Radio Shack 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 011 AN N UAL REPORT

WHAT’S

IN STORE

Table of contents

-

Page 1

IN STORE WHAT'S 2011 ANNUAL REPORT -

Page 2

... products; and services. Consumer Electronics Digital music players, personal computing products, laptop computers, cameras, residential telephones, digital televisions and other consumer electronics products. 2011 Consolidated Net Sales and Operating Revenue by Product Platform Mobility Signature... -

Page 3

...we drove sales, strengthened our balance sheet and controlled costs, despite a persistent recessionary environment. We also significantly strengthened our mobility business, reconnecting with customers in our signature platform and taking advantage of select opportunities in the consumer electronics... -

Page 4

... our gross-margin results for the year. cash. In 2011, we opted to use our strong liquidity position to reinvest in our business and return value to shareholders through increased dividends. In the fourth quarter, the Board doubled the annual dividend from $0.25 to $0.50 per share and converted... -

Page 5

...and expanding our assortment of tablets and e-readers. These measures yielded increased sales and gross profits. We continued to expand our Target Mobile presence, opening nearly 650 new locations in select Target stores across the nation in 2011. For decades, DIY customers have relied on RadioShack... -

Page 6

... site, adding new functions that link our online presence to our brick-and-mortar locations, leveraging the strengths that make RadioShack unique - a convenient small-store model, a knowledgeable and friendly sales team, and a targeted assortment of relevant products and services. Specifically... -

Page 7

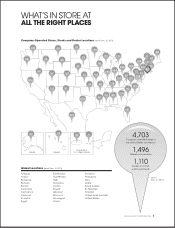

... 4 Company-operated stores in the United States and Mexico 4,703 1,496 1,110 Alaska Hawaii Puerto Rico U.S. Virgin Islands Wireless phone kiosks Global Locations Antigua Aruba Bahamas Bahrain Bolivia Colombia Costa Rica Curaçao Ecuador Egypt (as of Dec. 31, 2011) Dealer and other outlets... -

Page 8

-

Page 9

...a shell ll com company (as defined in Rule 12b-2 of the Act). Yes __ No X As of June 30, 2011, the aggregate market value of the he vot voting common stock of the registrant held by non-affiliates of the registrant rant was w $1,216,598,602 based on the New York Stock Exchange closing price. For the... -

Page 10

.... PART III Item 10. Item 11. Item 12. Item 13. Item 14. PART IV Item 15. Exhibits, Financial Statement Schedules Signatures Index to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Index to Exhibits 36 37 38 39 77 Directors, Executive Officers and Corporate... -

Page 11

... 31, 2011, there were 227 company-operated stores under the RadioShack brand, 9 dealers, and one distribution center in Mexico. RadioShack.com: Products and information are available through our commercial website www.radioshack.com. Online customers can purchase, return or exchange various products... -

Page 12

..., online network of computers that links all stores, kiosks, customer channels, delivery locations, service centers, credit providers, distribution facilities and our home office into a fully integrated system. Each retail location has its own server to support the point-of-sale ("POS") system... -

Page 13

...service activation. under the heading "Investor Relations," by accessing our corporate website: http://www.radioshackcorporation.com For information regarding the net sales and operating revenues and operating income for our reportable segment for fiscal years ended December 31, 2011, 2010 and 2009... -

Page 14

... products and technologies that do not offer us a similar sales opportunity or are sold at lower price points or margins. Because growth in the wireless industry is often driven by the adoption rate of new wireless handset and wireless service technologies, the absence of these new technologies... -

Page 15

... favorable terms could materially adversely affect our results of operations and financial condition. A significant portion of our net sales and operating revenues is attributable to a limited number of name brand products and service providers. The concentration of revenue in our mobility platform... -

Page 16

... the market, our results of operations and financial condition could be materially adversely affected. Any new products, services or technologies we identify may have a limited sales life. Furthermore, it is possible that new products, services or technologies will never achieve widespread consumer... -

