Radio Shack 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

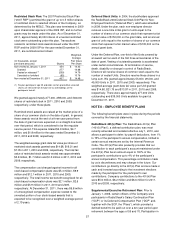

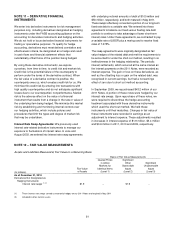

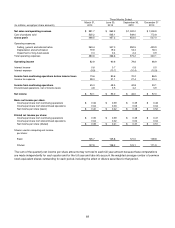

The following table contains the actuarial assumptions used

to determine the benefit obligations and the net periodic

benefit cost for each year presented:

2011 2010 2009

Benefit obligations:

Discount rate 3.3% 4.1% 4.7%

Rate of compensation

increase

3.5%

3.5%

3.5%

Net periodic benefit cost:

Discount rate 4.1% 4.7% 5.9%

Rate of compensation

increase

3.5%

3.5%

3.5%

We base our discount rate on the rates of return available

on high-quality bonds with maturities approximating the

expected period over which the pension benefits will be

paid. The rate of compensation increase is based on

historical and expected increases.

As the SERP is an unfunded plan, benefit payments are

made from the general assets of RadioShack. The

expected future benefit payments based upon the

assumptions described above and including benefits

attributable to future employee service for the following

periods are as follows:

(In millions)

2012 $ 3.6

2013 3.4

2014 3.0

2015 2.5

2016 1.6

2017 through 2021 4.4

In 2012, we expect to make contributions to the plan of $3.6

million in the form of benefit payments.

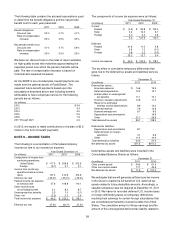

NOTE 9 – INCOME TAXES

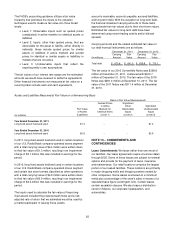

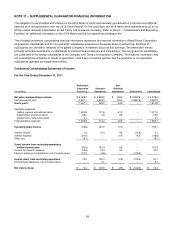

The following is a reconciliation of the federal statutory

income tax rate to our income tax expense:

Year Ended December 31,

(In millions) 2011

2010

2009

Components of income from

continuing operations:

United States $ 117.0 $ 308.8 $ 312.5

Foreign (9.7)

2.1 2.1

Income from continuing

operations before income

taxes

107.3

310.9

314.6

Statutory tax rate x 35.0%

x 35.0%

x 35.0%

Federal income tax expense

at statutory rate

37.6

108.8

110.1

State income taxes,

net of federal benefit

2.1

8.3

8.7

Unrecognized tax benefits 2.5 1.0 (3.1)

Other, net (2.0)

