Pentax 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

6

.

25

6

.

25

12

.

50

12

.

50

12

.

50

25

.

00

22

.

50

15

.

00

37

.

50

30

.

00

30

.

00

60

.

00

35.00

30.00

65.00

80

60

40

20

0

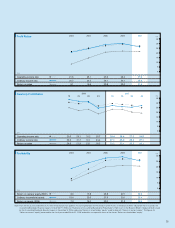

2003 2004 2005 2006

2007

5

,

000

4

,

000

3

,

000

2

,

000

1

,

000

0

100

80

60

40

20

0

2003 2004 2005 2006

2007

41

.

8

21

.

6

3

.

7

1

,

787

28

.

9

14

.

5

5

.

2

2

,

537

20

.

4

17

.

2

4

.

7

2

,

950

27

.

7

19

.

7

7

.

3

4

,

750

20.2

17.1

4.6

3,910

100

,

000

80

,

000

60

,

000

40

,

000

20

,

000

0

5

,

000

4

,

000

3

,

000

2

,

000

1

,

000

0

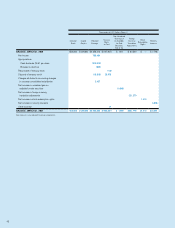

FY

2006

FY2007

Disclaimer

This report is provided solely for the purpose of reference to those investors making their own evaluation of the

Company at their own risk. We accept no liability whatsoever for any direct or consequential loss arising from any use

of this report.

4

5

6

7

8

9

10

11

12

1

2

3

4

5

6

7

8

9

10

11

12

1

2

3

Business Risk

The main items believed to be potential risk factors for development of the businesses of the Hoya Group are described below. Matters

concerning forward-looking activities included in these statements are based on information evaluated by Hoya’s management as of the date

these materials were prepared.

Fluctuation of Exchange Rates

As the Hoya Group develops its business on a global scale, if the

currencies of those countries in which the Hoya Group has major

manufacturing operations appreciate, export prices of its products

would rise, which would incur an increase in costs on a consolidated

basis. If the currencies of those countries in which the Hoya Group

has major sales operations depreciate, it would bring about a decrease

in sales.

Influence of International Situations

At present, the situation in some countries, is extremely tense.

Hereafter, in the event that movement of people, goods or money were

restrained extraordinarily in a certain region, or if certain unexpected

events took place in those countries in which the Hoya Group has

business operations—including changes in the political, economic or

legal environments, labor shortages, strikes, or natural calamities, etc.—

certain problems may arise in the execution of business operations.

Our Business as in Production Goods

Every part of the Electro-Optics products range, which constitutes a

major portion of the Hoya Group revenue, involves intermediate

production goods, components or materials. Therefore, growth of the

business thereof is affected substantially by the market conditions of

such products as semiconductors, LCD panels and HDDs that are

manufactured utilizing the Hoya Group products, and by that of personal

computers and home appliances, etc. that are manufactured utilizing the

resultant products.

Emergence of Discounters and

Lowering of Prices in the Consumer Goods Sector

In recent years in the eyeglass and contact lens markets, discount

shops of an unprecedented type have emerged and brought about a

lowering of prices. If the influence of such discount shops swells to an

extent that cannot be absorbed by the Hoya Group’s cost reduction

efforts and strategies for adding high value both in Japan and abroad,

the business results and financial condition of the Hoya Group might be

adversely affected.

Competence for Developing New Products

In the industrial sector to which Hoya Group belongs, technological

advances are swift and the Hoya Group strives at all times to develop

state-of-the-art technologies. However, if the Hoya Group fails to

sufficiently predict changes in the sector and markets or to develop new

products that meet customer needs in time, the business results and

financial condition of Hoya Group might be adversely affected.

Competition

The Hoya Group, which has the top market share for its many products

in their respective sectors, is constantly exposed to relentless

competition. There is no guarantee that the Hoya Group can maintain its

overwhelming market share and compete efficiently in future. If

customers shift allegiance due to cost pressures or inefficiency of

Hoya’s competitiveness, the business results and financial condition of

Hoya Group might be adversely affected.

Production Capacity

At present, the Hoya Group reinforces its production capacity so as to

meet orders that exceed existing production capacity in multiple

business areas. However, if the setting up of such capacity were

delayed for any reason, it would affect not only the Hoya Group’s results

but also the production and sales plans of its customers, which might

bring about increased market share for its competitors, etc., and

adversely affect the business results and financial condition of the

Hoya Group.

New Business

New business is important for future growth. In the event that no

promising new business is developed, the growth of the Hoya Group

might not be achieved as planned. Besides, the Hoya Group may carry

out mergers and acquisitions as a part of its business strategy. If

unexpected obstacles emerge after such acquisition and unscheduled

time and costs are required, the business results and financial condition

of the Hoya Group might be adversely affected.