Page 17

... business is heavily dependent upon information systems, given the number of individual transactions we process each year. Our information systems include an instore point-of-sale system that helps us track sales performance, inventory replenishment, product availability, product margin and customer... -

Page 18

..., Plant and Equipment Supplemental Balance Sheet Disclosures - Property, Plant and Equipment, Net Commitments and Contingencies Note 2 Note 3 Note 13 We lease, rather than own, most of our retail facilities. Our stores are located in shopping malls, stand-alone buildings and shopping centers owned... -

Page 19

...a test program of retail locations in approximately 100 Target stores. In the third quarter of 2010 we signed a multi-year agreement with Target Corporation to operate Target Mobile centers in certain Target stores. Our dealer and other outlets decreased by 109 and 102 locations, net of new openings... -

Page 20

... Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming District of Columbia Puerto Rico U.S. Virgin Islands... -

Page 21

... by the Board of Directors in January 2011 and became Chief Executive Officer in May 2011. Mr. Gooch joined RadioShack as Chief Financial Officer in August 2006. Prior to such time, he spent 10 years with Kmart Holding Corporation and subsequently Sears Holdings Corporation after the merger... -

Page 22

...PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. PRICE RANGE OF COMMON STOCK Our common stock is listed on the New York Stock Exchange and trades under the symbol "RSH." The following table presents the high and low trading... -

Page 23

...1 - 31, 2011 Total Total Number of Shares Purchased -930,000 -930,000 Average Price Paid per Share $ -$ 12.80 $ -- (1) In October 2011, our Board of Directors approved an authorization for a total share repurchase of $200 million of the Company's common stock to be executed through open market or... -

Page 24

... high-capitalization stocks representing the specialty retail sector of the S&P 500. The graph assumes an investment of $100 at the close of trading on December 31, 2006, in RadioShack common stock, the S&P 500 Index and the S&P Specialty Retail Index. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN... -

Page 25

... from continuing operations (3) Dividends declared per share Capital expenditures Number of retail locations at year end: U.S. RadioShack company-operated stores Target Mobile Centers Mexico RadioShack company-operated stores Dealer and other outlets Discontinued kiosks Total Average square footage... -

Page 26

... company-operated stores, but we do not include sales from these locations for periods while they were operated as Sprint-branded kiosks. (4) The following table is a reconciliation of adjusted EBITDA from continuing operations to income from continuing operations. Year Ended December 31, 2009... -

Page 27

... of our net sales and operating revenues in 2010 to 51.4% in 2011. This and 19 EXECUTIVE OVERVIEW RadioShack is a leading national retailer of innovative mobile technology products and services, as well as products related to personal and home technology and power supply needs. We offer a targeted... -

Page 28

... Target Mobile centers and U.S. RadioShack company-operated stores. Smartphones generally, and the Apple iPhone in particular, carry a lower gross margin rate, given their higher average cost basis. Revenue from smartphones as a percentage of our mobility platform in 2011 was 17.3 percentage points... -

Page 29

... our Target Mobile centers and a net loss on the closing of our Chinese manufacturing plant of $11.4 million. Income from continuing operations was $0.65 per diluted share in 2011, compared with $1.55 and $1.56 per diluted share in 2010 and 2009, respectively. 2011 COMPARED WITH 2010 Net Sales and... -

Page 30

... Target Mobile centers and U.S. RadioShack company-operated stores. Smartphones generally, and the Apple iPhone in particular, carry a lower gross margin rate given their higher average cost basis. Revenue from smartphones as a percentage of our mobility platform in 2011 was 17.3 percentage points... -

Page 31

..., the effect of Sprint and Verizon offering the iPhone for all of 2012 compared with less than full years in 2011, and the effect of our recently opened Target Mobile centers being open for a full year. The gross margin rate for our U.S. RadioShack companyoperated stores segment decreased by... -

Page 32

... Depreciation and amortization included in cost of products sold Total depreciation and amortization from continuing operations 2010 COMPARED WITH 2009 Wireless Service Provider Settlement Agreement The business terms of our relationships with our wireless service providers are governed by our... -

