Radio Shack 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

(1) Total capitalization is defined as total debt plus total stockholders' equity.

(2) This ratio is calculated by dividing our cost of products sold by our average inventory balance. For comparative purposes, we have included the cost of

products sold by and the inventory balances of our discontinued operations in this ratio for all periods presented.

(3)

Adjusted EBITDA from continuing operations (“Adjusted EBITDA”),

a non-GAAP financial measure, is defined as earnings from continuing operations

before interest, taxes, depreciation, and amortization. Our calculation of Adjusted EBITDA is also adjusted for other income or loss. The comparable

financial measure to Adjusted EBITDA under GAAP is income from continuing operations. Adjusted EBITDA is used by management to evaluate the

operating performance of our business for comparable periods. Adjusted EBITDA should not be used by investors or others as the sole basis for

formulating investment decisions, as it excludes a number of important items. We compensate for this limitation by using GAAP financial measures as well

in managing our business. In the view of management, Adjusted EBITDA is an important indicator of operating performance because Adjusted EBITDA

excludes the effects of financing and investing activities by eliminating the effects of interest and depreciation costs.

(4) Comparable store sales include the sales of U.S. and Mexico RadioShack company-operated stores and kiosks with more than 12 full months of recorded

sales. Following their closure as Sprint-branded kiosks in August 2009, certain former Sprint-branded kiosk locations became multiple wireless carrier

RadioShack-branded locations. At December 31, 2009, we managed and reported 111 of these locations as extensions of existing RadioShack company-

operated stores located in the same shopping malls. For purposes of calculating our comparable store sales, we include sales from these locations for

periods after they became extensions of existing RadioShack company-operated stores, but we do not include sales from these locations for periods while

they were operated as Sprint-branded kiosks.

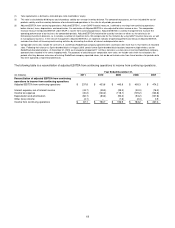

The following table is a reconciliation of adjusted EBITDA from continuing operations to income from continuing operations.

Year Ended December 31,

(In millions) 2011 2010 2009 2008 2007

Reconciliation of adjusted EBITDA from continuing

operations to income from continuing operations

Adjusted EBIT

DA from continuing operations $ 237.8

$ 433.6

$ 445.8

$ 405.3

$ 474.2

Interest expense, net of interest income (43.7)

(39.3)

(39.3)

(20.3)

(16.2)

Income tax expense (40.2)

(120.2)

(118.1)

(105.2)

(123.8)

Depreciation and amortization (82.7)

(83.4)

(90.3)

(94.2)

(107.8)

Other (loss) income (4.1)

--

(1.6)

(2.4)

0.9

Income from continuing operations $ 67.1

$ 190.7

$ 196.5

$ 183.2

$ 227.3