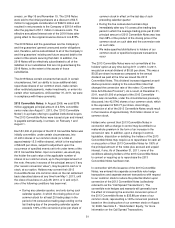

(In thousands, except

per share amounts)

Shares

Weighted-

Average

Fair Value

Per Share

Non-vested at January 1, 2011 454 $ 14.43

Granted 277 14.68

Vested or released

(1)

(259) 14.79

Canceled or forfeited (65) 13.76

Non-vested at December 31, 2011 407 $ 14.48

(1)

For plan participants age 55 and older, certain granted but unvested

shares are released from the plan for tax withholdings on the

participants’ behalf.

We granted approximately 277,000, 298,000, and 346,000

shares of restricted stock in 2011, 2010 and 2009,

respectively, under these plans.

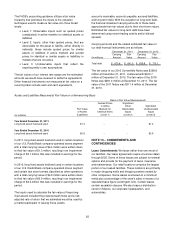

Restricted stock awards are valued at the market price of a

share of our common stock on the date of grant. In general,

these awards vest at the end of a three-year period from

the date of grant and are expensed on a straight-line basis

over that period, which is considered to be the requisite

service period. This expense totaled $2.9 million, $4.7

million, and $1.8 million for the years ended December 31,

2011, 2010 and 2009, respectively.

The weighted-average grant-date fair value per share of

restricted stock awards granted was $14.68, $19.21 and

$7.05 in 2011, 2010 and 2009, respectively. The total fair

value of restricted stock awards vested was approximately

$3.8 million, $1.7 million and $1.3 million in 2011, 2010 and

2009, respectively.

The compensation cost charged against income for all

stock-based compensation plans was $5.4 million, $9.9

million and $12.1 million in 2011, 2010 and 2009,

respectively. The total income tax benefit recognized for all

stock-based compensation plans was $2.1 million, $2.6

million and $3.9 million in 2011, 2010 and 2009,

respectively. At December 31, 2011, there was $6.8 million

of unrecognized compensation expense related to the

unvested portion of our stock-based awards that is

expected to be recognized over a weighted average period

of 2.19 years.

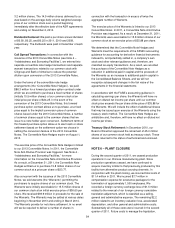

Deferred Stock Units: In 2004, the stockholders approved

the RadioShack 2004 Deferred Stock Unit Plan for Non-

Employee Directors (“Deferred Plan”), which was amended

in 2008. Under the plan, each non-employee director

receives a one-time initial grant of units equal to the

number of shares of our common stock that represent a fair

market value of $150,000 on the grant date, and an annual

grant of units equal to the number of shares of our common

stock that represent a fair market value of $105,000 on the

annual grant date.

Under the Deferred Plan, one-third of the Units covered by

an award vest on each of the first three anniversaries of the

date of grant. Vesting of outstanding awards is accelerated

under certain circumstances. At termination of service,

death, disability or change in control of RadioShack,

Directors will receive shares of common stock equal to the

number of vested Units. Directors receive these shares in a

lump sum. We granted approximately 53,000, 29,000, and

45,000 Units in 2011, 2010 and 2009, respectively. The

weighted-average grant-date fair value per Unit granted

was $14.80, $21.75 and $13.97 in 2011, 2010 and 2009,

respectively. There were approximately 277,000 Units

outstanding and 639,000 Units available for grant at

December 31, 2011.

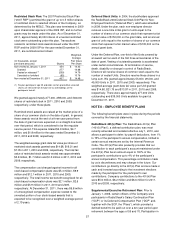

NOTE 8 – EMPLOYEE BENEFIT PLANS

The following benefit plans were in place during the periods

covered by the financial statements.

RadioShack 401(k) Plan: The RadioShack 401(k) Plan

(“401(k) Plan”), a defined contribution plan, was most

recently amended and restated effective July 1, 2010, and

allows a participant to defer, by payroll deductions, from 1%

to 75% of the participant’s annual compensation, limited to

certain annual maximums set by the Internal Revenue

Code. The 401(k) Plan also presently provides that our

contribution to each participant’s account maintained under

the 401(k) Plan be an amount equal to 100% of the

participant’s contributions up to 4% of the participant’s

annual compensation. This percentage contribution made

by us is discretionary and may change in the future. Our

contributions go directly to the 401(k) Plan and are made in

cash and invested according to the investment elections

made by the participant for the participant’s own

contributions. Company contributions to the 401(k) Plan

were $5.6 million, $6.2 million and $6.6 million for 2011,

2010 and 2009, respectively.

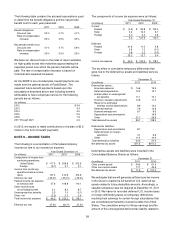

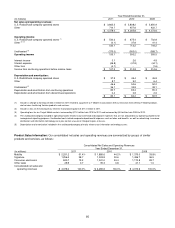

Supplemental Executive Retirement Plan: Prior to

January 1, 2006, certain officers of the Company were

participants in RadioShack’s Salary Continuation Plan

(“SCP”) or its Deferred Compensation Plan (“DCP” and,

together with the SCP, the “Plans”), which provided a

defined benefit to be paid out over a ten-year period upon

retirement between the ages of 55 and 70. Participation in