Page 33

... sourcing business, and our manufacturing operations. We closed our Sprintbranded kiosks in the third quarter of 2009. Our Mexican subsidiary accounted for less than 5% of our consolidated net sales and operating revenues in 2010. Gross Profit Consolidated gross profit and gross margin for 2010... -

Page 34

... in 2010. Capital expenditures primarily related to information system projects, Target Mobile centers, and our U.S. RadioShack company-operated stores. Financing Activities: Net cash used in financing activities was $115.5 million in 2011 compared with $413.8 million in 2010. Our net cash used in... -

Page 35

... 4, 2016. The 2016 Credit Facility may be used for general corporate purposes and the issuance of letters of credit. This facility is collateralized by substantially all of the Company's inventory, accounts receivable, cash and cash equivalents, and certain other personal property, and is guaranteed... -

Page 36

... more information regarding lease commitments, refer to Note 13 - "Commitments and Contingencies" of our Notes to Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K. Purchase obligations primarily include our product commitments and marketing agreements. Includes... -

Page 37

... business days immediately after any 10 consecutive trading day period in which the average trading price per $1,000 principal amount of 2013 Convertible Notes was less than 98% of the product of the closing price of the common stock on such date and the conversion rate on such date • We make... -

Page 38

... quarter of 2012 and will be funded from cash on hand and operating cash flows. Share Repurchases: In October 2011, our Board of Directors approved an authorization for a total share repurchase of $200 million of the Company's common stock to be executed through open market or private transactions... -

Page 39

... Committee of our Board of Directors. Revenue Recognition Description Our revenue is derived principally from the sale of name brand and private brand products and services to consumers. Revenue is recognized, net of an estimate for customer refunds and product returns, when persuasive evidence... -

Page 40

..., current selling prices, seasonality factors, consumer trends, competitive pricing, performance of similar products or accessories, planned promotional incentives, technological obsolescence, and estimated costs to sell or dispose of merchandise such as sales commissions. If the estimated market... -

Page 41

... Policies" and Note 7 - "Stock-Based Incentive Plans" in the Notes to Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K for a more complete discussion of our stock-based compensation programs. At the date an award is granted, we determine the fair value... -

Page 42

... not consistent with the assumptions used, the stock-based compensation expense reported in our financial statements may not be representative of the actual economic cost of the stock-based compensation. Additionally, if actual employee forfeitures significantly differ from our estimated forfeitures... -

Page 43

... fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. We will file a definitive proxy statement with the SEC on or about April 17, 2012... -

Page 44

... from the Proxy Statement for the 2012 Annual Meeting under the heading Corporate Governance - Director Independence and Review and Approval of Transactions with Related Persons. PART IV ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES. Documents filed as part of this Annual Report on Form 10... -

Page 45

... and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this Annual Report on Form 10-K has been signed below by the following persons on behalf of RadioShack Corporation and in the capacities indicated on this 21st day of February, 2012... -

Page 46

... CORPORATION INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Report of Independent Registered Public Accounting Firm Consolidated Statements of Income for each of the three years in the period ended December 31, 2011 Consolidated Balance Sheets at December 31, 2011 and 2010 Consolidated Statements... -

Page 47

... respects, the financial position of RadioShack Corporation and its subsidiaries at December 31, 2011 and 2010, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2011 in conformity with accounting principles generally accepted in... -

Page 48

RADIOSHACK CORPORATION AND SUBSIDIARIES Consolidated Statements of Income Year Ended December 31, 2010 % of Dollars Revenues $ 4,265.8 100.0% 2011 (In millions, except per share amounts) Net sales and operating revenues Cost of products sold (includes depreciation amounts of $7.5 million, $7.7 ... -

Page 49

... CORPORATION AND SUBSIDIARIES Consolidated Balance Sheets (In millions, except for share amounts) Assets Current assets: Cash and cash equivalents Accounts and notes receivable, net Inventories Other current assets Total current assets Property, plant and equipment, net Goodwill Other assets, net... -

