Pentax 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

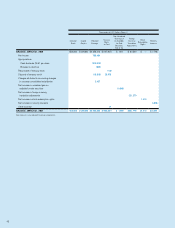

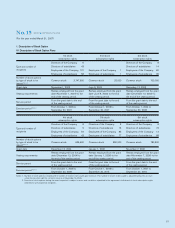

No. 4 INVENTORIES

Inventories at March 31, 2007 and 2006 consisted of the following:

Millions of Yen Thousands of U.S. Dollars

2007 2006 2007

Finished products and merchandise ¥17,453 ¥15,646 $147,844

Semi-finished products and work in process 10,069 9,446 85,294

Raw materials 9,498 6,836 80,457

Supplies 12,702 9,250 107,599

Total ¥49,722 ¥41,178 $421,194

The Group reviewed its long-lived assets for impairment for the

years ended March 31, 2007, 2006 and 2005. As a result, the

Group recognized impairment losses of ¥88 million ($745 thou-

sand), ¥864 million and ¥92 million for the years ended March 31,

2007, 2006 and 2005, respectively, as other expense for a decline

in value, mainly from property of certain plants including the Tokyo

Studio (in Akishima Plant) of the Crystal division, due to a continu-

ous operating loss of that unit. The carrying amount of the relevant

machinery was written down to the recoverable amount, which

was measured at its value in use. The discount rate used for com-

putation of the present value of future cash flows was 5%.

The Group reviewed its long-lived assets for impairment for

the year ended March 31, 2006, and as a result recognized an

impairment loss of ¥369 million ($3,141 thousand) as other

expense for a decline in value of the leased land in Machida-city,

due to a fall of market land prices. The carrying amount of the

relevant land was written down to the recoverable amount, which

was measured at its declared value.

The Group reviewed its long-lived assets for impairment for

the year ended March 31, 2005 and as a result, recognized an

impairment loss of ¥767 million as other expense for a decline in

value, mainly from land of the Photonics division of the Maebashi

Plant due to a close of that unit. The carrying amount of the

relevant property, plant and equipment was written down to the

recoverable amount, which was measured upon consultation of

appraised value of land facing a thoroughfare and sales amount,

among others.

No. 5 IMPAIRMENT OF LONG-LIVED ASSETS

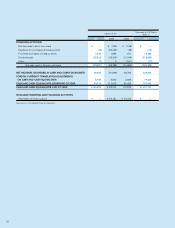

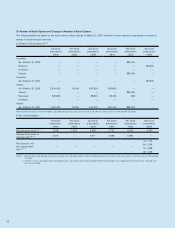

The components of net periodic benefit costs for the years ended March 31, 2007, 2006 and 2005 were as follows:

Millions of Yen Thousands of U.S. Dollars

2007 2006 2005 2007

Additional retirement benefits paid to employees ¥1,055 ¥1,689 ¥843 $8,937

Net periodic benefit costs ¥1,055 ¥1,689 ¥843 $8,937

No. 6 RETIREMENT BENEFITS AND PENSION PLANS