Pentax 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

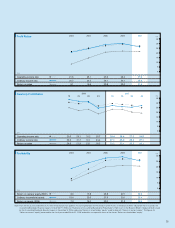

Net Income

As net sales expanded, the cost of sales also rose, increasing 14.8% year

on year to ¥197,410 million. Because cost of sales grew at a rate greater

than the 13.3% increase in net sales, the gross profit margin slipped to

49.4%, down 0.6 percentage point from 50.0% in the previous fiscal year.

Selling, general and administrative (SG&A) expenses rose 20.2% from the

previous fiscal year to ¥85,470 million, with the ratio of SG&A expenses to

net sales up 1.2 percentage points to 21.9% from 20.7% a year earlier. As

a result, although operating income increased 6.1% to ¥107,213 million,

the operating income ratio declined 1.9 percentage points to 27.5%. All of

the expenditures were the result of proactive spending to ensure future

growth, including capital expenditures and marketing activities, as well as

research and development, and personnel increases. By quarter, the

operating income ratio was 29.4% in the first quarter, 28.4% in the second

quarter, 27.5% in the third quarter and 24.8% in the fourth quarter.

Ordinary income for the subject fiscal year declined 0.7% year on year

to ¥102,909 million. This was due mainly to foreign exchange losses during

the subject fiscal year of ¥6,711 million, compared to a gain of ¥243 million

during the previous fiscal year, arising from the effect of exchange rate

conversions related to credit and debit of funds between Group compa-

nies, along with a decline in equity in earnings of affiliates from ¥1,285

million the previous fiscal year to ¥642 million for the subject fiscal year.

Other income and expenses included a ¥9,520 million increase in gain

on sales of property, plant and equipment, against a ¥2,703 million

increase in loss on disposal of property, plant and equipment from the

previous fiscal year, along with a ¥2,958 million decrease in loss on

clarification of soil pollution and others, and a ¥1,145 million decrease in

loss on impairment. As a result, net income for the subject fiscal year rose

10.3% year on year to ¥83,391 million.

Return on assets (ROA) declined by 0.6 percentage point to 20.6%,

and return on owners’ equity (ROE) fell by 1.2 percentage points to 25.9%.

Dividends for the subject fiscal year consisted of an interim dividend of ¥30

per share and a year-end dividend of ¥35 per share, for an aggregate ¥65

per share for the full year, an increase of ¥5 from the previous fiscal year.

Hoya paid an interim dividend during the previous fiscal year of ¥120 per

share, but if adjusted retroactively to reflect the four-for-one stock split

implemented in November 2005, it is equal to ¥30 per share, which along

with the year-end dividend from the previous fiscal year of ¥30 per share

amounts to a full-year dividend of ¥60 per share.

34

Operating Income,

Ordinary Income and Net Income

(Millions of yen)

120

,

000

100

,

000

80

,

000

60

,

000

40

,

000

20

,

000

0

2003 2004 2005 2006

2007

52

,

983

50

,

874

20

,

038

68

,

167

66

,

554

39

,

549

84

,

920

89

,

525

64

,

135

101

,

096

103

,

638

75

,

620

107,213

102,909

83,391

35

30

25

20

15

10

5

0

2003 2004 2005 2006

2007

21

.

5

20

.

7

8

.

1

25

.

1

24

.

5

14

.

6

27

.

6

29

.

1

20

.

8

29

.

4

30

.

1

22

.

0

27.5

26.4

21.4

30

25

20

15

10

5

0

2003 2004 2005 2006

2007

9

.

0

18

.

4

7

.

3

17

.

8

23

.

6

14

.

0

25

.

8

27

.

9

20

.

0

27

.

1

29

.

1

21

.

2

25.9

25.4

20.6

Quarterly Profits (Millions of yen)

30

,

000

25

,

000

20

,

000

15

,

000

10

,

000

5

,

000

0

1

Q

2

Q

3

Q

2006

4

Q1Q 2Q 3Q

2007

4Q

1

Q

2

Q

3

Q

2006

4

Q1Q 2Q 3Q

2007

4Q

25

,

056

27

,

466

20

,

389

24

,

740

26

,

974

18

,

596

27

,

257

27

,

161

20

,

120

24

,

043

22

,

037

16

,

515

35

30

25

20

15

10

5

0

30

.

6

33

.

6

24

.

9

29

.

1

31

.

7

21

.

9

31

.

2

31

.

1

23

.

1

26

.

7

24

.

4

18

.

3

29.4

27.1

23.2

28.4

25.9

23.1

27.5

25.4

20.2

24.8

27.1

19.1

(Millions of yen)

(Millions of yen)

Operating income

Ordinary income

Net income

Operating income

Ordinary income

Net income

27,241

25,140

21,500

28,125

25,700

22,899

27,216

25,148

19,964

24,631

26,921

19,028