Radio Shack 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

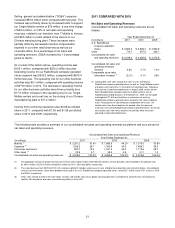

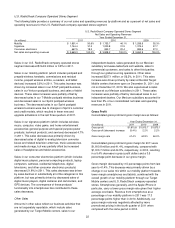

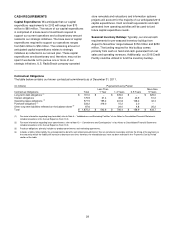

U.S. RadioShack Company-Operated Stores Segment

The following table provides a summary of our net sales and operating revenues by platform and as a percent of net sales and

operating revenues for the U.S. RadioShack company-operated stores segment.

U.S. RadioShack Company-Operated Stores Segment

Net Sales and Operating Revenues

Year Ended December 31,

(In millions) 2011 2010 2009

Mobility $ 1,851.4 50.6%

$ 1,753.7 46.1%

$ 1,289.9 35.3%

Signature 1,144.4 31.2

1,200.8 31.5

1,375.4 37.7

Consumer electronics 667.5 18.2

853.7 22.4

985.6 27.0

Net sales and operating revenues $ 3,663.3 100.0%

$ 3,808.2 100.0%

$ 3,650.9 100.0%

Sales in our U.S. RadioShack company-operated stores

segment decreased $144.9 million or 3.8% in 2011.

Sales in our mobility platform (which includes postpaid and

prepaid wireless handsets, commissions and residual

income, prepaid wireless airtime, e-readers, and tablet

devices) increased 5.6% in 2011. This sales increase was

driven by increased sales in our AT&T postpaid business,

sales in our Verizon postpaid business, and sales of tablet

devices. These sales increases were partially offset by

decreased sales in our T-Mobile postpaid wireless business

and decreased sales in our Sprint postpaid wireless

business. The decreased sales in our Sprint postpaid

wireless business were due to changes in Sprint’s customer

and credit models, which resulted in fewer new and

upgrade activations in the last three quarters of 2011.

Sales in our signature platform (which includes wireless,

music, computer, video game, and home entertainment

accessories; general purpose and special purpose power

products; technical products; and services) decreased 4.7%

in 2011. This sales decrease was primarily driven by

decreased sales of digital-to-analog television converter

boxes and related television antennas, music accessories,

and media storage, but was partially offset by increased

sales of headphones and tablet accessories.

Sales in our consumer electronics platform (which includes

digital music players, personal computing products, laptop

computers, cameras, residential telephones, digital

televisions, and other consumer electronics products)

decreased 21.8% in 2011. This sales decrease was driven

by sales declines in substantially all of the categories in this

platform, but was primarily driven by decreased sales of

digital music players, digital cameras and camcorders, and

GPS devices. The convergence of these products’

functionality into smartphones has contributed to these

sales decreases.

Other Sales

Amounts in other sales reflect our business activities that

are not separately reportable, which include sales

generated by our Target Mobile centers, sales to our

independent dealers, sales generated by our Mexican

subsidiary and www.radioshack.com website, sales to

commercial customers, and sales to other third parties

through our global sourcing operations. Other sales

increased $257.1 million, or 56.2%, in 2011. This sales

increase was driven primarily by sales at the 646 Target

Mobile centers that were open on December 31, 2011, but

not on December 31, 2010. We also experienced a sales

increase at our Mexican subsidiary in 2011. These sales

increases were partially offset by decreased sales to our

independent dealers. Our Mexican subsidiary accounted for

less than 5% of our consolidated net sales and operating

revenues in 2011.

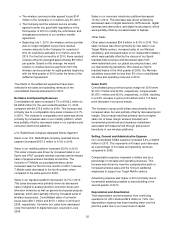

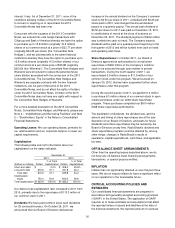

Gross Profit

Consolidated gross profit and gross margin are as follows:

Year Ended December 31,

(In millions) 2011

2010

2009

Gross profit $1,810.8

$1,913.7

$1,873.1

Gross profit (decrease) increase (5.4%)

2.2%

2.2%

Gross margin rate 41.4%

44.9%

46.0%

Consolidated gross profit and gross margin for 2011 were

$1,810.8 million and 41.4%, respectively, compared with

$1,913.7 million and 44.9%, respectively, in 2010, resulting

in a 5.4% decrease in gross profit dollars and a 3.5

percentage point decrease in our gross margin.

Gross margin decreased by 3.5 percentage points from last

year to 41.4%. This decrease was primarily driven by a

change in our sales mix within our mobility platform towards

lower margin smartphones and tablets, combined with the

overall growth of our mobility platform through our Target

Mobile centers and U.S. RadioShack company-operated

stores. Smartphones generally, and the Apple iPhone in

particular, carry a lower gross margin rate given their higher

average cost basis. Revenue from smartphones as a

percentage of our mobility platform in 2011 was 17.3

percentage points higher than in 2010. Additionally, our

gross margin rate was negatively affected by more

promotional pricing in the fourth quarter of 2011 when

compared with the same period in 2010.