Pentax 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

In addition to the cash dividends described above, the Company

paid interim cash dividends of ¥12,925 million ($109,488 thousand,

¥30 ($0.25) per share) on November 21, 2006 to shareholders of

record as of September 30, 2006, based on a resolution of the

Board of Directors.

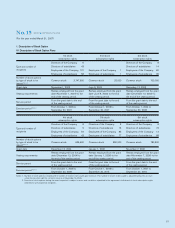

No. 17 SUBSEQUENT EVENTS

Appropriations of Retained Earnings

The following appropriations of retained earnings for the year ended March 31, 2007 were resolved by the Company’s Board of Directors on

May 31, 2007:

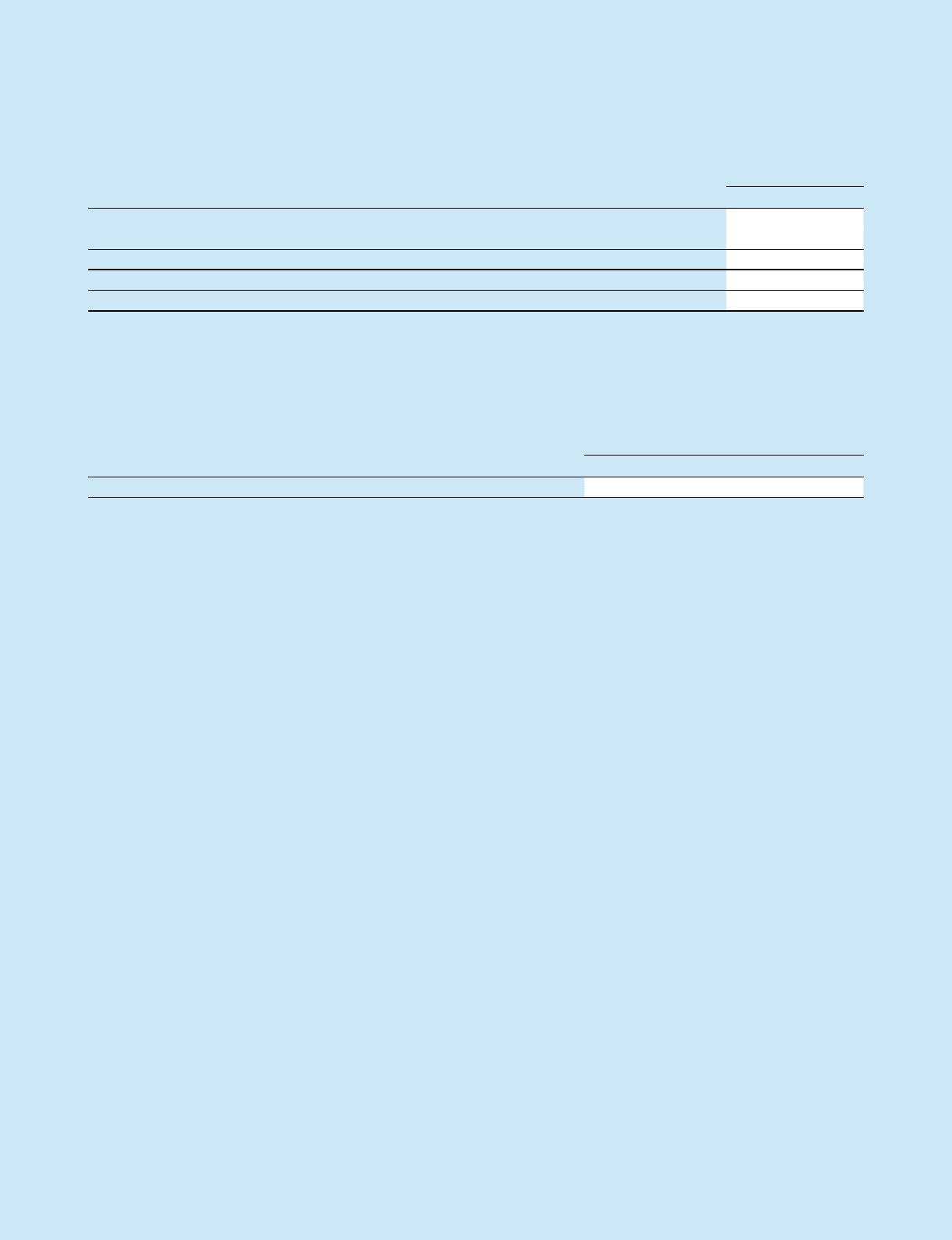

Millions of Yen Thousands of U.S. Dollars

Year-end cash dividends, ¥35.00 ($0.30) per share ¥15,105 $127,954

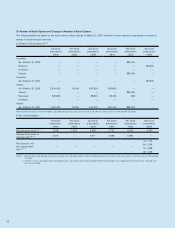

Significant Subsequent Events

The Company resolved, at the meeting of its board of directors

held on May 31, 2007, to acquire the shares of PENTAX

Corporation (“PENTAX”) through a tender offer (the “Tender

Offer”).

The Company resolved, at the meeting of its board of directors

held on June 15, 2007, the partial modification to Tender Offer.

1. Purpose of Tender Offer

The Company and PENTAX aim to establish a solid management

foundation by leveraging managerial resources of the two compa-

nies in a mutually complementary manner and to enhance corpo-

rate value by utilizing the two companies’ strength in optical and

precision processing technologies to develop appealing products

and provide them to a broader customer base. Following the

management integration, the Company and PENTAX aim to

optimize their business portfolios and to further strengthen

competitiveness.

2. Terms of Tender Offer

(1) Purchase Price

a. Common stock of PENTAX: ¥770 per share.

However, if PENTAX’s annual general meeting of shareholders

for the 77th period approves the surplus dividends for the 77th

period per share in the amount of more than ¥7, the purchase

price will be determined to be the result obtained by deducting

the amount equal to the surplus dividends resolved in excess of

¥7 per share from ¥770.

b. PENTAX bonds with share subscription warrants: ¥1,433,056

for each of the bonds (face value of each bond: ¥1,000,000)

However, if PENTAX’s annual general meeting of shareholders

for the 77th period approves the surplus dividends for the 77th

period per share in the amount of more than ¥7, the purchase

price for such bonds will be determined by dividing the issue

price of each bond by ¥540 (convertible price) and multiplying

by the purchase price of common stock.

c. 1st Series Share Subscription Warrants: ¥1 per warrant.

(2) Upper limit of the number of shares to be purchased: None.

(3) Lower limit of the number of shares to be purchased:

67,740,000 shares.

(4) Timing of the commencement of the Tender Offer:

Planned to commence on or around three business days after

the day on which PENTAX filed the securities report for the

77th period with the Director-General of the Kanto Local

Finance Bureau.

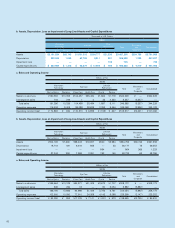

5. Assets and Liabilities to Be Transferred

Millions of Yen

Current assets ¥1,076

Fixed assets 589

Total assets ¥1,665

Current liabilities ¥ 68

Total liabilities ¥ 68