Pentax 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

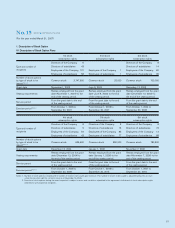

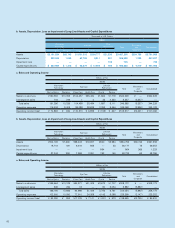

Obligations under operating leases:

Millions of Yen Thousands of U.S. Dollars

2007 2006 2007

Due within one year ¥184 ¥— $1,559

Due after one year 400 —3,388

Total ¥584 ¥— $4,947

No. 11 CONTINGENT LIABILITIES

At March 31, 2007, the Group had the following contingent liabilities:

Millions of Yen Thousands of U.S. Dollars

2007 2006 2007

Guarantees of borrowings and lease obligations for customers ¥2,772 ¥2,206 $23,482

Guarantees of borrowings for the Group’s employees 3425

Total ¥2,775 ¥2,210 $23,507

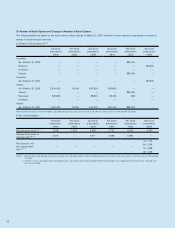

The Group enters into foreign currency forward contracts to hedge

foreign currency exchange risk associated with certain assets and

liabilities denominated in foreign currencies.

All derivative transactions are entered into to hedge foreign

currency exposures incorporated within its business. Accordingly,

market risk in these derivatives is basically offset by opposite

movements in the value of hedged assets or liabilities.

Because the counterparties to these derivatives are limited

to major international financial institutions, the Group does not

anticipate any losses arising from credit risk.

Derivative transactions entered into by the Group have been

made in accordance with internal policies which regulate the

authorization and credit limit amount.

Foreign currency forward contracts which qualify for hedge

accounting for the years ended March 31, 2007 and 2006 and

such amounts which are assigned to the associated assets or

liabilities and are recorded on the balance sheets at March 31,

2007 and 2006, are not subject to disclosure of market value

information.

No. 12 DERIVATIVES