Page 50

RADIOSHACK CORPORATION AND SUBSIDIARIES Consolidated Statements of Cash Flows Year Ended December 31, 2010 2009 $ 206.1 $ 205.0 (In millions) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and ... -

Page 51

... Statements of Stockholders' Equity and Comprehensive Income Shares at December 31, 2011 2010 2009 146.0 -146.0 191.0 (45.0) 146.0 191.0 -191.0 $ $ Dollars at December 31, 2010 $ $ 191.0 (45.0) 146.0 $ $ (In millions) Common stock Beginning of year Retirement of treasury stock End of year... -

Page 52

... of Business Summary of Significant Accounting Policies Supplemental Balance Sheet Disclosures Indebtedness and Borrowing Facilities Stockholders' Equity Plant Closure Stock-Based Incentive Plans Employee Benefit Plans Income Taxes Net Income Per Share Derivative Financial Instruments Fair Value... -

Page 53

... 31, 2011, there were 227 company-operated stores under the RadioShack brand, 9 dealers, and one distribution center in Mexico. RadioShack.com: Products and information are available through our commercial website www.radioshack.com. Online customers can purchase, return or exchange various products... -

Page 54

... or Target Mobile centers, and we redistributed our Sam's Club kiosk inventory to our remaining retail channels. Net sales and operating revenues related to these discontinued operations were $62.9 million, $206.9 million and $202.4 million for 2011, 2010 and 2009, respectively. Income before income... -

Page 55

... in other current liabilities in the Consolidated Balance Sheets. Goodwill and Intangible Assets: Goodwill represents the excess of the purchase price over the fair value of net assets acquired. Goodwill and intangible assets with indefinite useful lives are reviewed at least annually for impairment... -

Page 56

... for the years ended December 31, 2011, 2010 and 2009, respectively. Stock-Based Compensation: We measure all employee stock-based compensation awards using a fair value method and record this expense in the consolidated financial statements. Our stock-based compensation relates to stock options... -

Page 57

... included in selling, general and 0.1 administrative expense Uncollected receivables written off, net (0.1) Balance at the end of the year $ 1.4 December 31, 2010 $ 1.8 $ 2009 1.5 0.1 (0.5) 1.4 0.4 (0.1) 1.8 $ $ Other Current Assets, Net: (In millions) Deferred income taxes Prepaid income taxes... -

Page 58

... Sales and payroll taxes Rent Advertising Gift card deferred revenue Income taxes payable Other Total accrued expenses and other current liabilities December 31, 2011 2010 $ 45.7 $ 60.0 65.3 65.0 41.1 41.4 33.9 36.5 30.8 26.9 20.6 19.5 -9.7 78.0 68.7 $ 315.4 $ 327.7 Total long-term debt Long-term... -

Page 59

... business days immediately after any 10 consecutive trading day period in which the average trading price per $1,000 principal amount of 2013 Convertible Notes was less than 98% of the product of the closing price of the common stock on such date and the conversion rate on such date • We make... -

Page 60

...loss on our Consolidated Statements of Income. 2011 Credit Facility: Our $325 million credit facility provided us a source of liquidity. Interest charges under this facility were derived using a base LIBOR rate plus a margin that changed based on our credit ratings. This facility had customary terms... -

Page 61

... or share repurchases. NOTE 5 - STOCKHOLDERS' EQUITY 2011 Share Repurchase Program: In October 2011, our Board of Directors approved a share repurchase program with no expiration date authorizing management to repurchase up to $200 million of our common stock to be executed through open market or... -

Page 62

...changes in the fair value of the agreements in the financial statements. In accordance with the FASB's accounting guidance in calculating earnings per share, the Warrants will have no effect on diluted net income per share until our common stock price exceeds the per share strike price of $35.88 for... -

Page 63

... had been achieved. The market condition was met in 2007, and all stock price hurdles have been achieved. The fair value of the stock options granted during the years ended December 31, 2011, 2010 and 2009, was estimated using the Black-Scholes-Merton option-pricing model. The Black-Scholes-Merton... -

