Pentax 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

¥235,265

43,898

45,774

23,741

24.2

8.7

11.5

78.8

3.2

19,585

20,105

7.3

50.78

12.50

88.31

471.55

44.5

25.6

4.8

2,260

1,049.8

13,311

¥246,293

52,983

50,874

20,038

24.4

7.3

9.0

81.7

2.9

15,948

19,792

8.7

42.77

12.50

82.72

486.29

41.8

21.6

3.7

1,787

830.3

14,023

¥271,444

68,167

66,554

39,549

22.3

14.0

17.8

75.5

2.8

30,659

25,328

9.8

87.74

25.00

174.91

491.90

28.9

14.5

5.2

2,537

1,178.7

18,092

¥308,172

84,920

89,525

64,135

21.1

20.0

25.8

79.1

2.7

40,175

22,520

10.9

144.71

37.50

171.65

623.59

20.4

17.2

4.7

2,950

1,325.7

21,234

¥344,228

101,096

103,638

75,620

20.7

21.2

27.1

77.3

2.7

48,786

27,485

14.1

171.71

60.00

240.57

648.87

27.7

19.7

7.3

4,750

2,066.3

25,176

¥390,093

107,213

102,909

83,391

21.9

20.6

25.9

81.6

2.8

54,432

36,427

14.9

193.50

65.00

229.23

845.98

20.2

17.1

4.6

3,910

1,700.9

28,450

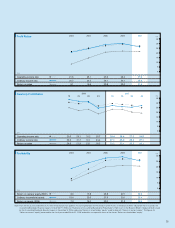

2002 2003 2004 2005 2006 2007

●

●

●

●

● Capital expenditures: Includes property, plant and equipment as well as intangible fixed assets.

● Depreciation, amortization and other: Includes the loss on impairment of long-lived assets and amortization of goodwill.

● Per share data: Per share data has been retroactively adjusted to reflect a four-for-one split of common shares implemented on November 15, 2005.

● Cash flow per share: From fiscal 2002 and after, figures for cash flow per share are shown as cash flow from operating activities divided by the average number of issued shares for the

fiscal period. Figures prior to 2002 are calculated using simple cash flow calculated by adding depreciation and other factors to net income.

● Price earnings ratio (PER; stock price at fiscal year-end/net income per share): An indicator to determine whether a company's share price is relatively high or low in comparison with

its earnings. A company's PER is compared against the market average or that of competitors to determine the standard for the share price and other data.

● Price cash flow ratio (stock price at fiscal year-end/cash flow per share): Cash flow is calculated by adding net income, depreciation, amortization and other. Depreciation indicates active

investment aiming for future growth, so the price cash flow ratio can be used to gauge the price level of a stock by taking into consideration future growth potential. It can be used

together with the price earnings ratio, the market average and comparative ratios for other companies in the same industry to judge whether the Company’s stock price is overvalued or

undervalued.

● Price book value ratio (stock price at fiscal year-end/net assets per share): An index of valuation that compares the Company’s stock price to the value of its net assets. An index of less

than one suggests that dissolving the company and selling off its assets may be more profitable than holding the Company’s stock.