Radio Shack 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

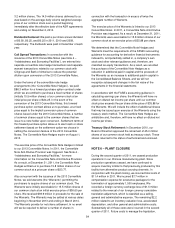

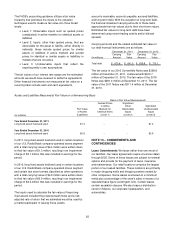

Future minimum rent commitments at December 31, 2011,

under non-cancelable operating leases (net of immaterial

amounts of sublease rent income), are included in the

following table.

(In millions)

Operating

Leases

2012 $ 195.2

2013 141.6

2014 100.2

2015 70.3

2016 37.9

2017 and thereafter 32.3

Total minimum lease payments $ 577.5

Rent Expense:

Year Ended December 31,

(In millions) 2011 2010 2009

Minimum rents $ 224.3

$ 224.6

$ 224.3

Occupancy cost 35.3

37.6

39.3

Contingent rents 4.1

5.0

4.7

Total rent expense $ 263.7

$ 267.2

$ 268.3

Purchase Obligations: We had purchase obligations of

$333.2 million at December 31, 2011, which include product

commitments and marketing agreements. Of this amount,

$316.0 million related to 2012.

Loss Contingencies: FASB Accounting Standards

Codification Topic 450 - Contingencies (“ASC 450”)

governs our disclosure and recognition of loss

contingencies, including pending claims, lawsuits, disputes

with third parties, investigations and other actions that are

incidental to the operation of our business. ASC 450 uses

the following defined terms to describe the likelihood of a

future loss: probable – the future event or events are likely

to occur, remote – the chance of the future event or events

is slight, and reasonably possible – the chance of the future

event or events occurring is more than remote but less than

likely. ASC 450 also contains certain requirements with

respect to how we accrue for and disclose information

concerning our loss contingencies. We accrue for a loss

contingency when we conclude that the likelihood of a loss

is probable and the amount of the loss can be reasonably

estimated. When the reasonable estimate of the loss is

within a range of amounts, and no amount in the range

constitutes a better estimate than any other amount, we

accrue for the amount at the low end of the range. We

adjust our accruals from time to time as we receive

additional information, but the loss we incur may be

significantly greater than or less than the amount we have

accrued. We disclose loss contingencies if there is at least

a reasonable possibility that a loss has been incurred. No

accrual or disclosure is required for losses that are remote.

Brookler v. RadioShack Corporation: On April 6, 2004,

plaintiffs filed a putative class action in Los Angeles

Superior Court, Brookler v. RadioShack Corporation,

claiming that we violated California's wage and hour laws

relating to meal and rest periods. The meal period portion

of the case was originally certified as a class action in

February 2006. Our first Motion for Decertification of the

class was denied in August 2007. After a favorable decision

at the California Court of Appeals in the similar case of

Brinker Restaurant Corporation v. Superior Court, we again

sought decertification of the class. Based on the California

Court of Appeals decision in Brinker, the trial court granted

our second motion for class decertification in October 2008.

The plaintiffs in Brookler appealed this ruling. Due to the

unsettled nature of California law regarding the obligations

of employers in respect of meal periods, we and the

Brookler plaintiffs requested that the California Court of

Appeals stay its ruling on the plaintiffs’ appeal of the class

decertification ruling pending the California Supreme

Court’s decision in Brinker. The appellate court denied this

joint motion and then heard oral arguments in the case on

August 5, 2010. On August 26, 2010, the California Court of

Appeals reversed the trial court’s decertification of the

class, and our Petition for Rehearing was denied on

September 14, 2010. On September 28, 2010, we filed a

Petition for Review with the California Supreme Court,

which granted review and placed the case on hold pending

its decision in Brinker. On November 8, 2011, the California

Supreme Court heard oral arguments in Brinker. It is

expected that a decision will be rendered by the Court

sometime in April 2012. The outcome of this case is

uncertain and the ultimate resolution of it could have a

material adverse effect on our consolidated financial

statements in the period in which the resolution is recorded.

Ordonez v. RadioShack Corporation: In May 2010,

Daniel Ordonez, on behalf of himself and all other similarly

situated current and former employees, filed a Complaint

against the Company in the Los Angeles Superior Court. In

July 2010, Mr. Ordonez filed an Amended Complaint

alleging, among other things, that we failed to provide

required meal periods, provide required rest breaks, pay

overtime compensation, pay minimum wages, and maintain

required records. In September 2010 we removed the case

to the United States District Court for the Central District of

California. The proposed putative class in Ordonez consists

of all current and former non-exempt employees for a

period within the four (4) years preceding the filing of the

case. The meal period claims raised in Ordonez are similar

to the claims raised in Brookler as discussed above.

Pursuant to a motion filed by the Ordonez parties, the court

recently granted a Stipulation and Order to Stay

Proceedings pending the decision of the California

Supreme Court in Brinker. The outcome of this case is

uncertain and the ultimate resolution of it could have a

material adverse effect on our consolidated financial

statements in the period in which the resolution is recorded.

Song-Beverly Credit Card Act: In November 2010,

RadioShack received service of process with respect to the

first of four putative class action lawsuits filed in California