Pentax 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

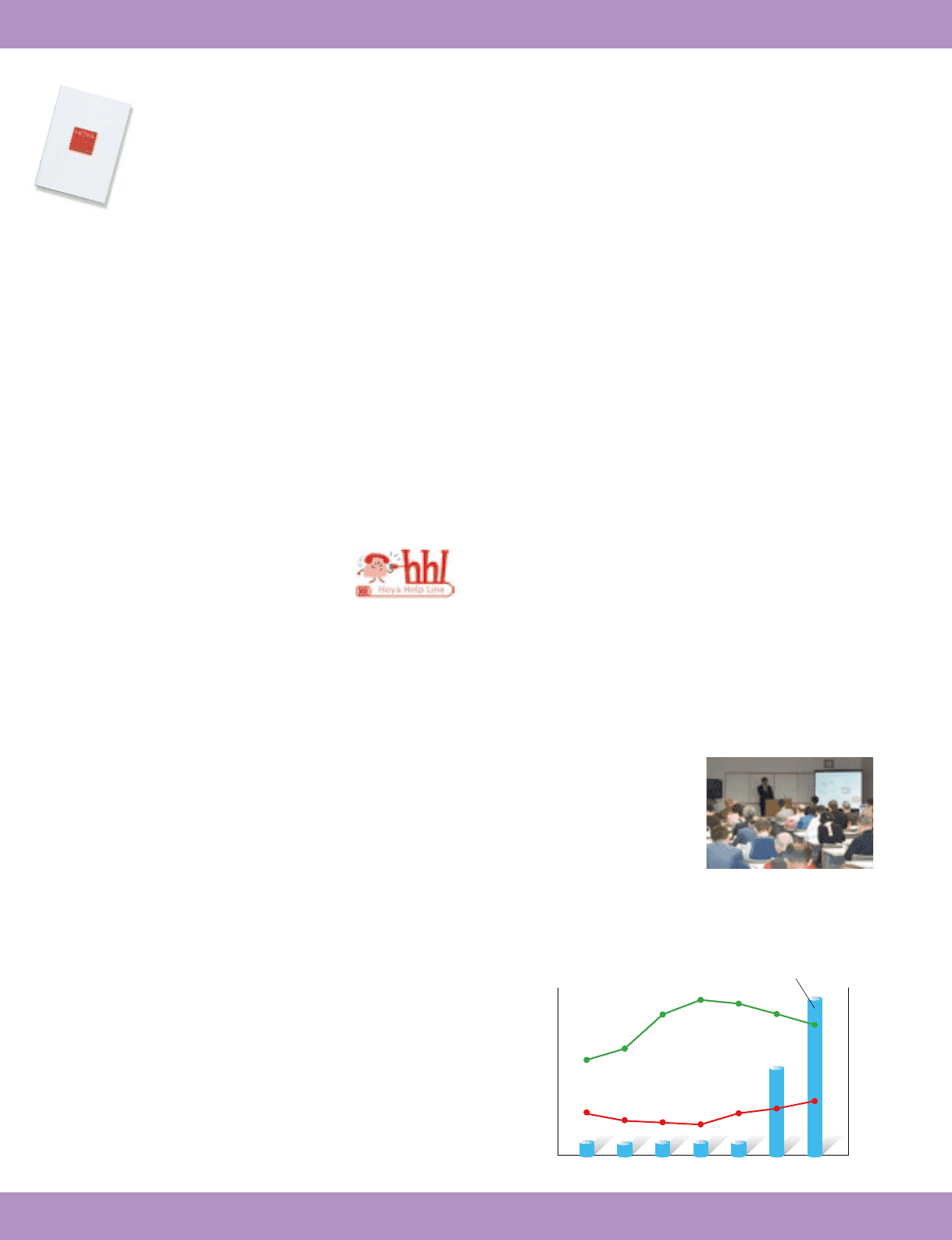

●Number of Shareholders and Shareholding Ratio

100,000

80,000

60,000

40,000

20,000

0

(People)

60

50

40

30

20

10

0

(%)

2001 2002 2003 2004 2005 2006 2007

Number of shareholders

Foreign stockholding ratio

Individual stockholding ratio

control systems are functioning as they should, ensures

that there is no dishonesty, and checks for possible areas

for improvement, etc. Problem areas that come to light as a

result of audit procedures become subject of a

recommendation for improvement. Particularly important

matters are reported to the Audit Committee and the Board of

Directors, as well as to the executive officers. The executive

officers decide upon and issue directives for speedy, appropriate

responses.

