Pentax 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

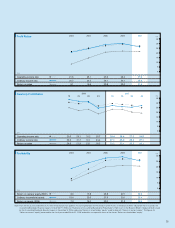

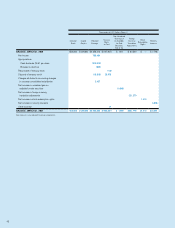

The Crystal and Services businesses used to be presented

separately as individual divisions. However, shrinking sales and

operating income brought about by restructuring has reduced the

importance of separate presentation, and from the fiscal year ended

March 31, 2007, these businesses are presented together as

“Other Businesses.”

The Crystal business has been reduced in scale through

restructuring, but is currently continuing to pioneer new markets and

38

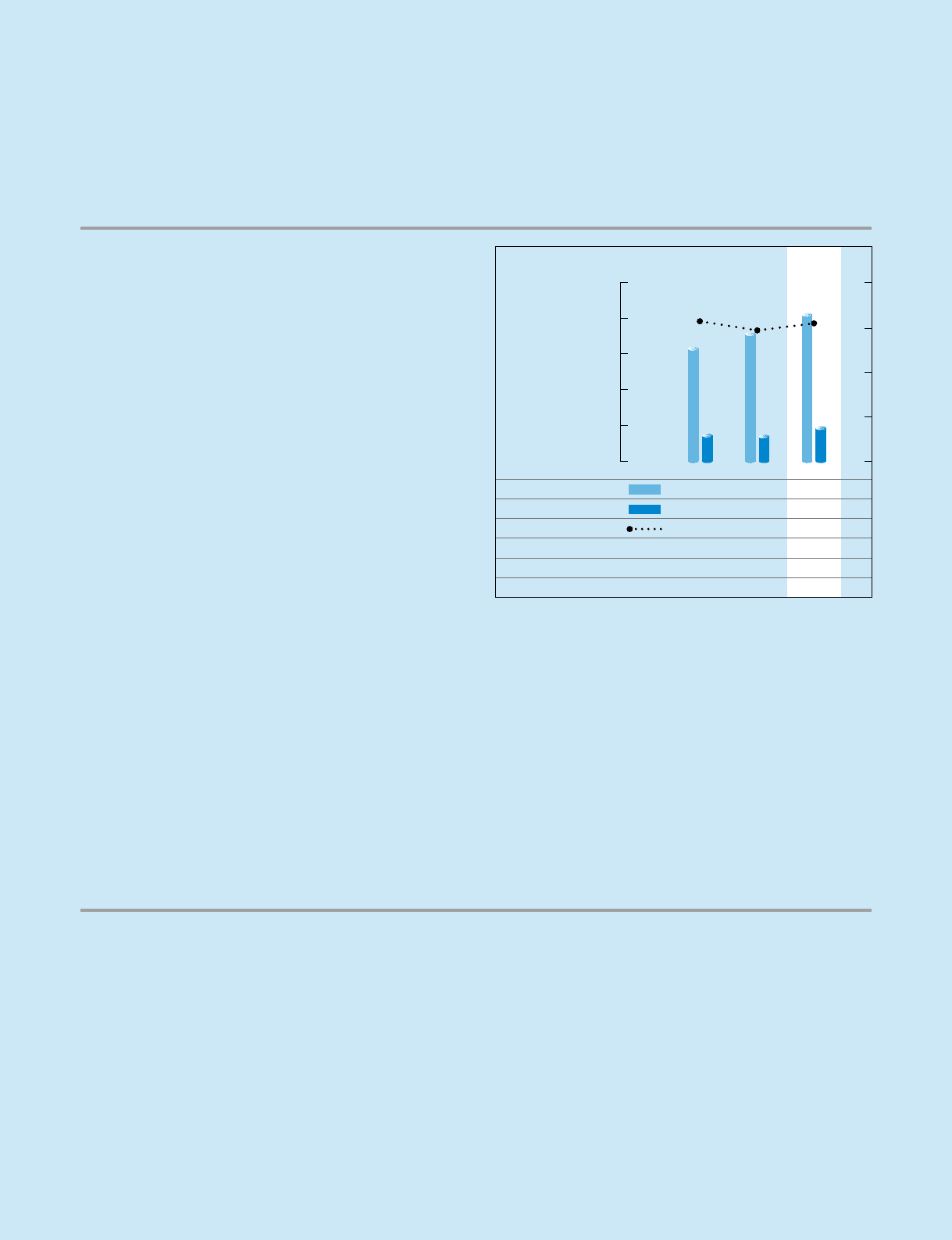

Segment Overview

Other Businesses

100

75

50

25

0

2003 2004 2005 2006

2007

14

,

023

3

,

150

7

,

346

2

,

082

1

,

445

18

,

092

3

,

023

11

,

925

1

,

821

1

,

323

21

,

234

3

,

007

15

,

102

1

,

809

1

,

316

25

,

176

2

,

800

19

,

030

2

,

009

1

,

337

28,450

2,861

21,780

2,429

1,380

(%)

5

4

3

2

1

0

2003 2004 2005 2006

2007

60

,

000

50

,

000

40

,

000

30

,

000

20

,

000

10

,

000

0

2003 2004 2005 2006

2007

15

,

948

19

,

792

30

,

659

25

,

328

40

,

175

22

,

520

48

,

786

27

,

485

54,432

36,427

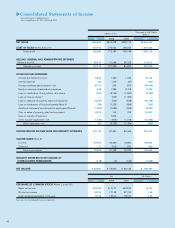

Net sales for the Health Care division grew 15.1% year on year to

¥40,850 million. In contact lenses, amid sweeping changes in the

market following revision of the remuneration system for medical

services, Hoya achieved revenue growth through continued opening

of new locations of directly managed Eye City stores, along with

customer appreciation of high-quality service. In intraocular lenses

(IOLs) used for surgical treatment of cataracts, sales rose both in

Japan and overseas as a result of Hoya’s growing share of the

domestic market, where high-quality products are valued, along with

steadily growing visibility in overseas markets.

Operating income for the Health Care division increased 34.3%

to ¥9,215 million, with an operating income ratio of 22.6%, 3.3

percentage points higher than in the previous fiscal year. During the

