Pentax 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

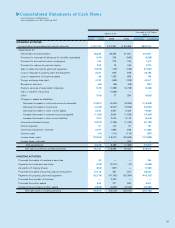

because of high correlation and effectiveness between the hedg-

ing instruments and the hedged items, gains or losses on deriva-

tives are deferred until maturity of the hedged transactions.

Hedging instruments and hedged items as of March 31, 2007

were as follows:

Hedging instruments: Forward exchange contracts

Hedged items: Loans payable denominated in

foreign currency

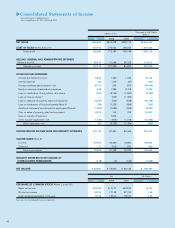

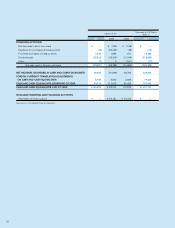

p. Per Share Information—Basic net income per share is

computed by dividing net income available to common share-

holders by the weighted-average number of common shares

outstanding for the period, retroactively adjusted for stock splits.

Diluted net income per share reflects the potential dilution that

could occur if the outstanding stock options were exercised into

common stock. Diluted net income per share of common stock

assumes full exercise of the outstanding stock options at the

beginning of the year (or at the time of grant).

Cash dividends per share presented in the accompanying con-

solidated statements of income are dividends applicable to the

respective years including dividends to be paid after the end of

the year.

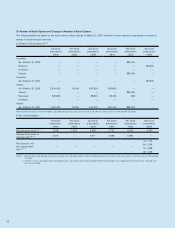

q. Accounting Standard for Presentation of Net Assets in the

Balance Sheet—Effective from the year ended March 31, 2007,

the Company and its consolidated subsidiaries adopted the new

accounting standard, “Accounting Standard for Presentation of

Net Assets in the Balance Sheet” (Statement No.5 issued by the

Accounting Standards Board of Japan on December 9, 2005), and

the implementation guidance “Guidance on Accounting Standard

for Presentation of Net Assets in the Balance Sheet” (Guidance

No.8 issued by the Accounting Standards Board of Japan on

December 9, 2005), (collectively, the “New Accounting

Standards”).

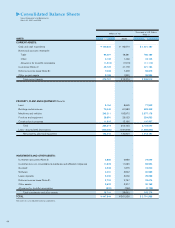

Under the New Accounting Standards, the balance sheet com-

prises three sections, which are the assets, liabilities and net

assets sections. Previously, the balance sheet comprised the

assets, liabilities, minority interests, as applicable, and the share-

holders’ equity sections.

The consolidated balance sheet as of March 31, 2006 has been

restated to conform to the 2007 presentation. There were no

effects on total assets or total liabilities from applying the New

Accounting Standards to the balance sheet as of March 31, 2006.

The adoption of the New Accounting Standards had no impact

on the consolidated statements of income for the years ended

March 31, 2007 and 2006.

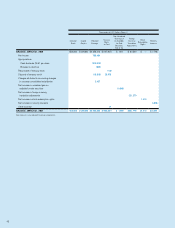

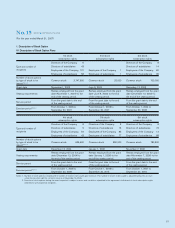

r. Accounting Standard for Statement of Changes in Net

Assets—Effective from the year ended March 31, 2007, the

Company and its consolidated subsidiaries adopted the new

accounting standard, “Accounting Standard for Statement of

Changes in Net Assets” (Statement No.6 issued by the

Accounting Standards Board of Japan on December 27, 2005),

and the implementation guidance, “Guidance on Accounting

Standard for Statement of Changes in Net Assets” (Guidance

No.9 issued by the Accounting Standards Board of Japan on

December 27, 2005), (collectively, the “Additional New

Accounting Standards”).

Accordingly, the Company prepared the statements of changes

in net assets for the year ended March 31, 2007 in accordance

with the Additional New Accounting Standards. Also, the

Company voluntarily prepared the consolidated statement of

changes in net assets for 2006 in accordance with the Additional

New Accounting Standards. Previously, consolidated statements

of shareholders’ equity were prepared for the purpose of inclusion

in the consolidated financial statements although such statements

were not required under Japanese GAAP.

s. Accounting Standards for Business Combinations, Etc.—

Effective April 1, 2006, the Company and its consolidated subsid-

iaries adopted the new accounting standards, “Accounting

Standard for Business Combinations” (Business Accounting

Council Statement of Opinion, October 31, 2003) and “Accounting

Standard for Business Divestitures” (Statement No.7 issued by

the Accounting Standards Board of Japan on December 27,

2005), and the implementation guidance, “Guidance on

Accounting Standard for Business Combinations and Accounting

Standard for Business Divestitures” (Guidance No.10 issued by

the Accounting Standards Board of Japan on December 27,

2005).

Adoption of these standards has no impact on income for the

current fiscal year.

t. Accounting Standard for Directors’ Bonus—Effective April 1,

2006, the Company and its consolidated subsidiaries adopted the

new accounting standard, “Accounting Standard for Directors’

Bonus” (Statement No.4 issued by the Accounting Standards

Board of Japan on November 29, 2005).

As a result, operating income and income before income taxes

and minority interests for the current fiscal year decreased by ¥68

million, respectively.

Adoption of this standard has little impact on segment

information.