To achieve the best results from internal control systems, it is

important that all employees performing duties for an organization

work to foster greater awareness. The Hoya Group has

established a set of Business Conduct Guidelines that clarify the

guiding principles under which each employee should perform his

or her duties, with resolute adherence to work ethics, and Hoya is

engaged in a wide range of employee education activities. Another

initiative, the Hoya Help Line, an internal reporting and consultative

system, was established in 2003. If there is an act that

contravenes the law or the Hoya Business Conduct Guidelines,

the Hoya Help Line ensures that Hoya can discover the

contravention and that a report will quickly reach top management,

enabling timely and appropriate action to be

taken on the issue. This helps to preserve the

integrity of the Hoya Group as a whole. The

Hoya Help Line is a dedicated system located within the

Company’s headquarters, and it can also be used as a point of

contact with external lawyers who are available to listen to

employees. This preserves anonymity and works to maintain the

system’s functional effectiveness. As at the end of March 2007,

the system had been introduced in Japan, the United States and

in group companies in Thailand, which has the largest number of

employees on a global basis. The intention is to continue to

expand the number of countries covered, giving the Hoya Help

Line worldwide coverage.

Building an Internal Controls Reporting System

Hoya has responded to the Japanese version of the Sarbanes-Oxley

law (dubbed “J-SOX”)* by newly forming an Internal Controls Group

and appointing full-time staff thoroughly familiar with accounting and

audit procedures. The Group has already commenced work on

documentation in order to elucidate the Hoya Group’s state of

preparedness in relation to its internal controls over financial reporting

and is in the process of developing operational as well as assessment

systems for internal controls. Working towards the law coming into

effect in April 2008, the effectiveness of internal control systems will

be inspected and verified in stages, and where necessary,

improvements will be instituted.

* An internal controls reporting system required under Japan’s Financial Instruments

and Exchange Law, which was promulgated in June 2006 and which will come into

effect and apply to fiscal periods beginning in or after April 2008. Covering publicly

listed companies, it seeks to strengthen internal controls through assessments of

internal controls relating to financial reporting by management, and audits by

certified public accountants. The law is designed to boost overall reliability and trust

in corporate disclosure.

Full Disclosure and Investor Relations Activities

Hoya believes that fair and prompt disclosure of information and

other investor relations activities are a fundamental duty of

management. The Company respects the rights of its

shareholders concerning appropriate disclosure of information. It

also values communication with shareholders, and it continues to

clearly reflect their views in its management practices.

In 1998, Hoya began the disclosure of quarterly financial

statements ahead of many other Japanese firms, and has

gradually shortened the period between the end of each quarter

and the disclosure, and the volume of information is the same as

that contained in the year-end financial reports. The Company

continues to strive to increase the speed of disclosure and

broaden the content. Top management actively participates in

investor relations activities. For example, the CEO attends

investor meetings that are held each quarter to discuss quarterly

financial reports, where he explains strategy and fields questions.

In the fiscal year ended March 2007, Hoya devoted additional

energies to interaction with individual shareholders and investors.

For example, it held seminars across Japan for individual investors.

Since 2003 the ratio of shares held by foreign shareholders has

been maintained at a high 50% or so. More recently, the number

of individual shareholders has also risen rapidly, and in the fall of

2006 Hoya conducted a survey focused on the Company of

Japanese shareholders, and received many valuable comments

and opinions. Respondents gave good marks to the Company for

its growth, stability and technical strengths, and expectations for

the future were also high in these areas. Valuable feedback was

also given regarding returns on shareholder investment and

investor relations activities. Hoya plans to refer to the results of

the survey in its investor relations work in the future. Hoya will

continue to respond to the

increasingly diverse wishes of its

shareholders, and will strive to

further improve its investor

relations activities, aiming to

achieve even higher levels of

corporate transparency.

HOYA Business Conduct Guidelines is distributed to all employees

Hoya’s seminar for individual investors

(Year)