2.1 2.4

Total income tax expense $ 40.2 $ 120.2 $ 118.1

Effective tax rate 37.5%

38.7%

37.5%

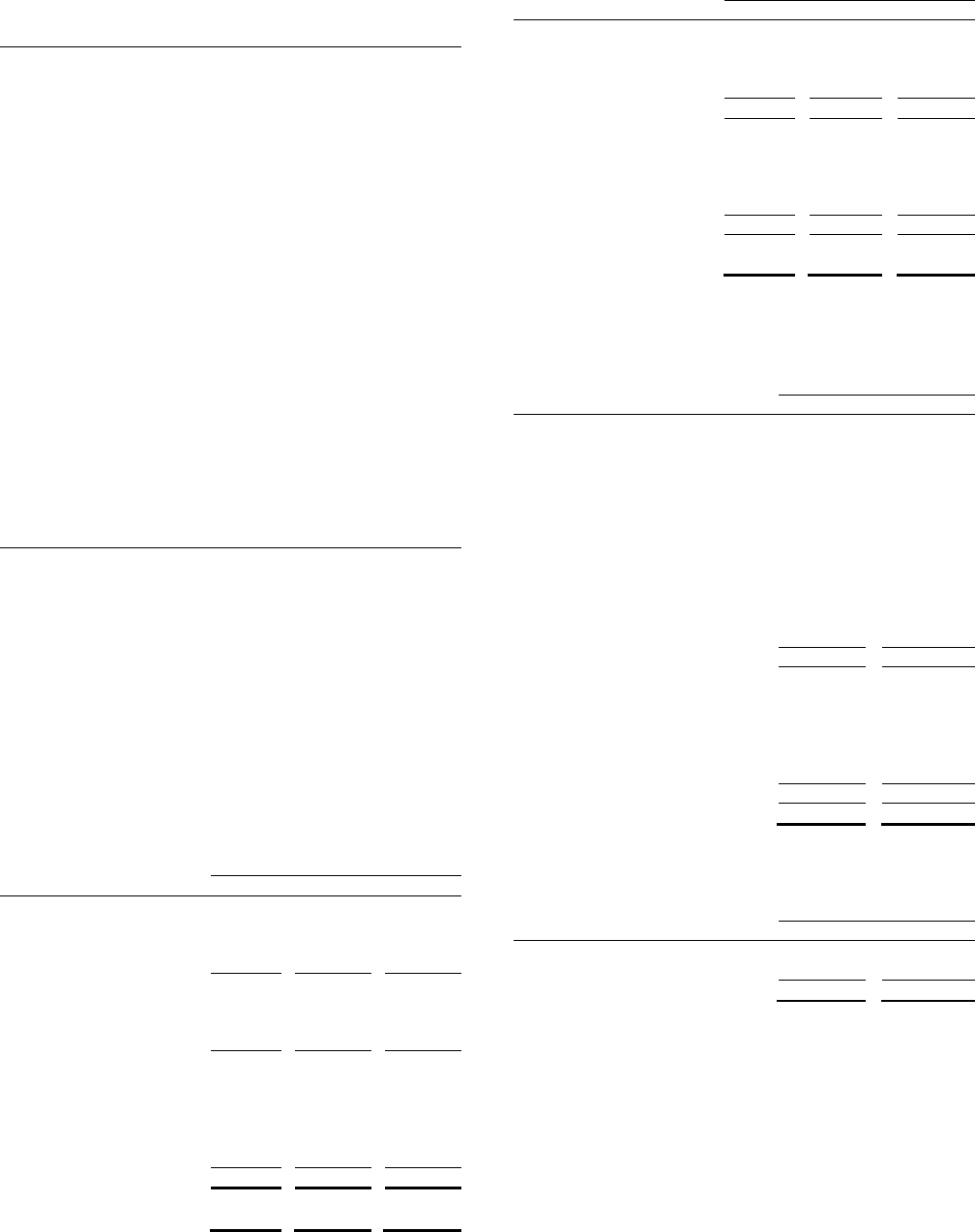

The components of income tax expense were as follows:

Year Ended December 31,

(In millions) 2011

2010 2009

Current:

Federal $ (0.4)

$ 92.8 $ 103.4

State 3.4 12.3 6.7

Foreign 2.0 2.4 2.6

5.0 107.5 112.7

Deferred:

Federal 31.6 11.3 5.8

State 2.8 1.2 (0.1)

Foreign 0.8 0.2 (0.3)

35.2 12.7 5.4

Income tax expense $ 40.2 $ 120.2 $ 118.1

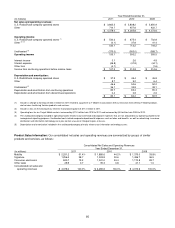

The tax effect of cumulative temporary differences that

gave rise to the deferred tax assets and liabilities were as

follows:

December 31,

(In millions) 2011 2010

Deferred tax assets:

Insurance reserves $ 14.6 15.5

Deferred compensation 12.2 13.7

Indirect effect of unrecognized

tax benefits

11.1

10.1

Inventory valuation adjustments 10.6 11.4

Reserve for estimated

wireless service deactivations

8.9

12.0

Deferred revenue 7.9 13.6

Accrued average rent 8.7 8.5

Depreciation and amortization -- 16.6

Other 21.7 26.9

Total deferred tax assets 95.7 128.3

Deferred tax liabilities:

Depreciation and amortization 8.7 --

Deferred taxes on foreign

operations

4.1

6.6

Other 11.4 14.4

Total deferred tax liabilities 24.2 21.0

Net deferred tax assets $71.5 $107.3

Deferred tax assets and liabilities were included in the

Consolidated Balance Sheets as follows:

December 31,

(In millions) 2011 2010

Other current assets $ 54.4 $ 61.4

Other non-current assets 17.1 45.9

Net deferred tax assets $ 71.5 $ 107.3

We anticipate that we will generate sufficient pre-tax income

in the future to realize the full benefit of U.S. deferred tax

assets related to future deductible amounts. Accordingly, a

valuation allowance was not required at December 31, 2011

or 2010. We have not recorded deferred U.S. income taxes

or foreign withholding taxes on temporary differences

resulting from earnings for certain foreign subsidiaries that

are considered permanently invested outside the United

States. The cumulative amount of these earnings and the

amount of the unrecognized deferred tax liability related to