Page 64

...(1) Risk free interest rate(2) Expected dividend yield Expected stock price volatility(3) Expected life of stock options (in years)(4) 2011 1.6% 2.0% 43.0% 5.4 2010 2.3% 1.3% 42.4% 5.4 2009 2.0% 1.8% 50.4% 5.4 (1) Forfeitures are estimated using historical experience and projected employee turnover... -

Page 65

... stock in 2011, 2010 and 2009, respectively, under these plans. Restricted stock awards are valued at the market price of a share of our common stock on the date of grant. In general, these awards vest at the end of a three-year period from the date of grant and are expensed on a straight-line... -

Page 66

...Balance Sheets consist of: (In millions) Accrued expenses and other current liabilities Other non-current liabilities Net amount recognized December 31, 2011 2010 $ $ 3.2 15.9 19.1 $ $ 3.9 17.3 21.2 The cost of the SERP defined benefit plan included the following components for the last three years... -

Page 67

... rate State income taxes, net of federal benefit Unrecognized tax benefits Other, net Total income tax expense Effective tax rate Year Ended December 31, 2011 2010 2009 Deferred tax assets and liabilities were included in the Consolidated Balance Sheets as follows: (In millions) Other current... -

Page 68

... shares for diluted net income per share 2011 2010 2009 The amount of net unrecognized tax benefits that, if recognized, would affect the effective tax rate as of December 31, 2011, was $21.1 million. We recognize accrued interest and penalties associated with uncertain tax positions as part... -

Page 69

... effectiveness criteria, be designated as a hedge and result in cash flows and financial statement effects that substantially offset those of the position being hedged. By using these derivative instruments, we expose ourselves, from time to time, to credit risk and market risk. Credit risk is the... -

Page 70

... Basis of Fair Value Measurements Quoted Prices Significant in Active Other Significant Markets for Observable Unobservable Inputs Identical Items Inputs (Level 1) (Level 2) (Level 3) (In millions) Year Ended December 31, 2011 Long-lived assets held and used Year Ended December 31, 2010 Long-lived... -

Page 71

... effect on our consolidated financial statements in the period in which the resolution is recorded. Ordonez v. RadioShack Corporation: In May 2010, Daniel Ordonez, on behalf of himself and all other similarly situated current and former employees, filed a Complaint against the Company in the Los... -

Page 72

... cost of products sold. Furthermore, in conjunction with this transition, we incurred an additional charge to earnings of $23.4 million in the third quarter of 2011 relating to a payment to T-Mobile. We continue to sell T-Mobile wireless products and services in certain Target Mobile centers... -

Page 73

...company-operated retail stores, all operating under the RadioShack brand name. We evaluate the performance of our segments based on operating income, which is defined as sales less cost of products sold and certain direct operating expenses, including labor, rent, and occupancy costs. Asset balances... -

Page 74

... relate to our information technology assets. (5) Product Sales Information: Our consolidated net sales and operating revenues are summarized by groups of similar products and services, as follows: Consolidated Net Sales and Operating Revenues Year Ended December 31, 2010 2009 51.4% $ 1,885.6 44... -

Page 75

... in terms of sales and profits because of the winter holiday selling season. Three Months Ended June 30, September 30, 2011 2011 $ 941.9 509.8 432.1 $ 1,031.8 589.9 441.9 (In millions, except per share amounts) Net sales and operating revenues Cost of products sold (1) (2) Gross profit Operating... -

Page 76

..., except per share amounts) Net sales and operating revenues Cost of products sold Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment of long-lived assets Total operating expenses Operating income Interest income Interest expense Income from... -

Page 77

... Statements of Income For the Year Ended December 31, 2011 (In millions) Net sales and operating revenues Cost of products sold Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment of long-lived assets Total operating expenses Operating (loss... -

