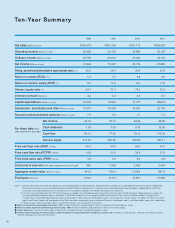

Pentax 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

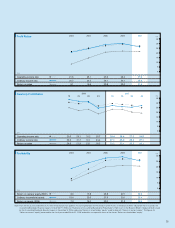

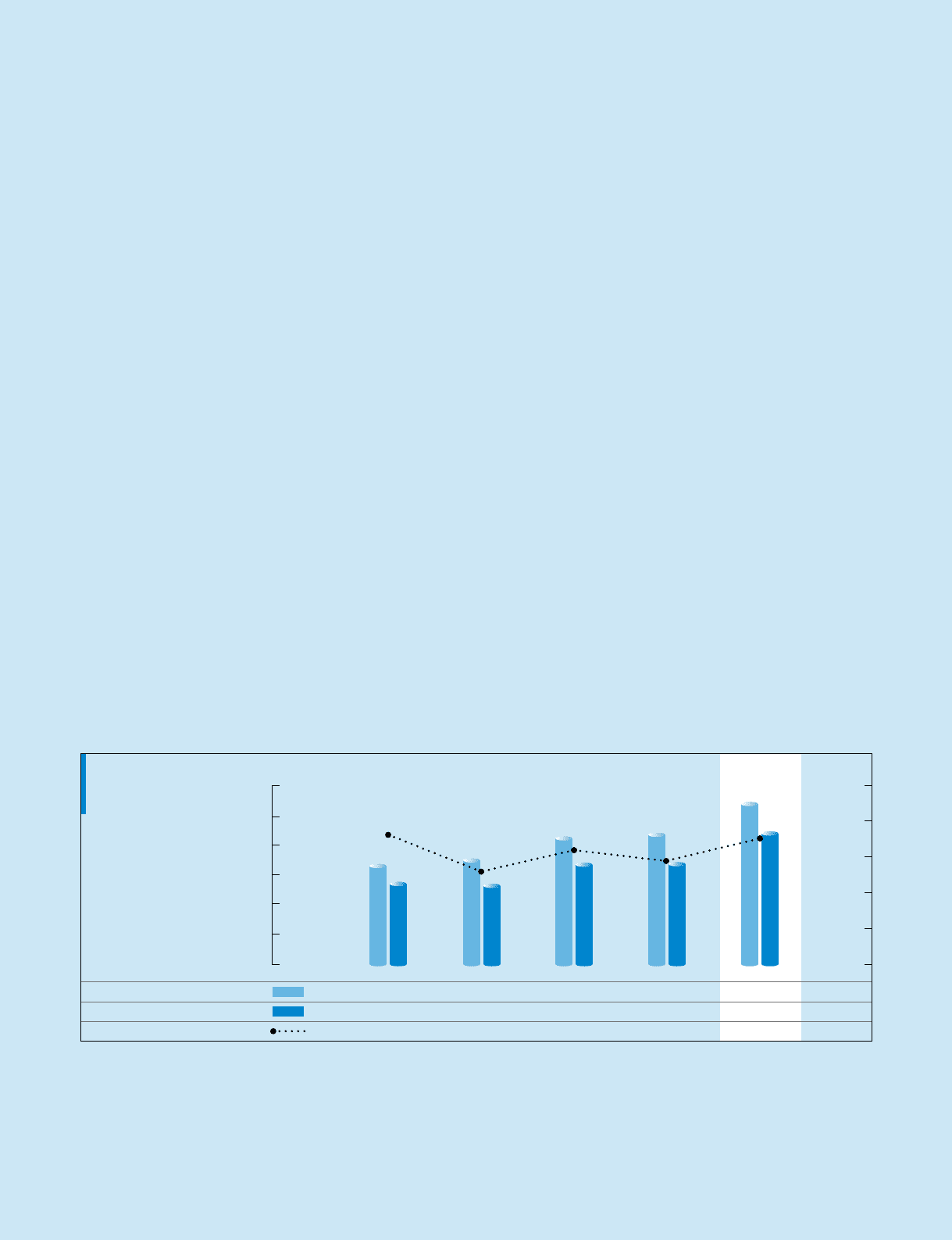

Total Assets,

Owners’ Equity and

Owners’ Equity Ratio

(Millions of yen)

500

,

000

400

,

000

300

,

000

200

,

000

100

,

000

0

(%)

