Pentax 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

The Company and its domestic subsidiaries are subject to Japanese national and local income taxes which, in the aggregate, resulted in a

normal effective statutory tax rate of approximately 40.4% for the years ended March 31, 2007, 2006 and 2005.

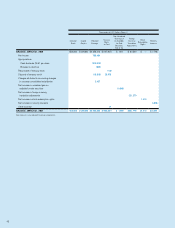

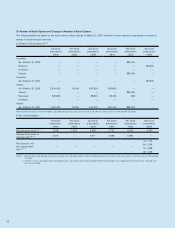

Significant components of deferred tax assets and liabilities as of March 31, 2007 and 2006 were as follows:

Millions of Yen Thousands of U.S. Dollars

2007 2006 2007

Current:

Deferred tax assets:

Inventories—intercompany unrealized profits ¥2,647 ¥1,692 $22,423

Accrued bonuses to employees 1,656 1,602 14,028

Accrued loss on clarification of soil pollution and others — 1,474 —

Accrued enterprise taxes 923 728 7,819

Inventories—loss on write-down 78 254 661

Other 1,764 1,658 14,942

Total ¥7,068 ¥7,408 $59,873

Non-current:

Deferred tax assets:

Amortization of goodwill and property, plant and equipment ¥1,577 ¥1,962 $13,359

Loss on impairment of long-lived assets 622 1,376 5,269

Allowance for doubtful receivables 111 105 940

Other 1,119 259 9,479

Total 3,429 3,702 29,047

Deferred tax liabilities:

Reserves for special depreciation and other 540 705 4,574

Other 165 240 1,398

Total 705 945 5,972

Net deferred tax assets ¥2,724 ¥2,757 $23,075

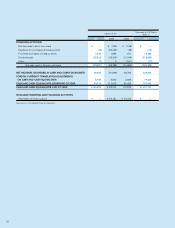

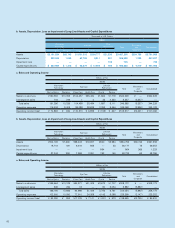

A reconciliation between the normal effective statutory tax rates and the actual effective tax rates reflected in the accompanying

consolidated statements of income for the years ended March 31, 2007, 2006 and 2005 was as follows:

2007 2006 2005

Normal effective statutory tax rate 40.4% 40.4% 40.4%

Lower or exemption income tax rates applicable to income in certain foreign countries (17.1) (18.2) (13.8)

Expenses not permanently deductible for income tax purposes 0.4 0.4 0.4

Per capita portion 0.1 0.1 0.1

Non-taxable dividend income (1.5) (1.8) (2.6)

Intercompany cash dividend and transactions 1.5 1.8 0.8

Equity in earnings of associated companies (0.2) (0.5) (1.8)

Tax credit on research and development expenses (0.7) (0.5) (0.8)

Other—net (0.9) 0.6 0.3

Actual effective tax rate 22.0% 22.3% 23.0%

No. 8 INCOME TAXES