Radio Shack 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

ITEM 7. MANAGEMENT'S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (“MD&A”).

This MD&A section discusses our results of operations,

liquidity and financial condition, risk management practices,

critical accounting policies, and estimates and certain

factors that may affect our future results, including

economic and industry-wide factors. Our MD&A should be

read in conjunction with our consolidated financial

statements and accompanying notes included in this

Annual Report on Form 10-K, as well as the Risk Factors

set forth in Item 1A above.

EXECUTIVE OVERVIEW

RadioShack is a leading national retailer of innovative

mobile technology products and services, as well as

products related to personal and home technology and

power supply needs. We offer a targeted assortment of

wireless phones and other electronic products and services

from leading national brands, exclusive private brands and

major wireless carriers.

Our more than 7,200 locations in the U.S. and Mexico give

us a unique competitive advantage in scale, reach and

convenience. We seek to differentiate ourselves from our

various competitors by providing:

• Innovative mobile technology products and services,

as well as products related to personal and home

technology and power supply needs, at competitive

prices

• Convenient neighborhood locations

• Knowledgeable, objective and friendly service

• Unique private brand offers and exclusive branded

promotions

Our day-to-day focus is concentrated on:

• Providing our customers with a positive in-store

experience

• Growing gross profit dollars

• Controlling costs throughout the organization

• Utilizing funds generated from operations to enhance

long-term shareholder value

External Factors Affecting Our Business

In 2011, we continued to experience a highly challenging

U.S. economic environment and reduced consumer

spending that began in the fourth quarter of 2008.

Consumer spending on wireless handsets has increased

significantly over the past several years. The spending

growth for wireless handsets has been primarily driven by

increased purchases of smartphones such as Apple’s

iPhone and Android-based devices.

A smartphone is a wireless handset that offers more

advanced computing ability, connectivity to the Internet,

and multimedia capabilities than a basic feature wireless

phone. Smartphones typically combine wireless handset

capabilities with capabilities previously found on separate

devices. Some examples include GPS (global positioning

system) navigation, digital music players and camera

capabilities. We believe this convergence of capabilities

into smartphones has contributed to a decline in these

product categories. This convergence trend is likely to

continue as smartphones evolve and as more consumers

adopt smartphone technology.

According to the Consumer Electronics Association

(“CEA”), in 2012 the consumer electronics industry will

surpass $200 billion in overall revenues in the U.S. for the

first time. The industry is expected to grow 3.7 percent in

2012, after reaching an estimated $195.2 billion in

revenues in 2011. Smartphones are expected to continue

to be the primary revenue driver for the industry.

Smartphone unit sales are expected to increase 24 percent

in 2012 to 108.8 million units, with total revenue exceeding

$33 billion.

The innovation in certain mature consumer electronic

product categories, such as DVD players, camcorders and

audio products, has not been sufficient to maintain average

selling prices. These mature products have become

commoditized, and we continue to experience price

declines and reduced margins for them.

Business Performance

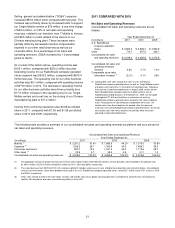

2011 was a year of progress and transitions for our

business. During 2011, we successfully completed several

initiatives:

• Added wireless offerings from Verizon Wireless to

our portfolio of top national wireless carriers

• Successfully completed the rollout of our Target

Mobile centers to 1,496 Target stores throughout the

U.S.

• Closed our Chinese manufacturing plant to transition

to a more efficient global sourcing operation

• Doubled our annual dividend to $0.50 per share to

increase value returned to shareholders

• Maintained our liquidity by entering into a new $450

million credit facility that expires in January 2016.

• Enhanced our balance sheet by selling $325 million

of 8-year 6.75% senior notes

During 2011, our Mobility business, which includes postpaid

and prepaid wireless handsets, commissions and residual

income, prepaid wireless airtime, e-readers, and tablet

devices, increased from 44.2% of our net sales and

operating revenues in 2010 to 51.4% in 2011. This and