90

85

80

75

70

65

60

2003 2004 2005 2006

2007

120

,

000

100

,

000

80

,

000

60

,

000

40

,

000

20

,

000

0

2003 2004 2005 2006

2007

50

,

000

40

,

000

30

,

000

20

,

000

10

,

000

0

1

Q

2

Q

3

Q

2006

4

Q1Q 2Q 3Q

2007

4Q

Financial Position

In terms of assets, current assets increased by 29.9% from the end

of the previous fiscal year to ¥275,707 million. The main factors for

this, following the increases in revenue and earnings, were a 44.3%

increase in cash and deposits to ¥120,622 million, a 20.3% rise in

notes and accounts receivable—trade to ¥94,297 million, and a

20.7% increase in inventories to ¥49,722 million. The rate of growth

in cash and deposits was particularly high owing to a decline in

expenditures for acquisition of treasury stock, from ¥64,032 million

in the previous fiscal year to ¥13 million during the subject fiscal

year. Total property, plant and equipment increased 18.8% year on

year to ¥143,218 million, total investment and other assets rose

0.2% to ¥28,719 million, and total noncurrent assets expanded

15.3% to ¥171,938 million. As a result, total assets at the end of the

subject fiscal year amounted to ¥447,644 million, an increase of

23.8% from the end of the previous fiscal year.

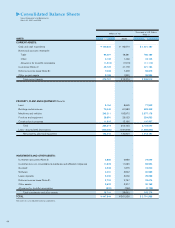

In terms of liabilities, notes and accounts payable—trade

decreased 1.2% to ¥27,733 million, while income tax payable

declined 10.6% to ¥12,821 million, with total current liabilities

decreasing 1.4% from the end of the previous fiscal year to ¥78,181

million. Noncurrent liabilities increased 26.5% from the end of the

previous fiscal year to ¥2,318 million. As a result, total liabilities at

the end of the subject fiscal year amounted to ¥80,499 million, a

decrease of 0.8% from the end of the previous fiscal year.

In terms of net assets, retained earnings rose ¥56,167 million, or

21.1%, year on year to ¥322,513 million as a result of an increase in

net income to ¥83,391 million, against ¥25,843 million in dividends

paid, and a decline in other components totaling ¥1,381 million.

Treasury stock declined ¥3,528 million. Consequently, total

shareholders’ equity amounted to ¥331,924 million. Translation

adjustments were ¥33,264 million, up ¥26,122 million year on year.

As a result, total accumulated gains (losses) from revaluation and

translation adjustments amounted to ¥33,178 million. Total net

assets were ¥367,145 million.

Also, from the fiscal year ended March 31, 2007, in accordance

with the “Accounting Standard for Presentation of Net Assets in the

Balance Sheet” (Statement No.5 issued by the Accounting

Standards Board of Japan on December 9, 2005) and “Guidance on

Accounting Standard for Presentation of Net Assets in the Balance

Sheet” (Guidance No.8 issued by the Accounting Standards Board

of Japan on December 9, 2005), the “Shareholders’ equity” section

has been replaced by a “Net assets” section, to which

“Accumulated gains (losses) from revaluation and translation

adjustments,” “Stock subscription rights,” and “Minority interests”

have been added to shareholders’ equity. As a replacement for the

former “Shareholders’ equity” the Company uses “Owners’ equity,”

which excludes “Stock subscription rights” and “Minority interests”

from “Net assets.” The ratio of owners’ equity to total assets

(owners’ equity ratio; the former shareholders’ equity ratio) for the

subject fiscal year was 81.6%, a total of 4.3 percentage points

higher than the 77.3% in the previous fiscal year.

274

,

289

224

,

219

81

.

7

289

,

887

218

,

979

75

.

5

351

,

482

277

,

889

79

.

1

361

,

538

279

,

481

77

.

3

447,644

365,102

81.6

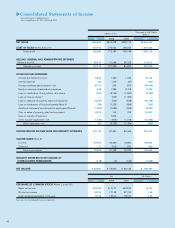

20

,

038

38

,

390

39

,

549

78

,

744

64

,

135

76

,

000

75

,

620

105

,

855

83,391

98,793

20

,

389

17

,

759

18

,

596

29

,

802

20

,

120

17

,

025

16

,

515

41

,

269

21,500

14,066

22,899

35,017

19,964

19,950

19,028

29,760

Total assets (Millions of yen)

Owners’ equity (Millions of yen)

Owners’ equity ratio (%)