Page 78

...Statements of Income For the Year Ended December 31, 2010 (In millions) Net sales and operating revenues Cost of products sold Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment of long-lived assets Total operating expenses Operating income... -

Page 79

...Statements of Income For the Year Ended December 31, 2009 (In millions) Net sales and operating revenues Cost of products sold Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment of long-lived assets Total operating expenses Operating income... -

Page 80

... Consolidating Balance Sheets At December 31, 2011 (In millions) Assets Current assets: Cash and cash equivalents Accounts and notes receivable, net Inventories Other current assets Intercompany receivables Intercompany notes receivable Total current assets Property, plant and equipment, net... -

Page 81

... Consolidating Balance Sheets At December 31, 2010 (In millions) Assets Current assets: Cash and cash equivalents Accounts and notes receivable, net Inventories Other current assets Intercompany receivables Intercompany notes receivable Total current assets Property, plant and equipment, net... -

Page 82

... Consolidating Statements of Cash Flows For the Year Ended December 31, 2011 (In millions) Net cash provided by operating activities Cash flows from investing activities: Additions to property, plant and equipment Dividends received from subsidiary Other investing activities Net cash used in... -

Page 83

... Consolidating Statements of Cash Flows For the Year Ended December 31, 2010 (In millions) Net cash provided by operating activities Cash flows from investing activities: Additions to property, plant and equipment Dividends received from subsidiary Other investing activities Net cash used in... -

Page 84

... Consolidating Statements of Cash Flows For the Year Ended December 31, 2009 (In millions) Net cash provided by operating activities Cash flows from investing activities: Additions to property, plant and equipment Dividends received from subsidiary Other investing activities Net cash used in... -

Page 85

...18, 2008, between RadioShack Corporation and The Bank of New York Mellon Trust Company, N.A., as trustee (filed as Exhibit 4.1 to RadioShack's Form 8-K filed on August 18, 2008, and incorporated herein by reference). Exhibit Number 4.5 Description Master Terms and Conditions for Warrants Issued by... -

Page 86

... Restated RadioShack Corporation Officers Deferred Compensation Plan, effective as of December 31, 2008 (filed as Exhibit 10.54 to RadioShack's Form 10-K filed on February 24, 2009, and incorporated herein by reference). RadioShack Corporation 1993 Incentive Stock Plan as amended (filed as Exhibit... -

Page 87

... Amended and Restated RadioShack Corporation Officers' Severance Program, effective December 31, 2011. 10.41 (2) Incentive Stock Plan Non-Qualified Stock Option Agreement under the 1997 Incentive Stock Plan, dated July 6, 2006, between RadioShack Corporation and Julian C. Day (filed as Exhibit 10... -

Page 88

...First Amended and Restated 2009 RadioShack Corporation Annual & Long-Term Incentive Compensation Plan, effective as of November 3, 2011. 10.59 (2) RadioShack Corporation 2009 Incentive Stock Plan (included as Appendix B to RadioShack's Proxy Statement filed on April 17, 2009, and incorporated herein... -

Page 89

... 101.DEF 101.LAB 101.PRE (1) RadioShack Corporation was known as Tandy Corporation until May 18, 2000. Management contract or compensatory plan or arrangement required to be filed as an exhibit pursuant to Item 15(b) of Form 10-K. Filed with this report. These certifications shall not be deemed... -

Page 90

... and tablets; difficulties associated with profitably operating our new Target Mobile centers; overall sales performance; economic conditions; product demand; expense levels; competitive activity; interest rates; changes in the Company's financial condition; availability of products and services and... -

Page 91

... Public Accounting Firm PricewaterhouseCoopers LLP Fort Worth, Texas RADIOSHACK has included as Exhibits 31(a) and 31(b) to its Annual Report on Form 10-K for fiscal year 2011 filed with the Securities and Exchange Commission certificates of the Chief Executive Officer and Chief Financial Officer... -

Page 92

RADIOSHACK CORPORATION 300 RadioShack Circle Fort Worth, TX 76102 RadioShack.com RadioShackCorporation.com