Radio Shack 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

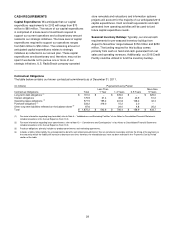

25

• The wireless service provider agreed to pay $141

million to the Company on or before July 30, 2010.

• The Company and the wireless service provider

agreed to enter into good faith negotiations in the

third quarter of 2010 to modify the commission and

chargeback provisions of our wireless reseller

agreement.

• Beginning July 1, 2010, the wireless service provider

was no longer obligated to pay future residual

revenue amounts to the Company for a period of

time for customers activated on or before June 30,

2010. For the first six months of 2010, these residual

revenue amounts averaged approximately $9 million

per quarter. Based on this average, we would

receive no residual revenue payments from this

wireless service provider for eight quarters beginning

with the third quarter of 2010 under the terms of the

settlement agreement.

The effects of the settlement agreement have been

reflected in net sales and operating revenues in the

consolidated financial statements for 2010.

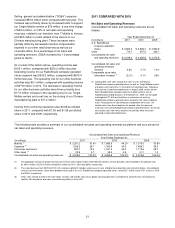

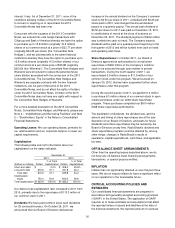

Net Sales and Operating Revenues

Consolidated net sales increased 4.7% or $192.2 million to

$4,265.8 million for the year ended December 31, 2010,

compared with $4,073.6 million in 2009. This increase was

primarily due to a comparable store sales increase of 4.1%

in 2010. The increase in comparable store sales was driven

primarily by increased sales in our mobility platform, which

was partially offset by decreased sales in our signature and

consumer electronics platforms.

U.S. RadioShack Company-Operated Stores Segment

Sales in our U.S. RadioShack company-operated stores

segment increased $157.3 million or 4.3% in 2010.

Sales in our mobility platform increased 36.0% in 2010.

This sales increase was driven by increased sales in our

Sprint and AT&T postpaid wireless business and increased

sales of prepaid wireless handsets and airtime. The

inclusion of T-Mobile as a postpaid wireless carrier

increased sales for the first nine months of 2010; however,

T-Mobile sales decreased in the fourth quarter, when

compared to the same period in 2009.

Sales in our signature platform decreased 12.7% in 2010.

This sales decrease was primarily driven by decreased

sales of digital-to-analog television converter boxes and

television antennas as well as general and special purpose

batteries, which were partially offset by increased sales of

wireless accessories. Consolidated sales of converter

boxes were $33.7 million and $170.1 million in 2010 and

2009, respectively. Converter box sales have decreased

since the transition to digital television occurred in June

2009.

Sales in our consumer electronics platform decreased

13.4% in 2010. This decrease was driven primarily by

decreased sales of digital televisions, GPS devices, digital

cameras and camcorders, and digital music players, which

were partially offset by increased sales of laptops.

Other Sales

Other sales increased $34.9 million or 8.3% in 2010. This

sales increase was driven primarily by new sales in our

Target Mobile centers, increased sales at our Mexican

subsidiary, and increased sales to our independent dealers,

which were partially offset by the closure of our Sprint-

branded kiosk business and decreased sales from

www.radioshack.com, our global sourcing business, and

our manufacturing operations. We closed our Sprint-

branded kiosks in the third quarter of 2009. Our Mexican

subsidiary accounted for less than 5% of our consolidated

net sales and operating revenues in 2010.

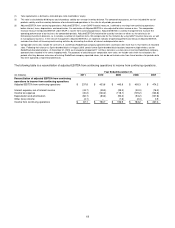

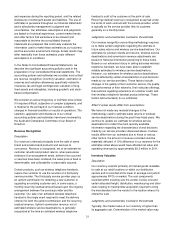

Gross Profit

Consolidated gross profit and gross margin for 2010 were

$1,913.7 million and 44.9%, respectively, compared with

$1,873.1 million and 46.0%, respectively, in 2009, resulting

in a 2.2% increase in gross profit dollars and a 110 basis

point decrease in our gross margin.

The increase in gross profit dollars was primarily due to

increased sales, but was partially offset by decreased gross

margin. Gross margin declined primarily due to a higher

sales mix of lower margin wireless handsets and

incremental promotional and clearance markdowns

associated with seasonal sell-through and product

transitions in non-wireless platforms.

Selling, General and Administrative Expense

Our consolidated SG&A expense increased 3.4% or $48.8

million in 2010. This represents a 40 basis point decrease

as a percentage of net sales and operating revenues

compared to 2009.

Compensation expense increased in dollars and as a

percentage of net sales and operating revenues. This

increase was driven by incentive compensation paid on

increased wireless sales and the hiring of additional

employees to support our Target Mobile centers.

Advertising expense was higher in 2010 primarily due to

incremental advertising related to brand building in the

second quarter of 2010.

Depreciation and Amortization

Total depreciation and amortization from continuing

operations for 2010 declined $6.9 million or 7.6%. Our

depreciation expense has been trending lower over the

past five years due to our lower level of capital