previous fiscal year, the Company changed the method of

accounting for expenses related to the points awarded to

customers for product purchases at Eye City, resulting in a full

year’s worth of point system expenses being recorded as a lump

sum in the fourth quarter of that fiscal year, which provided a

significant boost to earnings. By quarter, the operating income

margin was 21.7% in the first quarter, 23.3% in the second quarter,

20.5% in the third quarter and 24.6% in the fourth quarter.

In the segment graph on page 36, as a result of improvement in

both net sales growth rate and the profit margin, the circle shifted

upward and to the right.

Capital expenditures in the Health Care division decreased

11.4% to ¥2,119 million. Although the Company shifted IOL

production plants overseas and made other expenditures, the

decline arose from a temporary R&D investment generated in the

previous fiscal year.

Eye Care (Health Care Division)

(%)

40

20

0

(Millions of yen)

50

,

000

40

,

000

30

,

000

20

,

000

10

,

000

0

2005 2006

2007

Net sales (Millions of yen)

Operating income (Millions of yen)

Operating income ratio* (%)

Assets (Millions of yen)

Depreciation (Millions of yen)

Capital expenditures (Millions of yen)

31

,

409

7

,

141

22

.

7

18

,

330

669

738

35

,

484

6

,

859

19

.

3

19

,

927

855

2

,

391

40,850

9,215

22.6

24,410

1,170

2,119

* The operating income ratio above is calculated using net sales plus intersegment

sales. Please refer to details on page 65, Segment Information.

22

.

5

52

.

4

14

.

8

16

.

7

65

.

9

10

.

1

14

.

2

71

.

1

8

.

5

11

.

1

75

.

6

8

.

0

10

.

37

.

36

.

25

.

3

10

.

1

76

.

6

8

.

5

4

.

9

8

.

7

3

.

5

9

.

8

3

.

6

10

.

9

3

.

6

14

.

1

4

.

1

14.9

3.8

develop unique products by adhering to a concept unlike that

followed previously. The Services business provides IT systems,

outsourcing and other services to Hoya Group companies. The

division’s temporary staffing business was sold on March 1, 2006,

which resulted in the decline in both revenue and earnings of the

“Other Businesses.”

15

12

9

6

3

0